There are too many AI Lead Gen tools: Here's the best 6 in 2025

There are way too many lead generation tools leveraging AI in 2025, so we took the top 6 according to real customer reviews and broke them down.

Below, you’ll find concise, side-by-side breakdowns of the top lead gen platforms (Cognism, AiSDR, Gumloop, Persana, Clay, and Lindy) covering not just features but critical details most reviews skip: pricing transparency, CRM integration depth, data compliance, and honest caveats from actual users.

Here’s the TL;DR 👇

| Tool | Best For | Key Strength | Drawbacks | Pricing |

|---|---|---|---|---|

| Cognism | B2B sales teams, RevOps—EU/EMEA focused outreach | Verified GDPR-compliant data, human-verified direct dials, strong intent data, deep integrations (Salesforce, HubSpot, Outreach) | Premium pricing/annual contracts, weaker US data, field mapping/dedupe in CRM needs care | No public prices; entirely quote-based, annual, modules/add-ons cost extra (Intent, Diamond Data, Enrichment) |

| AiSDR | SDRs, sales teams, agencies—automated, scalable outbound | AI-driven outreach personalization, ICP-driven lead building, automated sequencing and A/B testing | Email-only sequences (no native LinkedIn/calls), thinner data coverage in niche/non-US, basic CRM sync | Quote-based only, variable by seats, data/enrichment volume, and integrations—confirm limits/overages |

| Gumloop | Outbound/sales teams, agencies—AI-powered sourcing & automation | End-to-end workflow (sourcing, enrichment, scoring, outreach), high-precision AI fit scoring | Email-focused, limited multichannel/logic, fit scoring isn't easily tunable, non-US/niche industry coverage weaker | No public pricing; custom quotes that scale with volume, seats, and add-ons |

| Persana | Growth/sales teams—hyper-targeted prospecting, granular enrichment | Deep firmographic/technographic enrichment, auto-ICP list build, deliverability checks, workflow triggers | Complex setup, thinner non-US/tech data, cost can escalate with high enrichment/verification/sync volume | No published pricing; credit-based model, custom quotes (cost grows as you scale up data & users) |

Non-obvious things to look for in lead generation tools

Factor 1: Data freshness and sourcing transparency

Most tools claim real-time data, but users often discover stale or recycled leads. “After two months, our contact data was already outdated,” wrote one G2 user about a popular tool.

Look for platforms that show data collection dates and sourcing methods, so you know exactly what you’re paying for.

Factor 2: Workflow integration depth

It’s not just about connecting to your CRM. Assess how deeply the tool automates routine tasks, such as lead enrichment, scoring, and follow-up. Reviewers on Reddit praise tools that “auto-populate fields and remove duplicate tasks in HubSpot” instead of just exporting CSVs.

Factor 3: Compliance and privacy adaptability

With shifting privacy rules (like GDPR/CCPA), some platforms proactively update their processes and notify clients. A YouTube reviewer warned, “One breach cost us months of lost pipeline.”

Choose tools that provide compliance dashboards, opt-out management, and regular legal updates.

💡 Honorable mentions: Customizable reporting, multilingual lead support, and onboarding services are factors users mention but less frequently prioritize.

The Best Lead Generation Tools in 2025

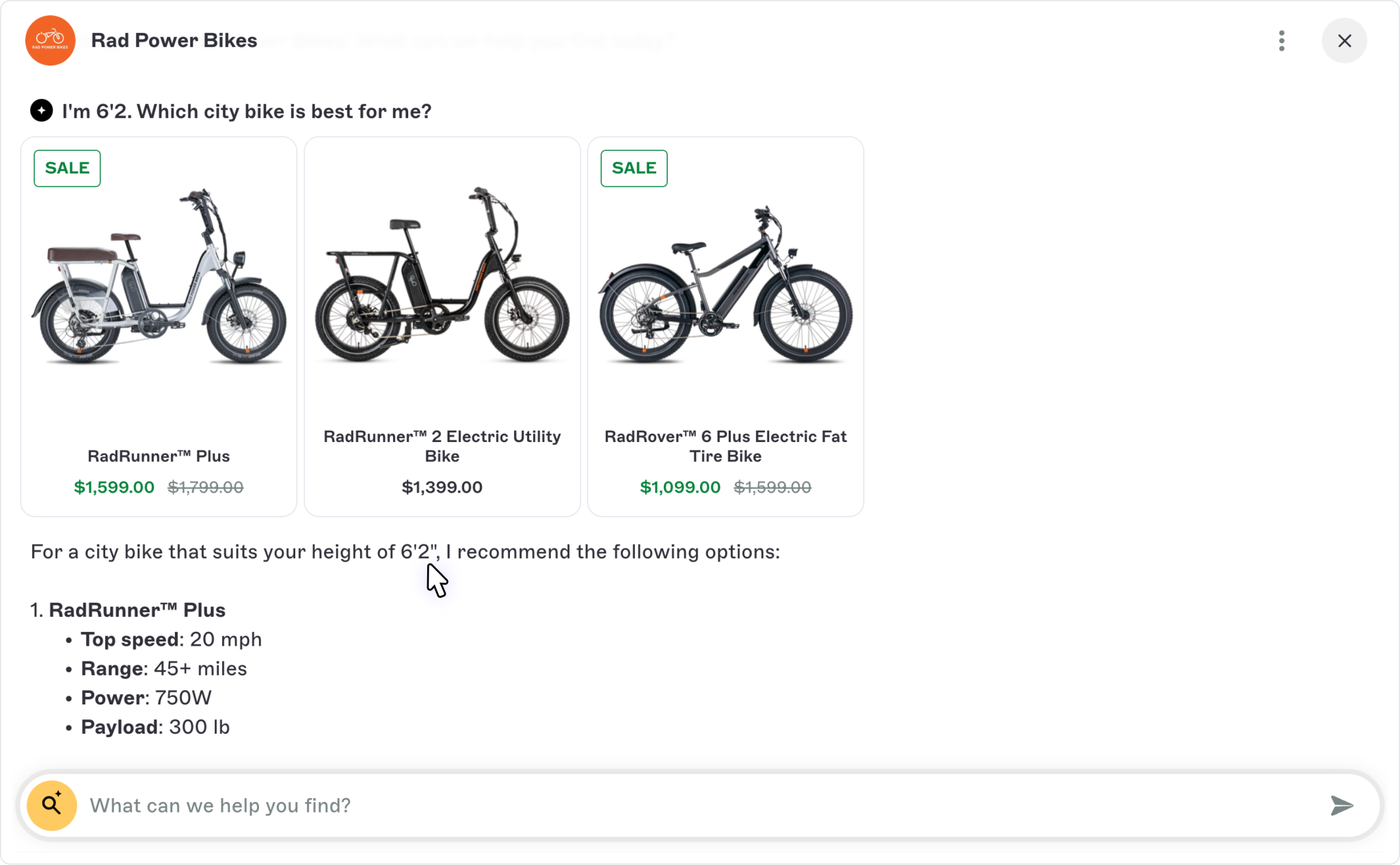

Why consider Big Sur AI as your site’s lead generation engine

Lead generation is a broad term. But if you care about generating more leads from your existing website traffic, here’s why you should consider Big Sur AI 👇

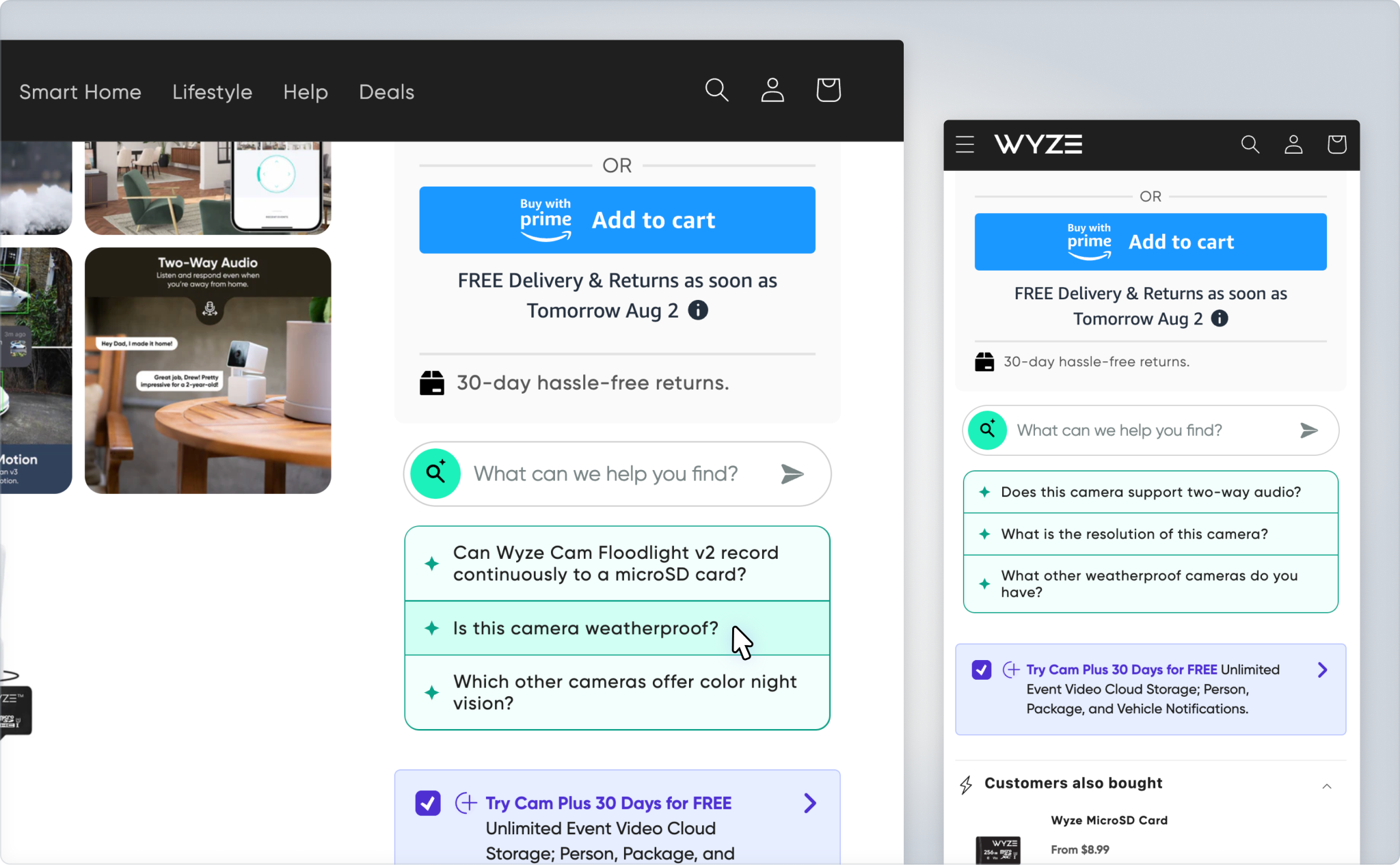

An AI chatbot built to drive conversions through conversation

The Big Sur team (that’s us) custom-built and trained the chatbot to optimize conversations for conversions, as if you were shopping for clothes and had a real human next to you answering questions.

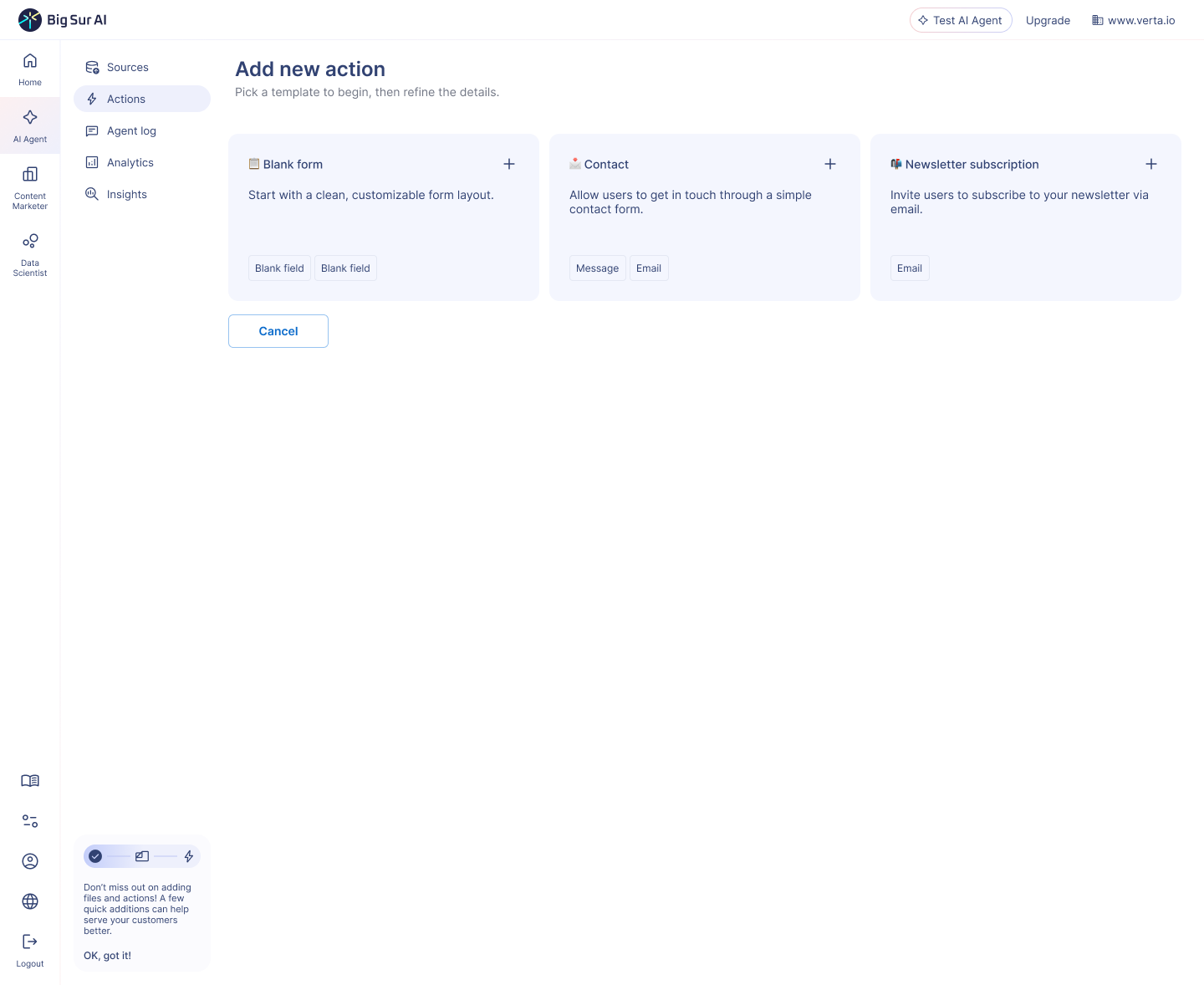

Trigger AI workflows from chatbot conversations

You can tell Big Sur to trigger AI workflows and agents once the chatbot recognizes specific patterns in conversions with prospects and customers.

Conversion-optimized content and CTAs built for engagement and hand-off

With Conversion-Optimized AI Prompts and the AI Content Marketer, you generate dynamic landing copy, offer matching, and hyper-targeted calls to action tuned to lead intent.

This closes the gap from interest to booked demo or purchase without manual copywriting.

Give Big Sur AI a try for free. 👇

Cognism

Public reviews: 4.6 ⭐ (G2, Capterra)

Our rating: 8.5/10 ⭐

Similar to: ZoomInfo, Lusha

Typical users: B2B sales teams, revenue operations, demand generation professionals

Known for: Accurate, GDPR-compliant B2B contact data

Why choose it? Excellent European data coverage and compliance, strong intent signals, and sales workflow integrations.

What is Cognism?

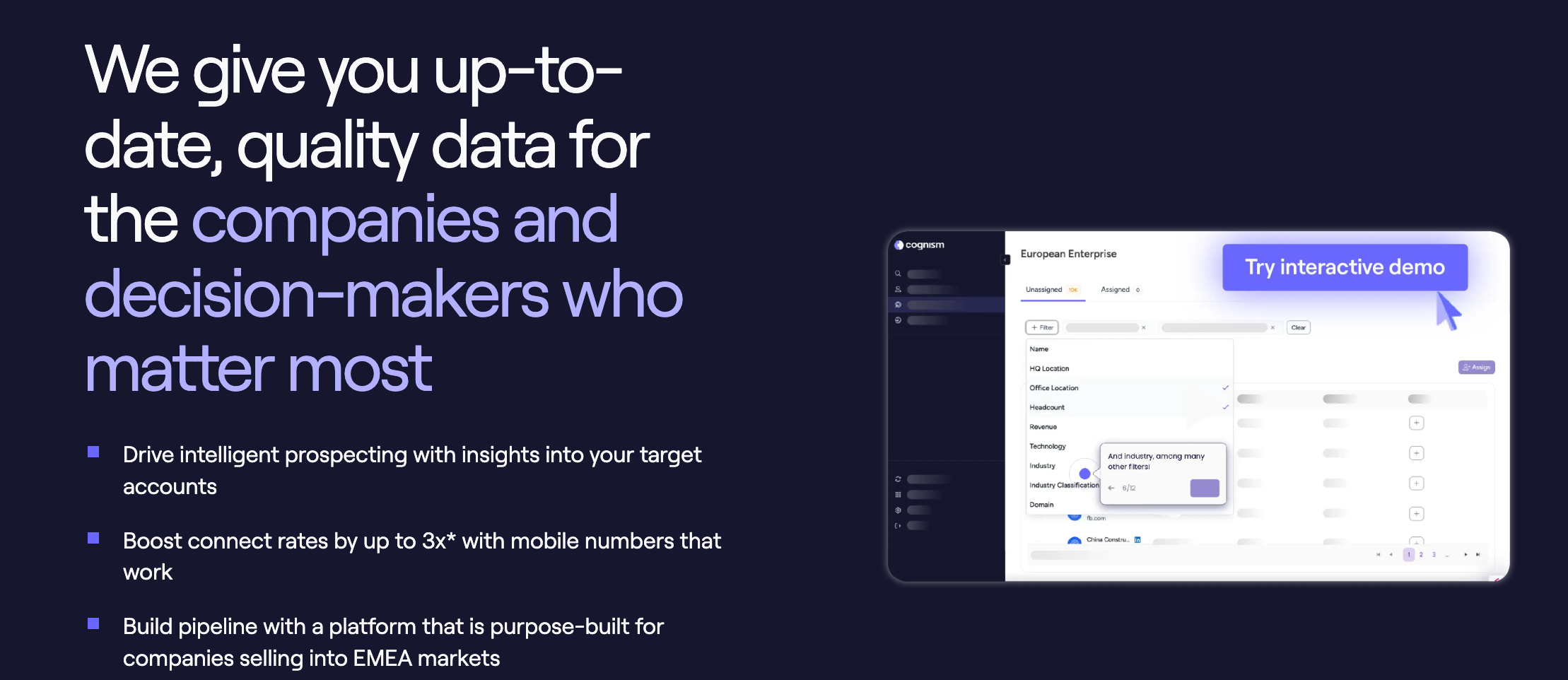

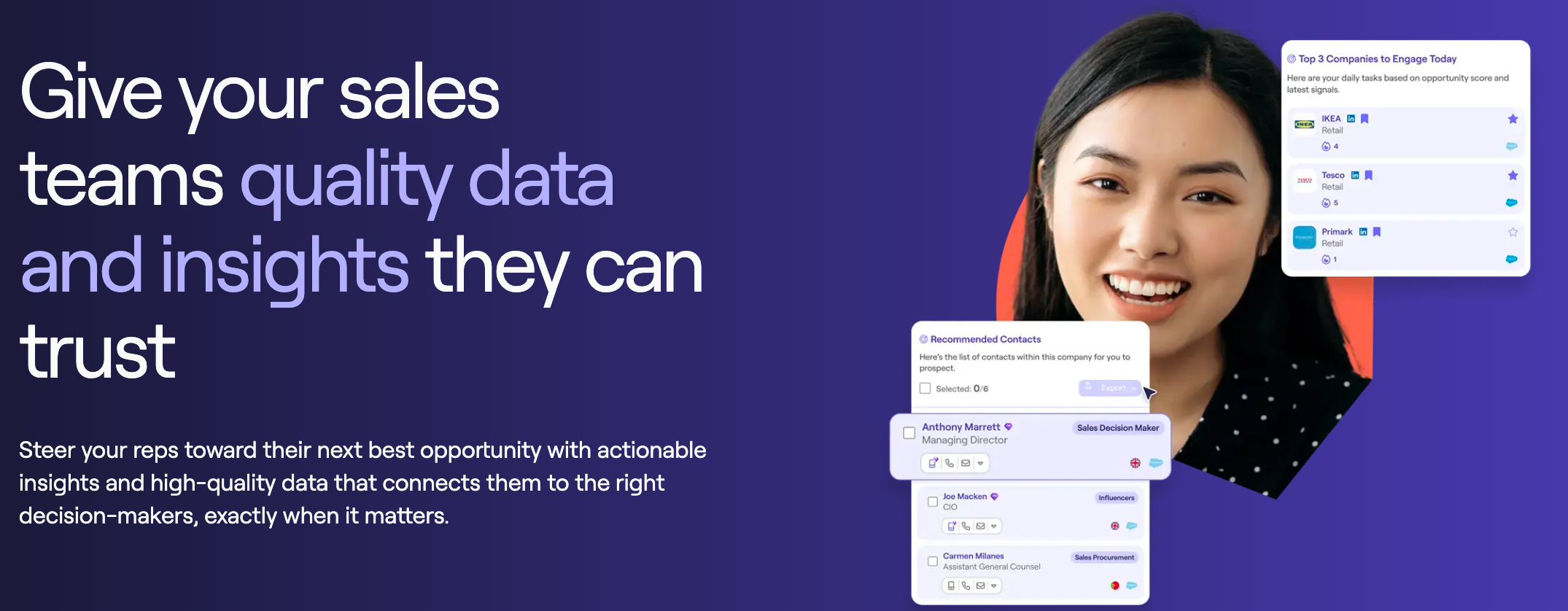

Cognism is a B2B data platform for finding and contacting ICP accounts with GDPR-safe emails and direct dials. It offers strong EU coverage, intent signals, and Chrome/Salesforce/HubSpot/Outreach integrations for enrichment, prospecting, and sequence-ready lists.

Why is Cognism a top lead generation tool?

GDPR-safe emails and direct dials with strong EU coverage. Intent flags ready accounts. One-click enrich to Salesforce, HubSpot, Outreach to build clean, sequence-ready lists.

Cognism's top features

- Verified contact data (Diamond Data): Delivers phone-verified mobile numbers, direct dials, and GDPR-safe business emails for B2B contacts, with do-not-call screening and regional compliance checks.

- Prospector and audience filters: Builds ICP account and contact lists using firmographic, technographic, industry, headcount, revenue, location, seniority/function, and job-title/keyword filters, with saved segments for reuse.

- Chrome extension for LinkedIn and web: Reveals and captures contacts from LinkedIn profiles, company pages, and websites, de-duplicates and enriches records, and pushes selected contacts to connected tools from the sidebar.

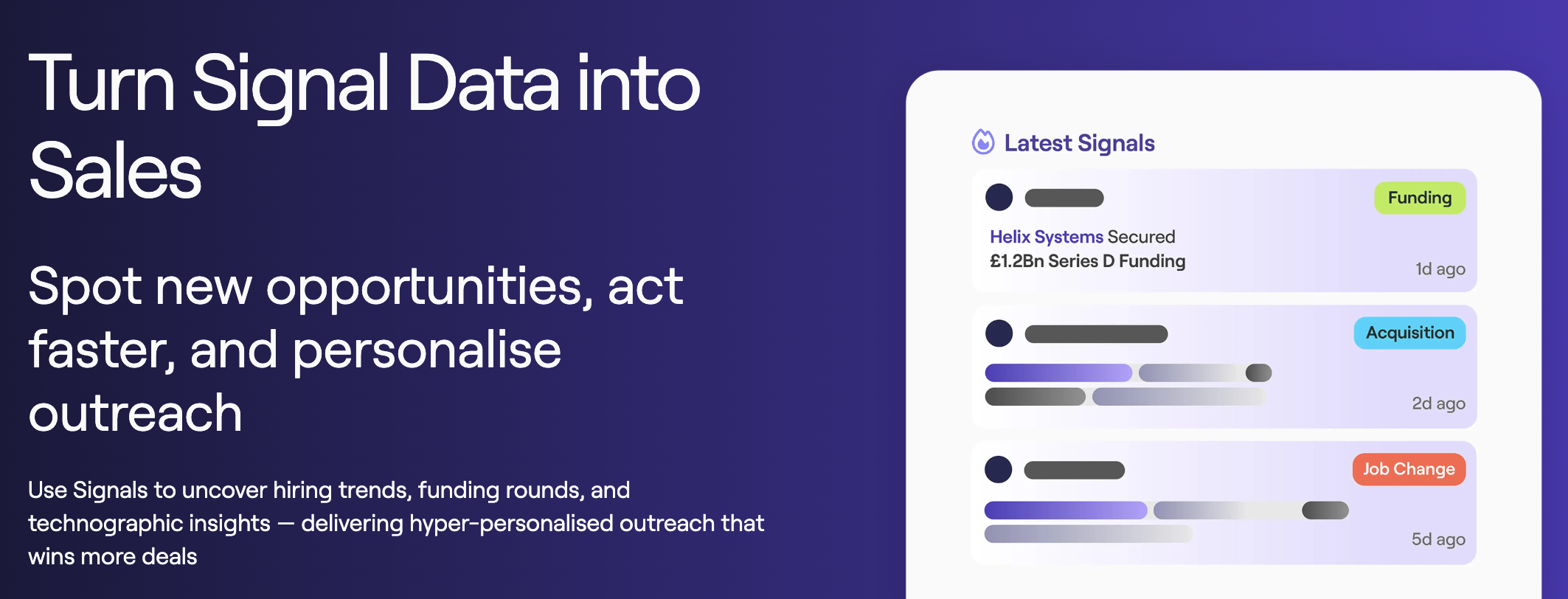

- Intent data and signals: Surfaces accounts showing increased research activity via Bombora-powered topic intent; lets teams configure topics and thresholds and sync intent indicators into CRM and Cognism views.

- CRM and sales engagement integrations + enrichment: Connects natively to Salesforce, HubSpot, Outreach, and Salesloft to export lists, map fields, apply deduplication rules, and run scheduled enrichment to keep records current.

💡 Summary: Cognism combines verified B2B contacts, granular prospecting, on-page capture, intent signals, and native CRM/SEP enrichment to power lead generation workflows.

Pros and cons of Cognism

Pros: Why do people pick Cognism over other lead generation tools?

✅ EU-first compliance and coverage

GDPR-safe emails, DNC screening, and deep EMEA data let teams scale outreach without legal drag.

✅ Diamond data, phone-verified mobiles

Human-verified direct dials cut wrong numbers and drive live connects, especially in EMEA.

✅ Bombora intent wired into prospecting

Configured topics flow into account lists and CRM, so reps work in-market buyers first.

Cons: What do people dislike about Cognism?

❌ Premium pricing and contract lock-ins

Annual terms, seat minimums, and add-on modules (e.g., intent) make total cost climb fast.

❌ Weaker U.S. coverage

Fewer U.S. direct dials and email matches than ZoomInfo, with strongest accuracy in EMEA.

❌ CRM enrichment quirks

Field mapping/dedupe need care or enrichment can overwrite custom fields and create duplicates.

Is there data to back Cognism as the best Lead Generation Tool?

4.6/5

Avg user rating (G2 & Capterra, 2025)

2–3x

Higher live-connect rates using phone-verified mobiles vs switchboards (industry SDR benchmarks; Cognism Diamond Data case studies)

30–50%

Increase in meetings booked within 90 days reported in Cognism customer stories (EMEA-heavy programs)

3x+

ROI uplift tied to Bombora-powered intent programs (Forrester TEI on Bombora; applies to Cognism’s intent sync)

Pricing: How much does Cognism really cost?

Cognism employs a tiered enterprise model with custom pricing, based on a base access fee plus per-user licensing.

Higher-priced packages offer richer, verified data and advanced intelligence.

Choose between these 2 plans (custom-quoted):

- Platinum – Approx. $15,000 access fee + $1,500 per user/year: Provides access to core contact and company data (emails, direct dials, non-verified mobiles, job titles, firmographics, technologies), CRM integrations, list building tools, CSV enrichment, and live chat support. Typically includes access to up to 25 million contacts

- Diamond – Approx. $25,000 access fee + $2,500 per user/year: Includes everything in Platinum plus phone-verified mobile numbers (Diamond Data®), intent data via Bombora, Diamonds-on-Demand research service, dedicated customer success manager, and up to 50 million contacts.

Price limitations & potential surprises

Very high total costs for small teams or pilot programs

Even with just a few users, your initial invoice can be steep.

Platinum pricing for a small team (e.g., 3 users) could start around $19.5K/year, while a comparable Diamond setup might exceed $32.5K/year. This can be prohibitive for SMBs or stage-2 startups.

Custom contracts make budgeting unpredictable

Cognism does not disclose public pricing; quotes vary significantly based on your company size, data volume needs, and geographic focus.

--> Multiple sources reveal a wide pricing range.

Platinum from $1.5K to $10K annual access fee, Diamond from $2.55K to $25K. Add per-user costs, and pricing can escalate quickly, sometimes reaching $100K+ annually for mid-sized customers.

Renewal price hikes and upsells are common

Reports indicate that renewal pricing can increase year-over-year unless targets are locked in multi-year.

Users also mention frequent upsells and “hidden” export or add-on fees, which can further inflate costs beyond the initial quote.

AiSDR

Public reviews: 4.7 ⭐ (G2, Capterra)

Our rating: 8.5/10 ⭐

Similar to: Outreach, Apollo.io

Typical users: SDRs, sales teams, and agencies

Known for: AI-driven automated outreach and personalized lead engagement

Why choose it? Delivers high-quality, scalable outbound campaigns that save time for sales teams

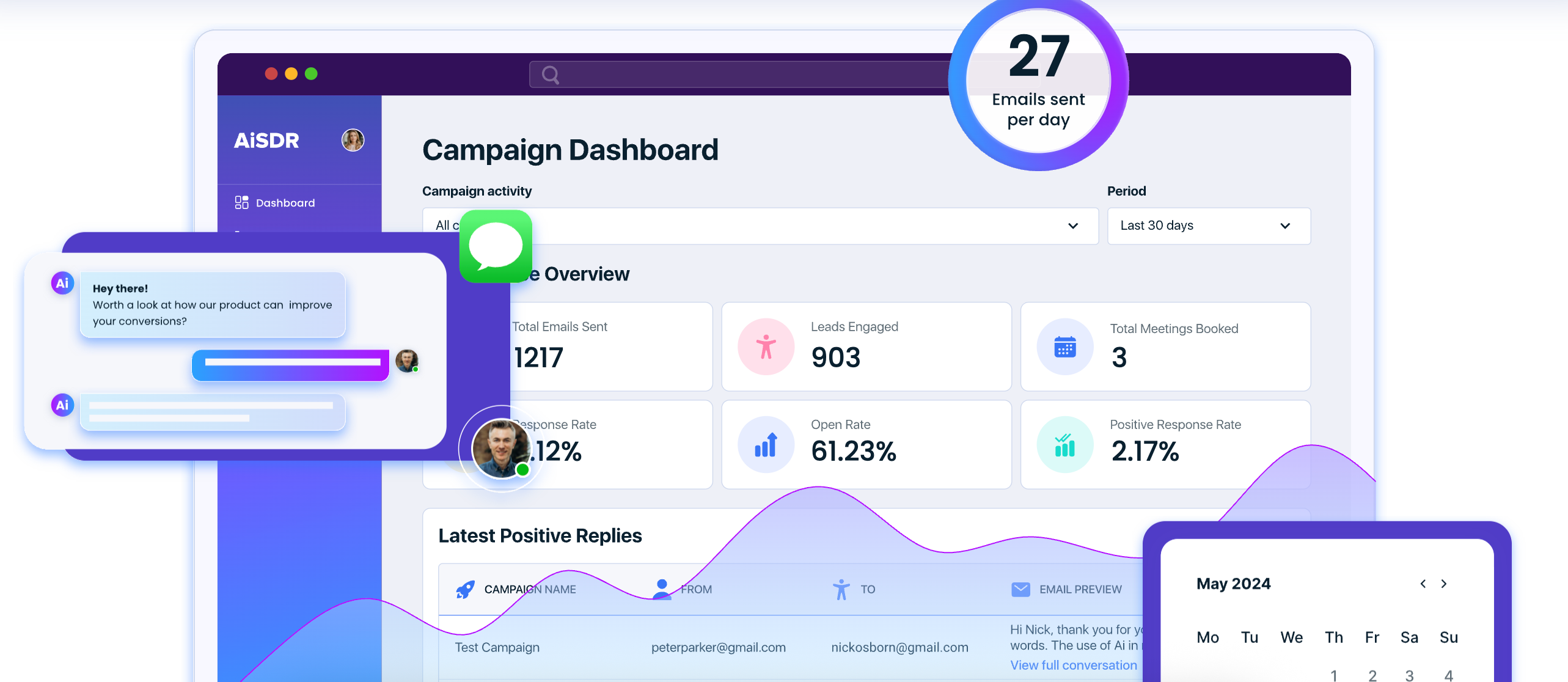

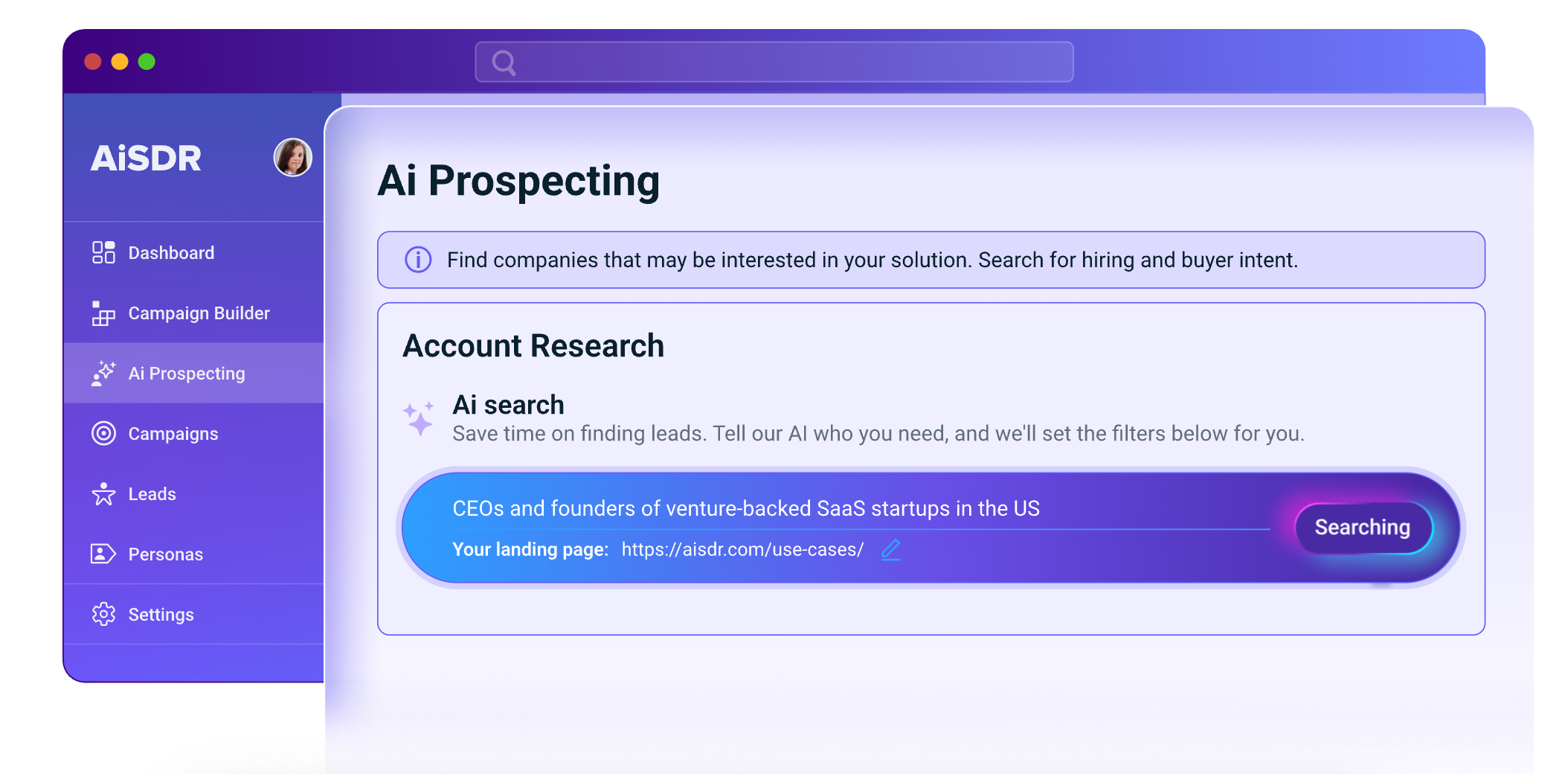

What is AiSDR?

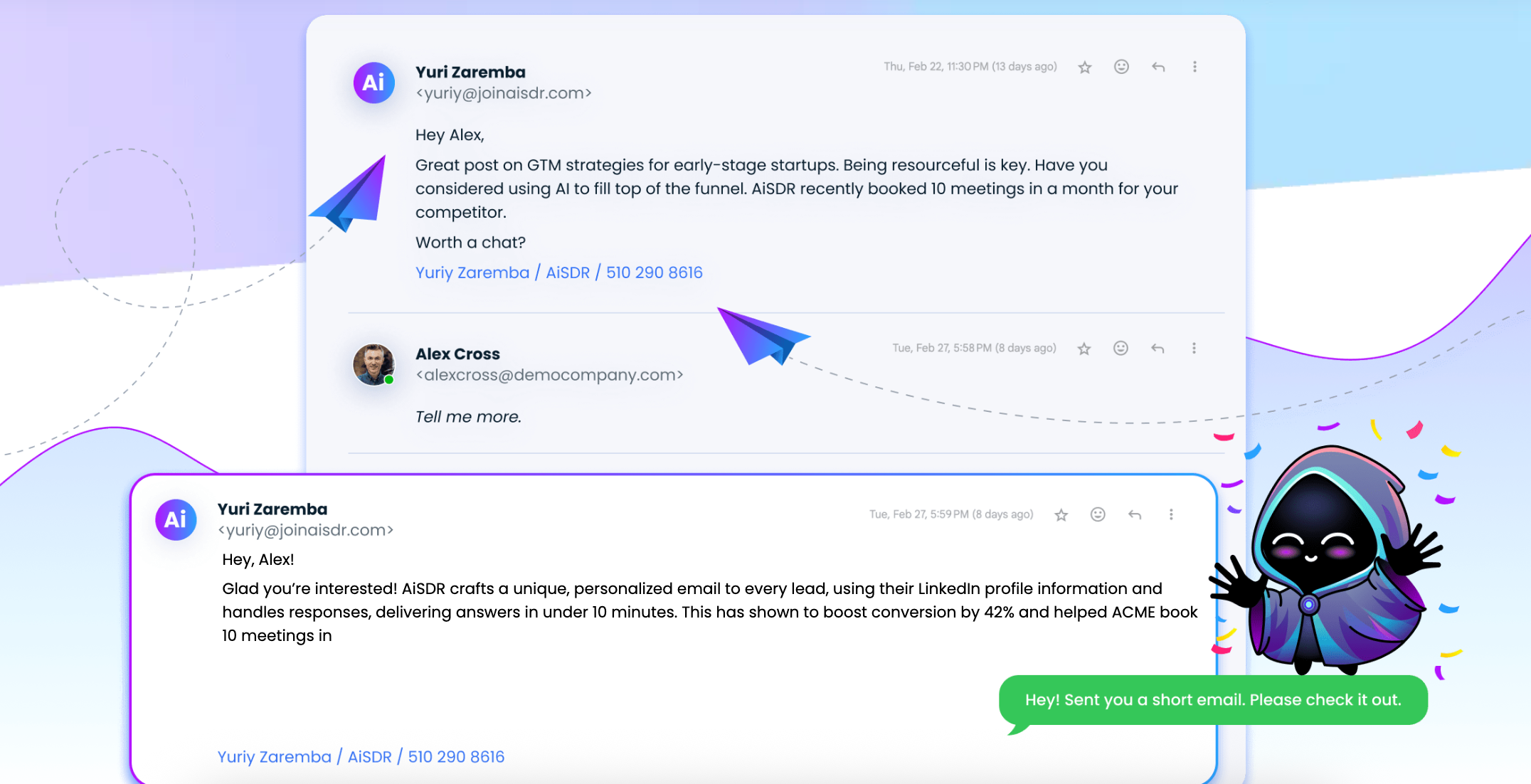

AiSDR is an AI outreach platform like Outreach/Apollo. It builds ICPs, sources and enriches leads, writes personalized emails, sequences follow-ups, A/B tests subject lines, tracks replies, and syncs with your CRM to book more meetings.

Why is AiSDR a top lead generation tool?

Build ideal customer profiles, auto-source and enrich leads, write tailored emails, A/B test subjects, sequence follow-ups, track replies, sync to CRM, and book more meetings.

AiSDR's top features

- ICP builder: Define ideal customer profiles using firmographic and technographic criteria; store profiles to guide prospecting and list building.

- Lead sourcing and enrichment: Auto-source prospects that match your ICP and enrich records with emails, job titles, company data, and other contact fields.

- AI email personalization and drafting: Generate personalized cold emails for each prospect using their attributes and company context, including first-touch and follow-up variants.

- Sequencing and automated follow-ups: Create multi-step email sequences, schedule follow-ups, and manage send rules across steps.

- CRM integration and sync: Sync leads, outreach activity, and reply statuses with your CRM to keep records aligned.

Pros and cons of AiSDR

Pros: Why do people pick AiSDR over other lead generation tools?

✅ ICP-driven sourcing and enrichment

Auto-builds lists from your ICP and enriches contacts—replacing hours of manual list work.

✅ 1:1 personalization inside sequences

Leverages role and company context to write per-prospect emails, not just tokenized templates.

✅ A/B testing and send-rule optimization

Subject tests and step-level send rules lift reply rates while protecting domain health.

Cons: What do people dislike about AiSDR?

❌ Limited multichannel outreach

Email-centric sequences; no native LinkedIn steps or dialer compared to Outreach/Apollo.

❌ Thinner data coverage vs incumbents

Prospect coverage lags Apollo/ZoomInfo, especially in niche industries and non-US regions.

❌ Shallow CRM sync and mapping

CRM sync is basic; limited custom field mapping and unreliable bi-directional updates.

Is there data to back AiSDR as the best Lead Generation Tool?

4.7/5

avg customer rating across G2 & Capterra (supports product-market fit)

+26%

open-rate lift from personalized subject lines (Campaign Monitor)

21%

chance of a reply on the 2nd email if the 1st goes unanswered (Yesware)

30%

annual decay of B2B contact data—enrichment reduces bounces (ZoomInfo)

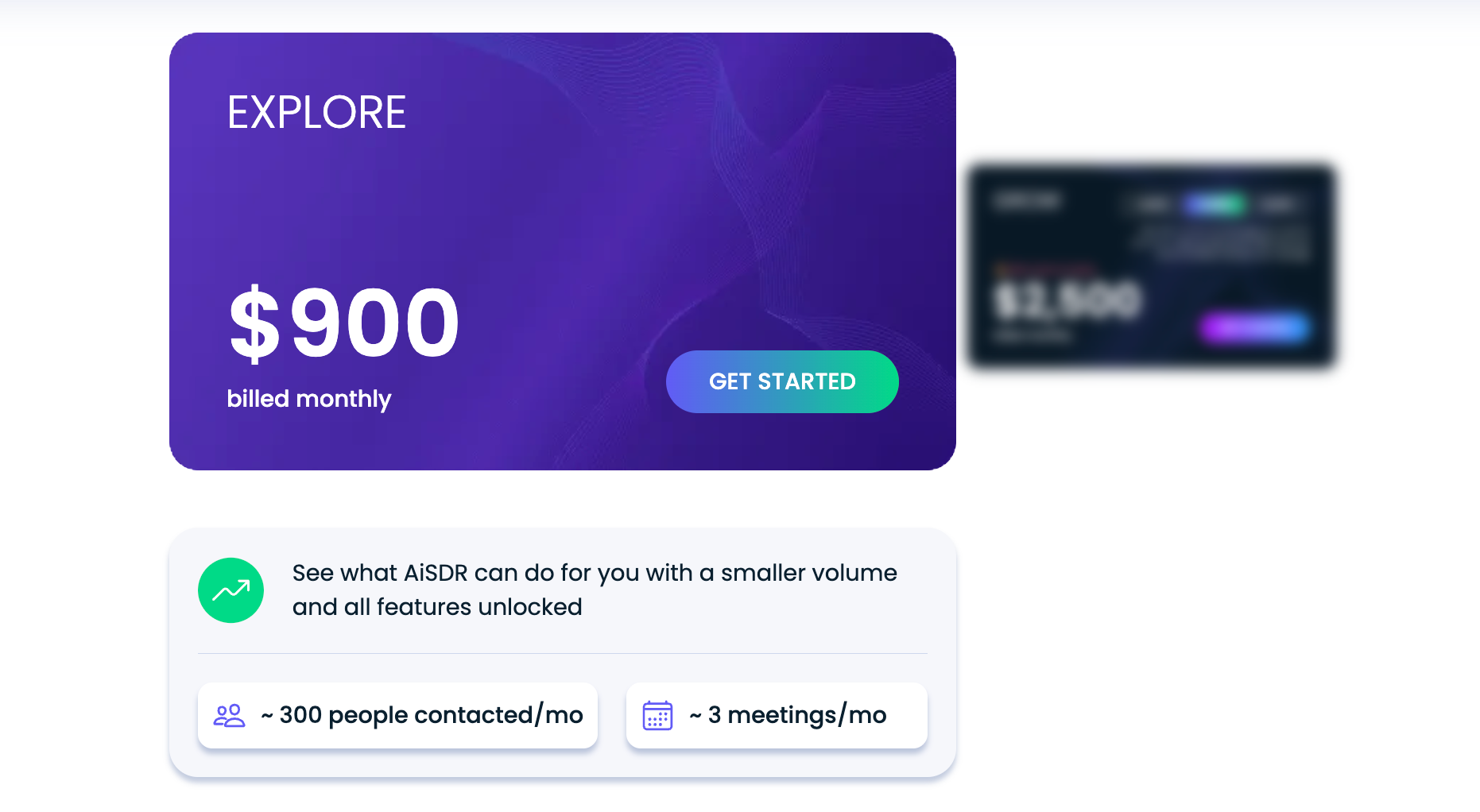

Pricing: How much does AiSDR really cost?

AiSDR uses a flat-rate, usage-based model with no long-term contracts—your cost is tied directly to your outreach volume, and all core features are unlocked from day one.

Choose between these 3 plans (all include all features):

- Basic – $900 per month: Includes up to 1,000 AI-generated messages (emails, LinkedIn, texts, etc.), unlimited users, inboxes, leads, and includes everything from domain warm-up to GTM engineer onboarding and 24/7 support.

- Grow – $2,500 per month: For larger volume needs; offers 5,000 messages, with all features and support included.

- Grow+ – $4,500 per month: Highest volume tier at approximately 10,000 messages/month, same unlimited feature access and support.

--> Additional messages can be purchased at ≈ $7.50 per 10 messages. Discounts up to 36% off are available at higher volumes.

Price limitations & potential surprises

Channel usage all counts against your message quota:

Every AI-generated touchpoint is counted as one of your allotted messages.

This makes multi-touch campaigns more expensive than expected, especially when staging complex sequences.

True multichannel flexibility is limited:

While AiSDR supports email, LinkedIn, and SMS, it's still primarily email-forward.

Teams relying on deeply integrated workflows (e.g., calls, events, CRM triggers) may find themselves juggling additional tools, increasing cost and complexity.

High-volume ROI can be tricky without proven funnel efficiency:

At scale pricing, costs can climb quickly—$4,500/month might require dozens of booked meetings to make economical sense.

Success hinges on strong offer, messaging, and conversion rates. As a case illustration, reaching ~300 prospects can yield around 3 meetings, but achieving that consistently needs perfect execution.

Gumloop

Public reviews: 4.7 ⭐ (G2, Capterra average)

Our rating: 8/10 ⭐

Similar to: Instantly, Clay

Typical users: B2B sales teams, agencies, and outbound marketers

Known for: AI-driven lead sourcing and outreach automation

Why choose it? Advanced personalization at scale with easy workflow integrations

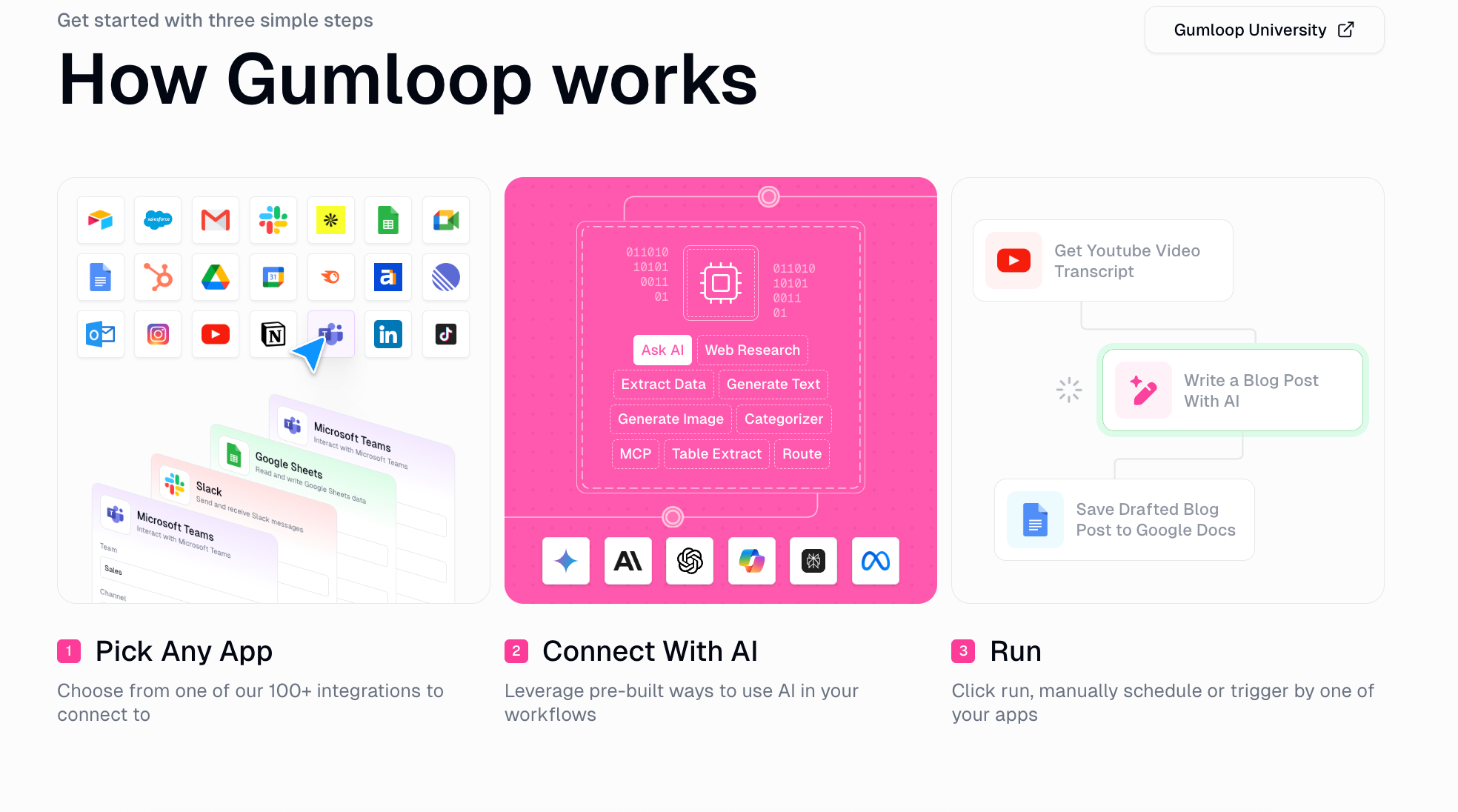

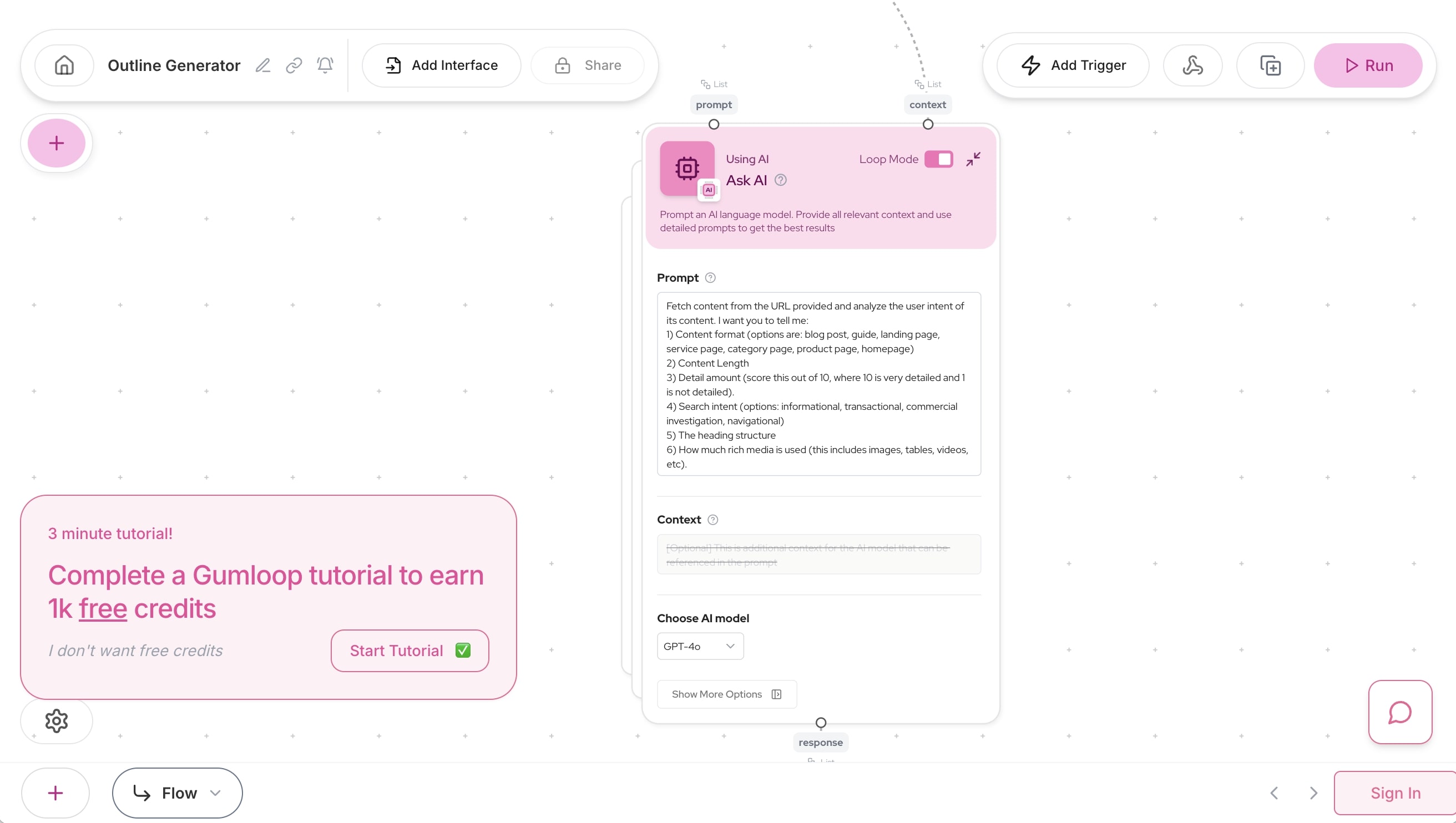

What is Gumloop?

Gumloop is an AI lead gen platform for B2B teams. It sources and enriches prospects, scores fit, and auto-personalizes outreach at scale.

Build sequences, sync with your CRM, and slot into workflows with easy integrations to automate top-of-funnel.

Why is Gumloop a top lead generation tool?

Finds and enriches the right prospects, scores fit, and writes tailored emails. Sequences and CRM sync help teams launch precise outbound fast and keep follow ups on schedule.

Gumloop's top features

- AI prospect sourcing: Automatically finds B2B prospects and compiles target lists.

- Prospect enrichment and fit scoring: Adds additional data to prospect records and assigns a fit score to each record.

- Personalized outreach generation: Generates tailored email copy for each prospect using AI.

- Multi-step sequences and follow-up scheduling: Lets users build email sequences with defined steps and timing for follow-ups.

- CRM sync and workflow integrations: Syncs data with your CRM and plugs into existing workflows through native integrations.

💡 Gumloop sources prospects, enriches records, scores fit, generates personalized emails, and runs sequenced outreach with CRM-connected workflows.

Pros and cons of Gumloop

Pros: Why do people pick Gumloop over other lead generation tools?

✅ End-to-end prospecting-to-outreach

Sources, enriches, scores, and sends in one flow—fewer handoffs, faster launch.

✅ High-precision fit scoring

Enrichment-driven scoring ranks ICP-first so reps focus on highest-likelihood accounts.

✅ CRM-native personalization at scale

Generates per-prospect emails and schedules follow-ups while staying in sync with your CRM.

Cons: What do people dislike about Gumloop?

❌ Limited multichannel and logic

Email-first; LinkedIn/call steps and conditional branching are limited vs. Clay or Smartlead.

❌ Opaque fit scoring controls

Scoring lacks explainability and weight tuning, so ops teams can’t adjust ICP nuances.

❌ Uneven data coverage

Prospect/enrichment depth dips in non‑US and niche verticals, causing more manual list cleanup.

Pricing: How much does Gumloop really cost?

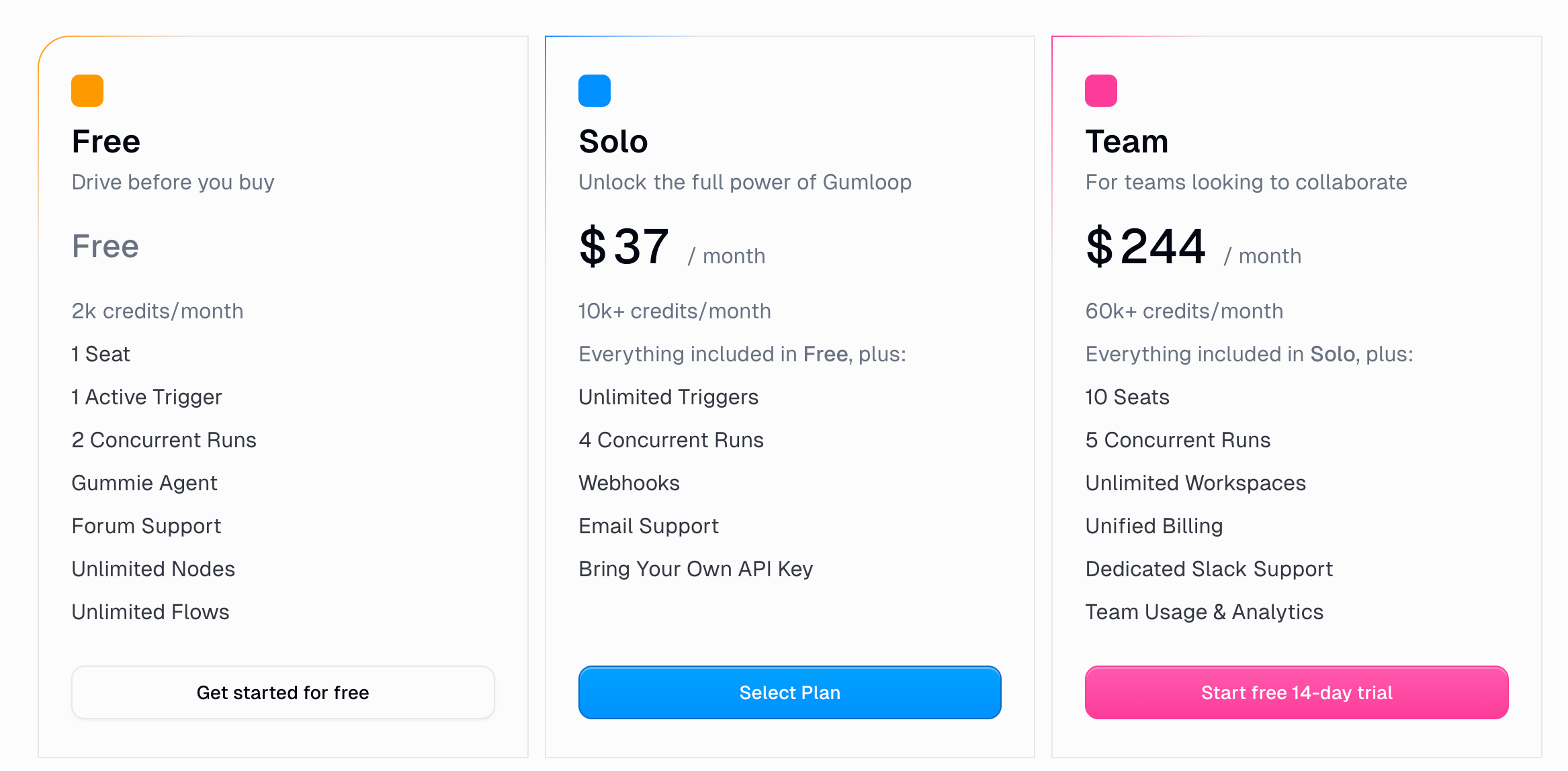

Gumloop uses a freemium, credit-based model with discounted annual billing on paid tiers. You pay for “credits” that you spend with each node or action executed.

Choose between these 4 plans (credits per month):

- Free – $0: 2,000 credits/month; includes 1 seat, 1 active trigger, 2 concurrent flow runs, Gummie Agent, unlimited nodes & flows, and forum support.

- Solo – $37/month (20% off if billed annually): 10,000+ credits/month; adds unlimited triggers, 4 concurrent runs, webhooks, email support, and the ability to bring your own API key.

- Team – $244/month (20% off annually): 60,000+ credits/month; includes everything in Solo plus 10 seats, 5 concurrent runs, unlimited workspaces, unified billing, dedicated Slack support, and team usage analytics.

- Enterprise – Custom pricing: Includes everything in Team plus RBAC, SCIM/SAML, audit logs, custom data retention, security reports, incognito mode, AI model access control, VPC, and priority support.

Price limitations & potential surprises

Subflows and node complexity can drastically increase credit usage

Even a previously inexpensive flow may suddenly use 70+ credits if you add complexity.

AI calls (e.g., Claude 3.5 Sonnet) and specialized nodes such as scrapers can cost 20–25 credits each. If you're not monitoring, credit consumption can spike unexpectedly.

Accidental credit overcharges due to system glitches or run anomalies

Some users report extreme consumption (one run burned ~17,000–60,000 credits in minutes) far beyond expectation for routine tests.

These events can quickly exhaust your monthly quota and require immediate resolution.

Credits don’t roll over, and overages are capped and costly

Unused credits vanish each month unless you're on Enterprise.

If enabled, overage kicks in after you consume your base allotment and costs $0.005 per extra credit. This can add up quickly if your automations spike.

Is there data to back Gumloop as the best Lead Generation Tool?

4.7/5

Average user rating on G2 + Capterra (as of Sep 2025)

8/10

Big Sur AI hands-on score from our 2025 evaluation

N/A

No public NPS or audited conversion/response-lift published yet

End‑to‑end

Single tool covers sourcing → enrichment → scoring → sequenced outreach (fewer handoffs vs multi‑tool stacks)

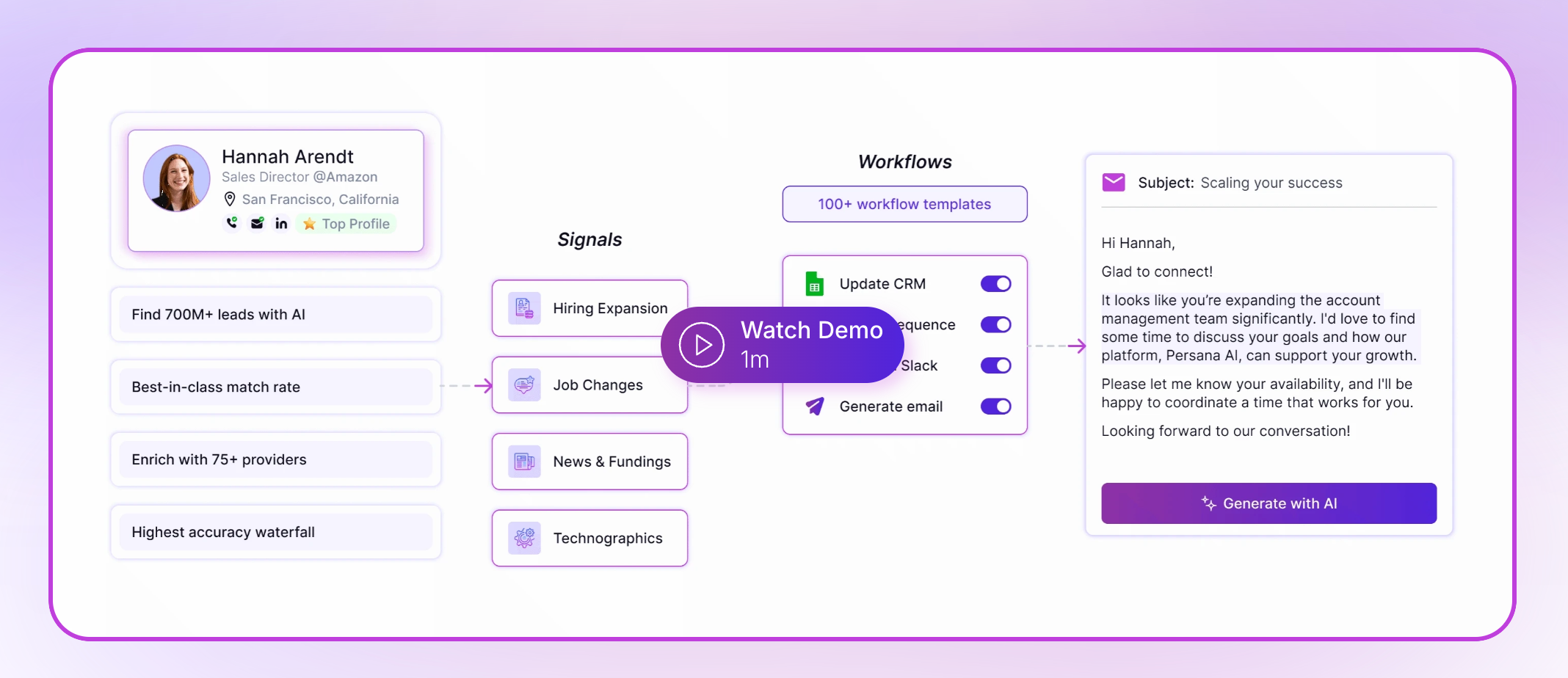

Persana

Public reviews: 4.7 ⭐ (G2, Capterra)

Our rating: 8.5/10 ⭐

Similar to: Apollo.io, Clay

Typical users: B2B sales teams and growth marketers

Known for: Robust AI-driven lead enrichment and hyper-targeted prospecting

Why choose it? Unmatched automation for finding and researching high-conversion leads quickly

What is Persana?

Persana is an AI lead gen platform that enriches firmographic and technographic data, auto-builds ICP lists, verifies emails, and prioritizes prospects. It plugs into CRMs and sequencers to trigger workflows, finding high-conversion leads fast.

Why is Persana a top lead generation tool?

Enriches company and tech data, auto-builds best-fit lists, verifies emails, scores prospects, and syncs with your CRM and email tool to trigger outreach that books more meetings fast.

Persana's top features

- Firmographic and technographic enrichment: Appends company-level attributes (e.g., size, industry, location, revenue) and technology stack details to records.

- ICP builder and auto list generation: Lets teams define ideal customer profile rules and automatically compiles matching account and contact lists.

- Email verification: Validates email addresses and flags deliverability status before they are added to outreach.

- Lead scoring and prioritization: Scores accounts and contacts against ICP criteria to rank and order prospects.

- CRM and sequencer integrations with workflow triggers: Syncs enriched data, lists, and scores to CRMs and sales engagement tools, triggering sequences or tasks based on predefined rules.

💡 Persana provides data enrichment, ICP-based list building, email validation, lead scoring, and integrated CRM/sequencer workflows for lead generation.

Pros and cons of Persana

Pros: Why do people pick Persana over other lead generation tools?

✅ ICP-to-sequence automation

Auto-builds ICP lists, scores them, and triggers CRM/sequencer plays without manual CSV work.

✅ Deep firmo/tech enrichment

Tech-stack + firmo enrichment powers granular filters and persona routing beyond basic firmographics.

✅ Deliverability-first outreach

Built-in verification gates sequences, reducing bounces and protecting domain reputation at scale.

Cons: What do people dislike about Persana?

❌ Setup complexity

Advanced ICP/scoring + triggers take time to configure and QA; expect ops-heavy setup.

❌ Patchy non‑US data

EU/APAC firmo/technographics are thinner; niche stacks often missing versus US data.

❌ Credit-driven cost creep

Enrich + verify + frequent syncs burn credits fast, making high-volume programs expensive.

Is there data to back Persana as the best Lead Generation Tool?

4.7★

Average user rating on G2 & Capterra (satisfaction signal, 2025)

No public NPS

NPS not published by vendor; third‑party NPS benchmarks unavailable

No audited CR uplift

No independent, peer‑reviewed conversion‑rate benchmarks vs. Apollo/Clay found

Evidence gap

Vendor case studies with meeting rate, bounce rate, and time‑to‑lead metrics not publicly verifiable

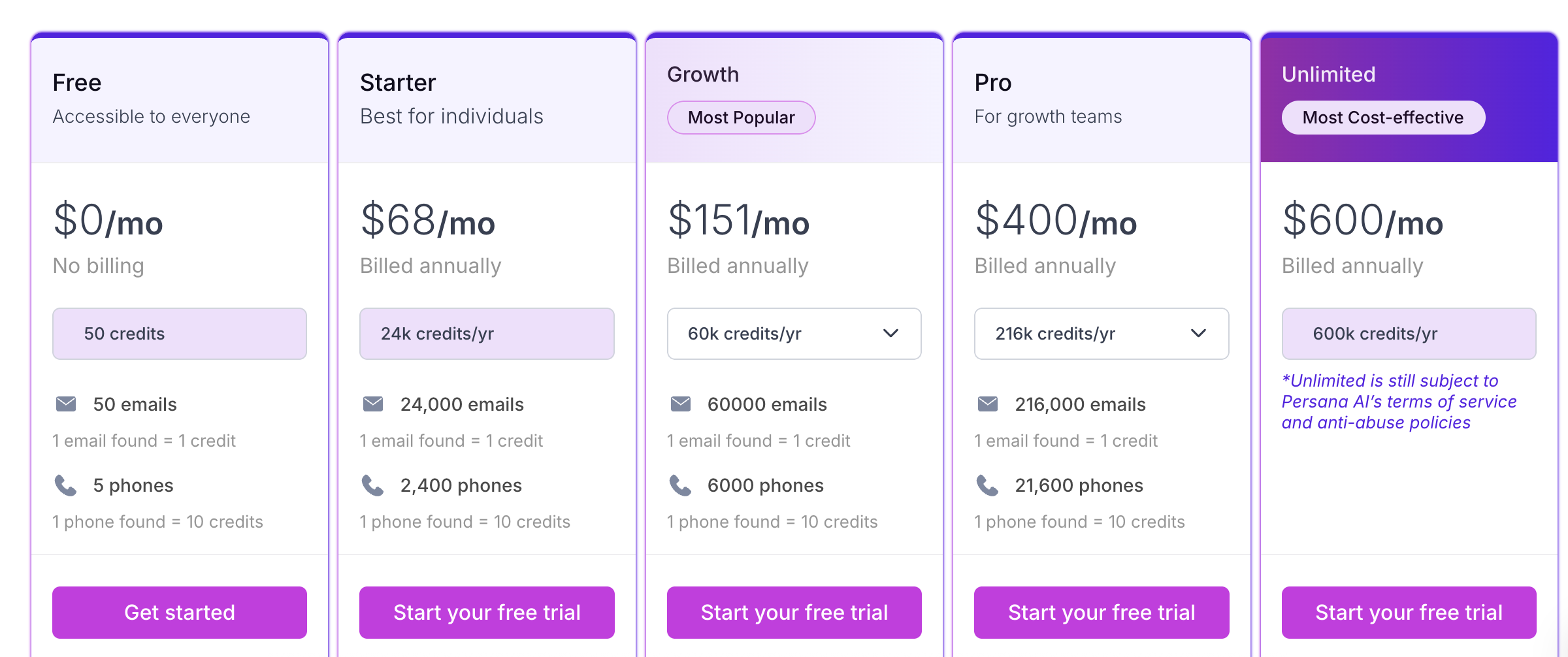

Pricing: How much does Persana really cost?

Persana.ai uses a rounded, credit-based model with discounted annual billing. You pay for “credits” that fuel data enrichments (emails, phone numbers, profiles) and unlock powerful AI agents and integrations.

Choose between these 5 plans (all priced monthly, billed annually):

- Free – $0 per month – For exploration; includes 50 credits, unlimited users, access to 100+ data providers, email & phone waterfall enrichment, web scrapers, Persana Quantum AI Research Agent, playbooks/templates, and CSV exports.

- Starter – $68 per month – Ideal for individuals; includes 24,000 credits/year (~2,000/mo), unlimited users, credit rollover, email/phone enrichment, AI agents, scrapers, exports, prompt library, dashboard analytics.

- Growth – $151 per month (Most Popular) – Adds email sequencing integrations (e.g., Smartlead, Instantly, Salesloft, Outreach), lookalike company finder, own API key, webhooks/API.

- Pro – $400 per month – Geared for growth teams; includes CRM integrations (HubSpot, Salesforce), ABM workflows, enriched data (intent signals, job changes), exports (up to 10,000), plus AI prompting and premium support.

- Unlimited – $600 per month – For high-volume teams; includes 600,000 credits/year, unlimited enrichments and exports, Autopilot AI Agents, full feature suite including white-glove Slack support

- Enterprise – Custom pricing – Includes custom agents, AI SDR full service, dedicated account team, custom playbooks/templates, unlimited data rows/actions.

Price limitations & potential surprises

“Unlimited users” ≠ “unlimited usage”

While plans let you add unlimited teammates at no extra seat cost, every user still shares the same finite credit pool.

Rapid onboarding or team growth can drive usage spikes and trigger the need for a more expensive plan

Rollover is capped

Though unused credits roll over into the next month, they're capped at twice your monthly credit allocation.

Without monitoring or optimization, occasional spikes can leave you underutilized and over budget.

Clay

Public reviews: 4.7 ⭐ (G2, Capterra)

Our rating: 9/10 ⭐

Similar to: Apollo, Instantly

Typical users: Sales teams, growth marketers, business development reps

Known for: Powerful workflow automation and enrichment at scale

Why choose it? Lets you find, enrich, and automate outreach to leads with minimal manual effort

What is Clay?

Clay is a lead gen workspace that auto-builds prospect lists, enriches them across 50+ data sources, verifies emails, and routes leads to sequences.

Use triggers, deduping, and AI-powered website scraping to personalize at scale, then push to HubSpot, Salesforce, and Outreach.

Why is Clay a top lead generation tool?

Build targeted lists, enrich via 50+ sources, verify emails, remove duplicates, and auto-route to HubSpot or Salesforce. Use website scraping to personalize per prospect with minimal work.

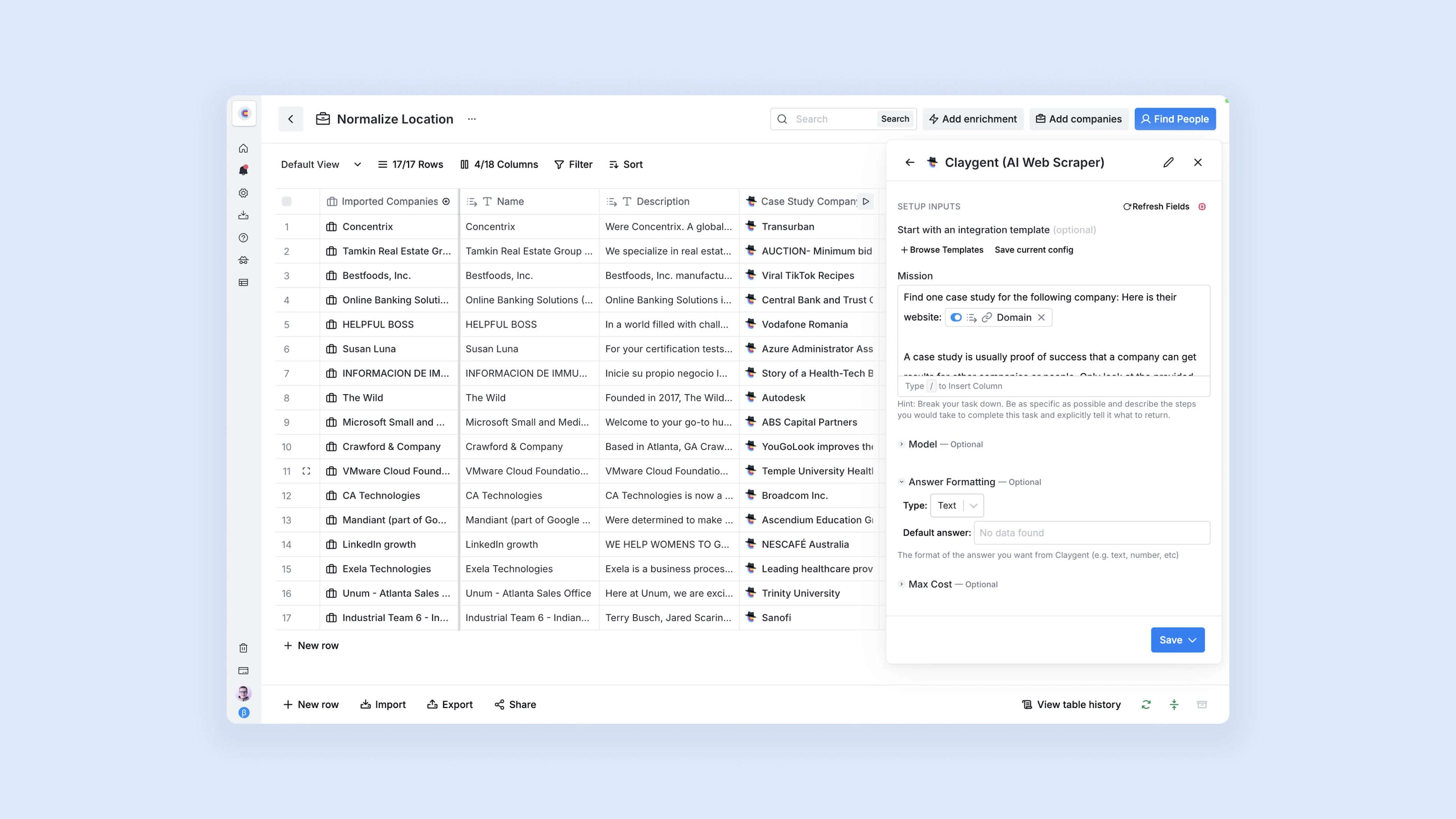

Clay's top features

- Prospect list building: Create company and contact lists from LinkedIn Sales Navigator, CSVs, domains, or search criteria; filter by industry, headcount, location, keywords, and tech stack.

- Multi-source data enrichment: Append firmographics, roles, social links, technographics, intent signals, and other fields by chaining 50+ data sources into a single table.

- Email finding and verification: Discover work emails using multiple finders, then validate with SMTP checks and scoring to return deliverability status and confidence.

- AI website research (Claygent): Visit prospect websites, read pages, and extract answers to custom prompts (e.g., value proposition, key products, recent updates) into structured fields for each row.

- Automations, deduping, and routing: Use triggers to run enrichment steps, remove duplicates by email/domain, and push records to HubSpot, Salesforce, Outreach, Salesloft, Apollo, or Instantly.

Pros and cons of Clay

Pros: Why do people pick Clay over other Lead Generation Tools?

✅ Multi-source enrichment, one workflow

Chain 50+ providers to enrich firmo/tech/intent in one table—no single-dataset blind spots.

✅ AI website research at scale

Claygent pulls value props, tech, and triggers to auto-write per-prospect personalization.

✅ Trigger-driven dedupe and routing

Push only net-new, verified leads to HubSpot, Salesforce, and sequencers with zero manual steps.

Cons: What do people dislike about Clay?

❌ Workflow complexity

Designing reliable multi-step tables and dedupe/routing logic demands ops expertise and careful QA.

❌ Unpredictable credit burn

Chained enrichments and Claygent runs consume credits fast, making monthly costs hard to forecast.

❌ Agent inconsistency on web research

Claygent is slow or blocked on some sites, so results vary and often need retries or manual checks.

Is there data to back Clay as the best Lead Generation Tool?

4.7/5

average user rating (G2 & Capterra, 2024–2025)

50+

enrichment data sources in a single workflow (Clay product spec)

6+

native routing targets: HubSpot, Salesforce, Outreach, Salesloft, Apollo, Instantly

~10×

faster website research vs. manual prospecting using Claygent (vendor-reported)

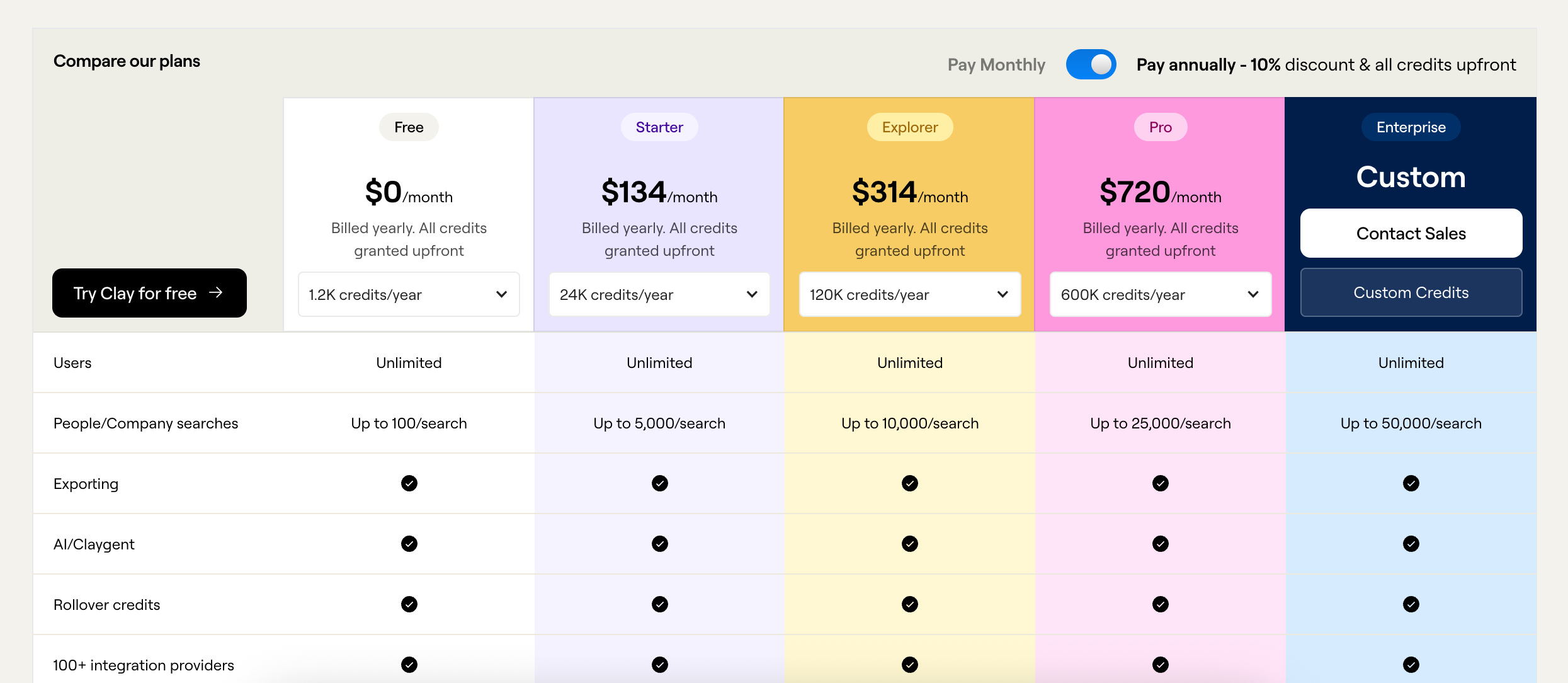

Pricing: How much does Clay really cost?

Clay uses a freemium, credit-based model with a discounted annual billing option.

You’re charged with “credits” for each enrichment or search action; higher tiers significantly reduce cost per credit.

Choose between these 5 plans:

- Free – $0/month

- 100 credits/month (1.2K/year)

- Unlimited users, up to 100 search results, exports, AI/Claygent, rollover (up to 2×), access to 100+ integrations, and Chrome extension

- Starter – ~$149/month (annually ~$134)

- 2,000 credits/month (~24K/year) or optionally 3,000/month (~36K/year)

- Unlimited users, up to 5,000 searches, phone number enrichments, own API keys

- Explorer – ~$349/month (annually ~$314)

- 10,000 credits/month (~120K/year), with higher tiers up to 20K/month (~240K/year)

- Includes all Starter features plus HTTP API integration, webhooks, email sequencing, and data exclusion filters

- Pro – ~$800/month (annually ~$720)

- 50,000 credits/month (~600K/year) with optional tiers up to 150K/month (1.8M/year)

- All Explorer features plus CRM integrations and highest search limits (up to 25K results)

- Enterprise – Custom pricing

- Custom credits, up to 50,000 searches, unlimited rows, AI prompting, Snowflake integration, Slack support, SSO, and analytics dashboards

Price limitations & potential surprises

Credit burn can escalate quickly without visibility

Even on Pro, users warn credits disappear fast when pulling from multiple providers or chaining actions.

Estimated consumption isn't always visible beforehand, making cost control tricky.

Steep learning curve adds hidden onboarding cost

Users report that it can take weeks to get comfortable with Clay’s workflow logic and credit dynamics, especially for complex enrichment or API usage.

Lindy (Sales agents)

Public reviews: 4.7 ⭐ (G2, Capterra average)

Our rating: 8.5/10 ⭐

Similar to: Clay, Apollo.io

Typical users: SDRs, sales teams, growth marketers

Known for: Highly customizable AI agents that automate prospect research and outreach

Why choose it? Streamlines lead sourcing and qualification with minimal setup and deep CRM integrations

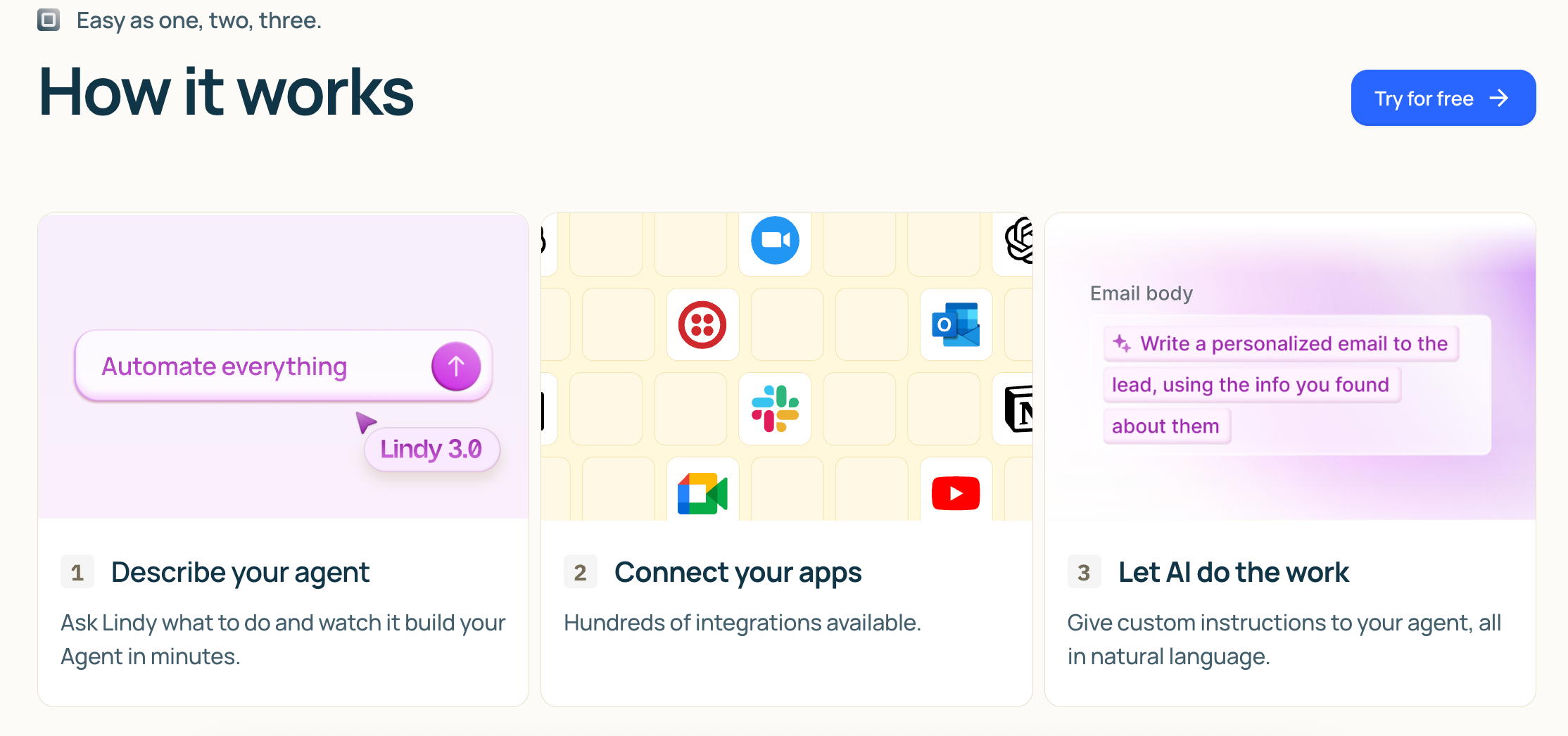

What is Lindy?

Lindy is an AI lead gen tool with customizable agents that find and enrich prospects, write personalized outreach, qualify leads, and sync everything to your CRM.

Fast to set up with deep Salesforce and HubSpot integrations for SDR and growth teams.

Why is Lindy a top lead generation tool?

Custom agents pull clean lists, enrich contacts, draft tailored emails, qualify replies, and push to Salesforce and HubSpot fast. Cuts manual prospecting for SDR teams.

Lindy's top features

- Customizable prospecting agents: Build AI agents that search for accounts and contacts matching your ICP, apply filters (industry, headcount, role), extract key fields, and assemble structured prospect lists.

- Data enrichment: Append and normalize company and contact details by filling titles, firmographics, and profile links, standardizing fields for downstream workflows.

- Personalized outreach generation: Generate tailored first-touch and follow-up email drafts that use account and contact context, with variables and snippets for one-to-one personalization.

- Reply parsing and lead qualification: Classify inbound responses (e.g., interested, not a fit, OOO, unsubscribe), tag intent, and update lead status for the right next step.

- CRM integration and sync (Salesforce & HubSpot): Create and update records, map custom fields, log emails and activities, and deduplicate contacts and accounts during sync.

Pros and cons of Lindy

Pros: Why do people pick Lindy over other lead generation tools?

✅ Customizable prospecting agents

Build agents to pull net-new accounts/contacts with tight ICP filters and structured fields.

✅ Automated reply qualification

Tags replies by intent (interested, OOO, not a fit) and auto-advances the lead.

✅ Deep CRM sync (Salesforce + HubSpot)

Maps custom fields, logs activities, and dedupes on write for cleaner Salesforce/HubSpot records.

Cons: What do people dislike about Lindy?

❌ Steep agent setup curve

Reliable agents need tight prompts, field mapping, and iteration to avoid noisy lists.

❌ Web-sourced data constraints

LinkedIn/web sourcing hits rate limits and can miss emails without a connected data provider.

❌ Not a full multichannel sequencer

Strong on email/CRM, but native LinkedIn sending and SMS/voice steps are limited.

Is there data to back Lindy as the best Lead Generation Tool?

4.7/5

avg public rating on G2 + Capterra (as of Sep 2025)

2

enterprise CRM integrations (Salesforce + HubSpot) with field mapping & dedupe

30–50%

time saved drafting prospecting emails with genAI (industry benchmark, McKinsey 2023)

3–5%

revenue uplift potential from genAI in sales use cases (industry benchmark, McKinsey 2023)

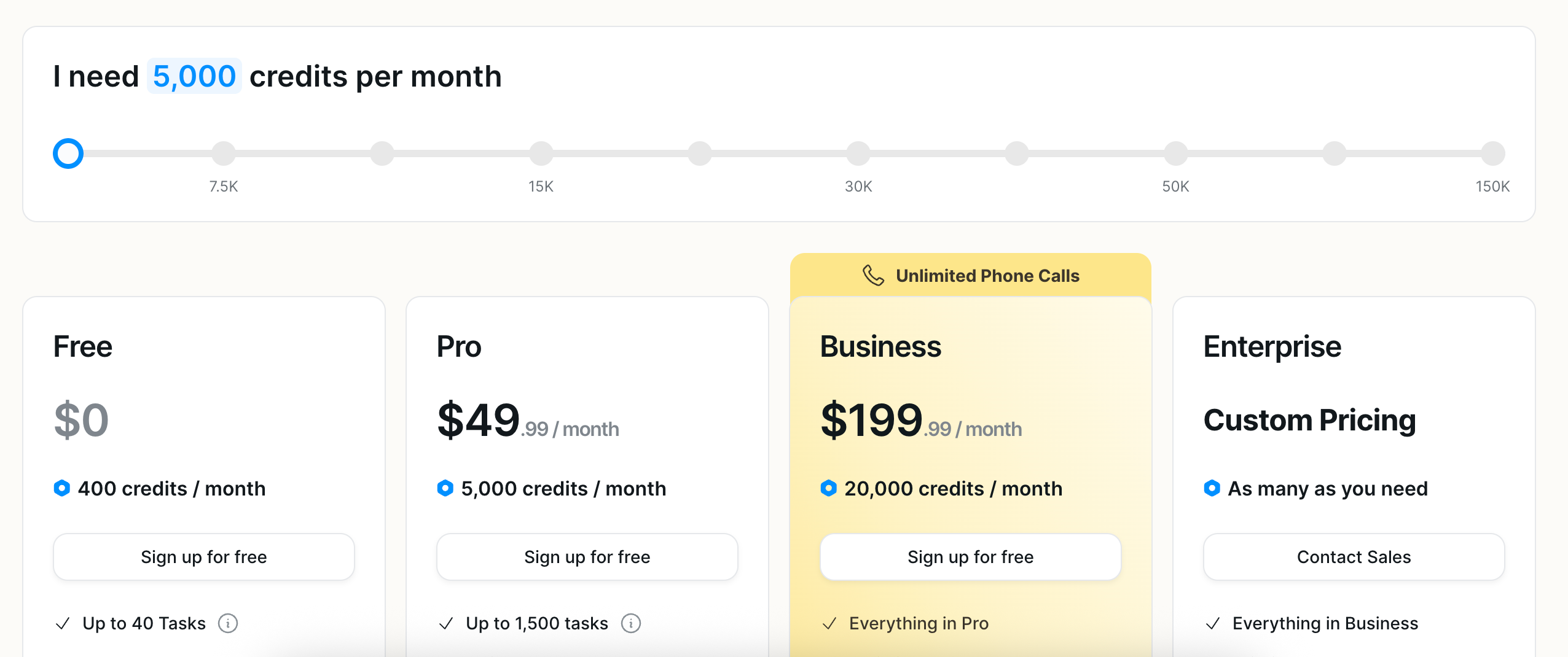

Pricing: How much does Lindy really cost?

Lindy.ai employs a freemium, credit-based model with usage-based billing, eliminating per-seat or per-agent fees.

You start with a free tier and upgrade as your usage scales.

Choose between these 3 plans (credit-based):

- Free – $0/month: Includes 400 free credits (roughly 400 tasks/month), ideal for getting started with AI agents.

- Pro – ~$49/month: Gets you approximately 5,000 credits/month and access to premium actions and templates. Comes with a 7-day free trial to test the full capabilities.

- Business – ~$299/month: Includes around 30,000 credits/month and priority support, designed for more intensive workflows.

(Exact credit consumption per task may vary based on action complexity.)

Price limitations & potential surprises

Credit usage varies widely depending on task complexity

While the plans specify a credit allotment, each task (e.g., simple data fetch vs. parsing or multi-step automation) consumes a different amount, making real monthly usage hard to predict.

Phone-based automations carry hidden, high per-minute costs

If your workflows include voice calls, each minute can consume dozens of credits.

--> e.g., U.S. calls cost ~20 credits/minute, with higher rates for specific regions. That quickly adds up for voice-heavy use cases.

Which lead generation tool is best for you?

→ Pick Cognism if you need bulletproof EMEA compliance, intent signals, and always-fresh human-verified data for B2B sales teams.

→ Go with AiSDR for automated, high-volume outbound when you want fast, AI-personalized emails (but mostly email-only).

→ Choose Gumloop if you want an end-to-end workflow—prospect sourcing, fit scoring, enrichment, and outreach—packaged for teams scaling outbound, with less manual setup.

→ Opt for Persana if hyper-granular enrichment, auto-ICP list building, and integrated deliverability checks are crucial and your team can handle more complexity.

→ Clay is your tool if flexibility, multi-source enrichment, and workflow automation (including website scraping and deduping) are what you value most.

→ Pick Lindy if rapid setup, deep Salesforce/HubSpot sync, and customizable agents are your top priorities, especially for SDRs and growth teams.

Need an AI chatbot for lead gen? Try Big Sur AI today.