The Best AI Product Discovery Tools for E-Commerce (Top 7 for 2025)

Looking for the best AI tools to help shoppers discover the right products?

This guide covers:

- Clear comparisons of top AI product discovery solutions for e-commerce (think quizzes, recommendations, personalized carousels, and more)

- Honest breakdowns of each tool’s strengths, limitations, and pricing

- Expert tips on what features actually drive more sales—so you can invest wisely

Here’s the TL;DR 👇

| Tool | Best For | Key Strength | Drawbacks | Pricing |

|---|---|---|---|---|

| Algolia Recommend | E-commerce teams needing fast, scalable, personalized product carousels and recs | Index-native with Algolia Search; real-time clickstream & catalog signals; prebuilt recommendation models (FBT/related/trending); robust merchandising and A/B testing controls | Limited session/user personalization (mainly item-to-item); cold-start on sparse data; high event instrumentation/setup required | Quote-based add-on to Algolia Search (no public pricing); scales with usage and contract tier |

| Digioh | Teams wanting highly customized shoppable quizzes, forms, and dynamic onsite personalization | Deep quiz customization; behavioral targeting by session/cart/device/UTM; real-time integrations with CRM/ESP/CDP; native A/B testing | No built-in ML ranking (rules-based quizzes); complex setup for large catalogs; limited native revenue attribution | Quote-based, varies by features/traffic/support; custom add-ons; no public plan tiers or rates |

| Amazon Rufus | Shoppers or brands operating within Amazon's marketplace, seeking AI-powered search/rec | Deep natural language, synonym & long-tail handling; leverages Amazon’s catalog and review data; live shortlist/ranking, in-chat refinement and buying guides | Amazon-only (no cross-site recs); sponsored rankings may bias results; limited transparency into ranking logic; not available as standalone SaaS | Free within Amazon app/web (not sold B2B/SaaS); brand placement subject to ad spend |

Non-obvious things to look for in product discovery tools

Factor 1: Long-tail search and synonym handling

Many platforms miss nuanced queries or struggle with synonyms and long-tail keywords.

In some forums, users warn: “We switched tools when our search couldn’t handle newer, slang product names.”

Ensure your tool understands intent, not just keywords. This matters greatly in e-commerce where products are described in multiple ways.

Factor 2: Data enrichment and third-party integrations

Look for plug-and-play integrations with CRM, product catalogs, or customer review platforms.

Many tools limit you to native data only, hurting accuracy.

Factor 3: Real user feedback loops

Top performers listen to users in real-time, adapting quickly based on click and rating data.

Avoid static systems that update only after quarterly reviews. Look for dynamic platforms that improve as shoppers browse.

💡 Honorable mentions: Customization for niche verticals, support for A/B testing, and cross-device experience consistency.

The Best Product Discovery Tools in 2025

Big Sur AI

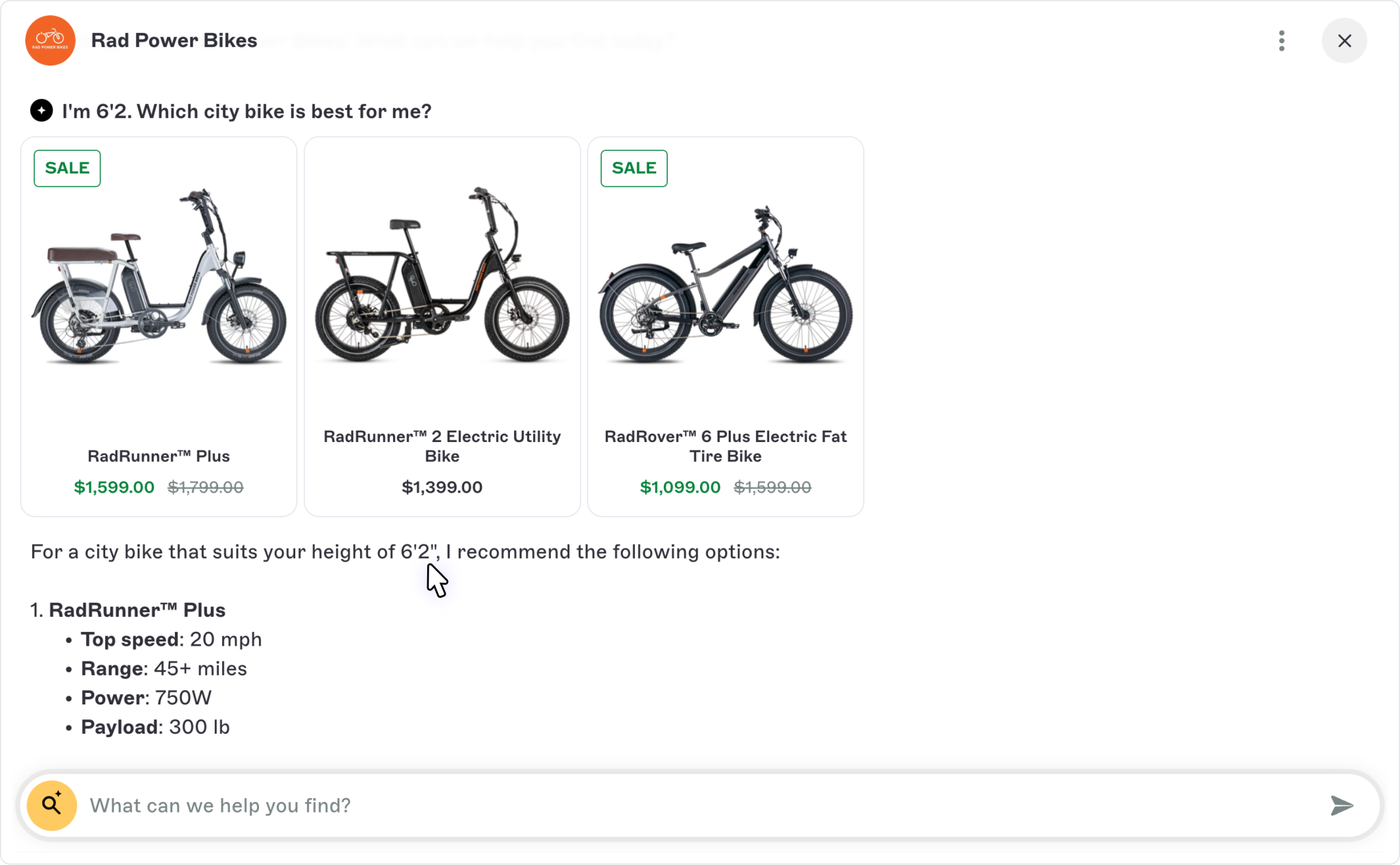

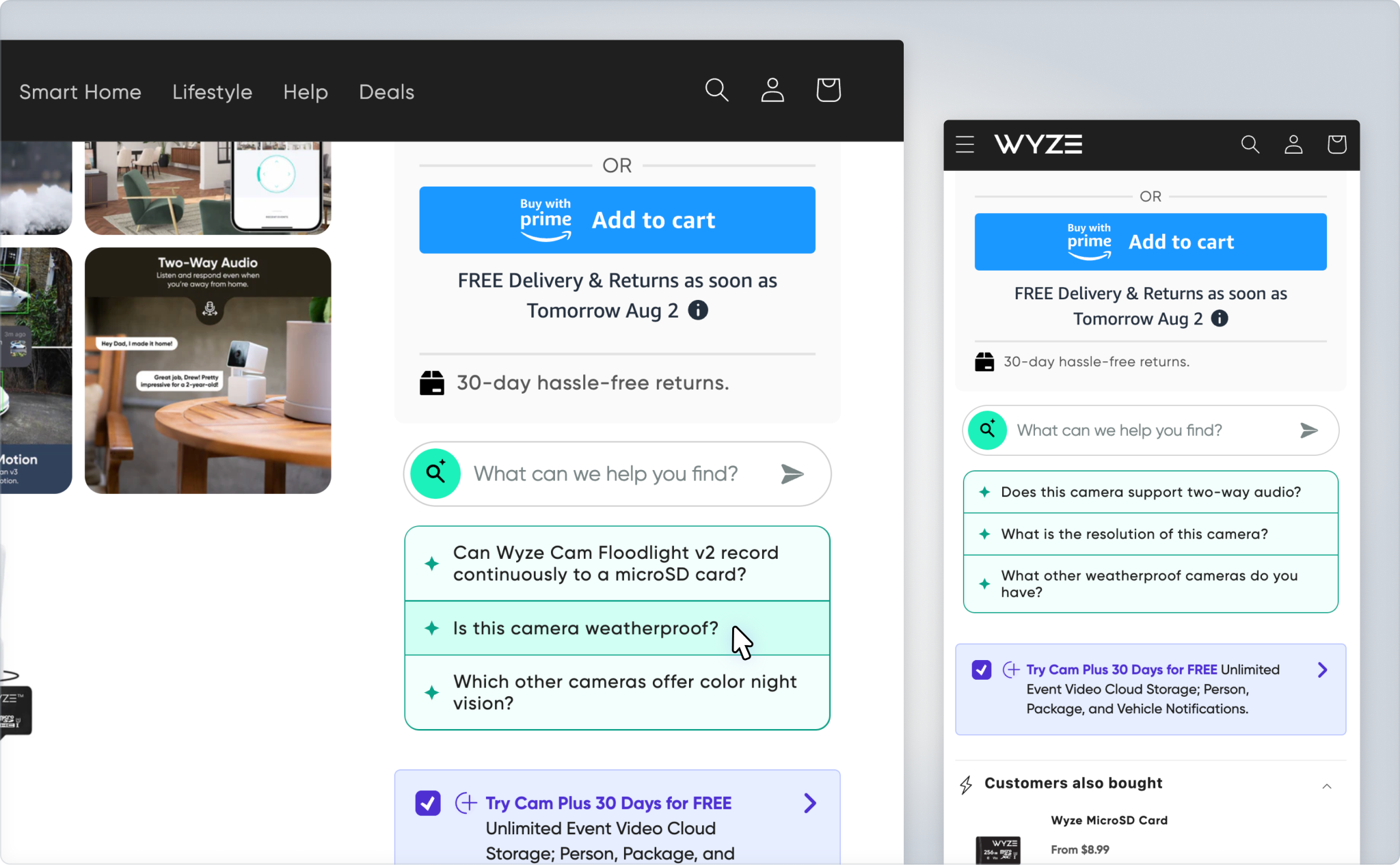

Public reviews: strong positive testimonials from brands like Rad Power Bikes, Wyze, and dpHUE

Our rating: 9.5/10 ⭐ (always room to improve!)

Similar to: Coveo AI, Bloomreach, Emarsys

Typical users: E-commerce product and marketing teams looking for conversational, conversion-driven discovery

Known for: Real-time conversational AI agent + contextual product recommendations optimized for conversions

Why choose it over others in this list?

Easy setup (minutes on Shopify, under days on other CMS), pay-for-performance or visitor-based pricing, and built-in analytics that track how conversational prompts and recommendations convert users.

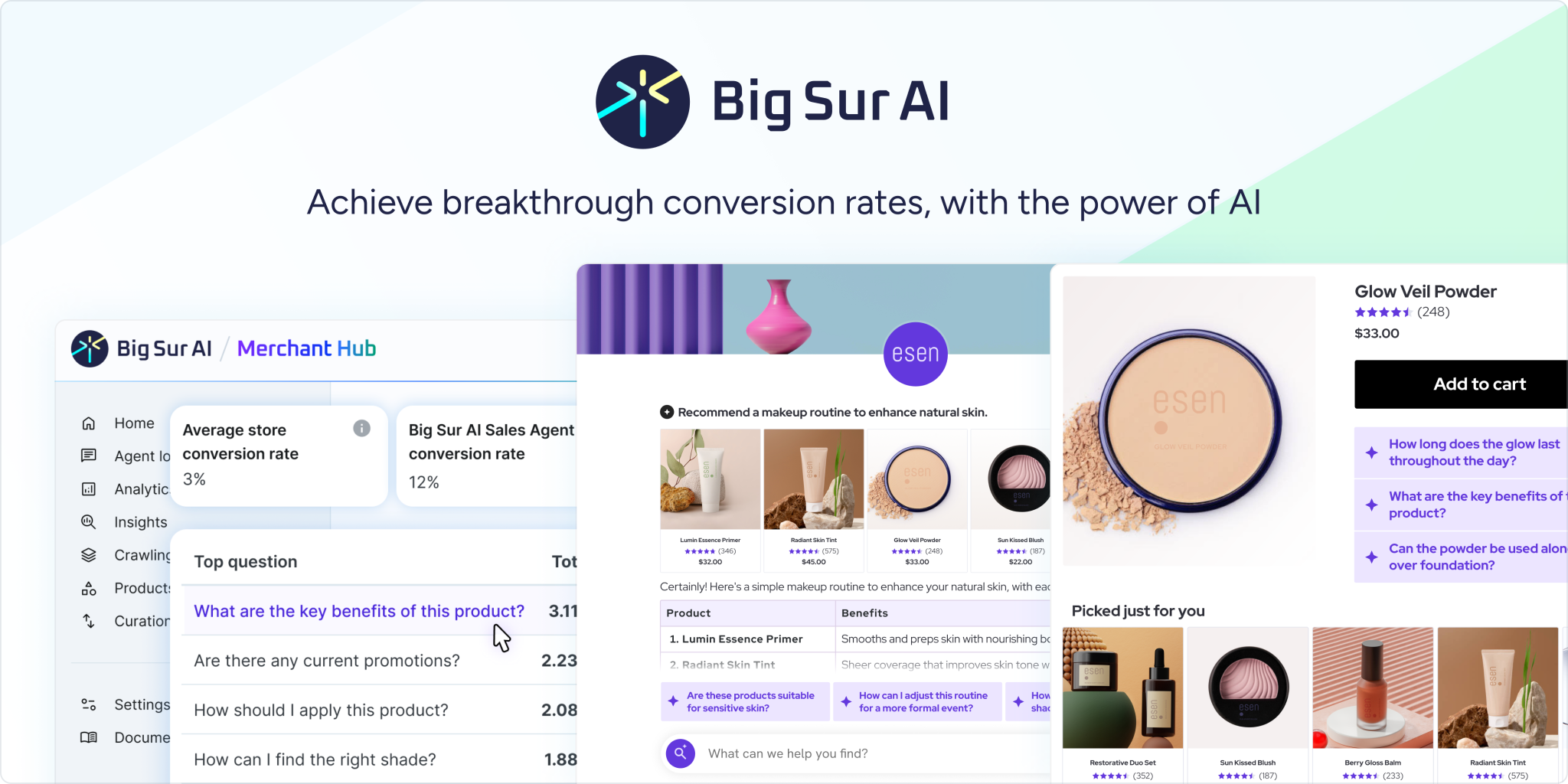

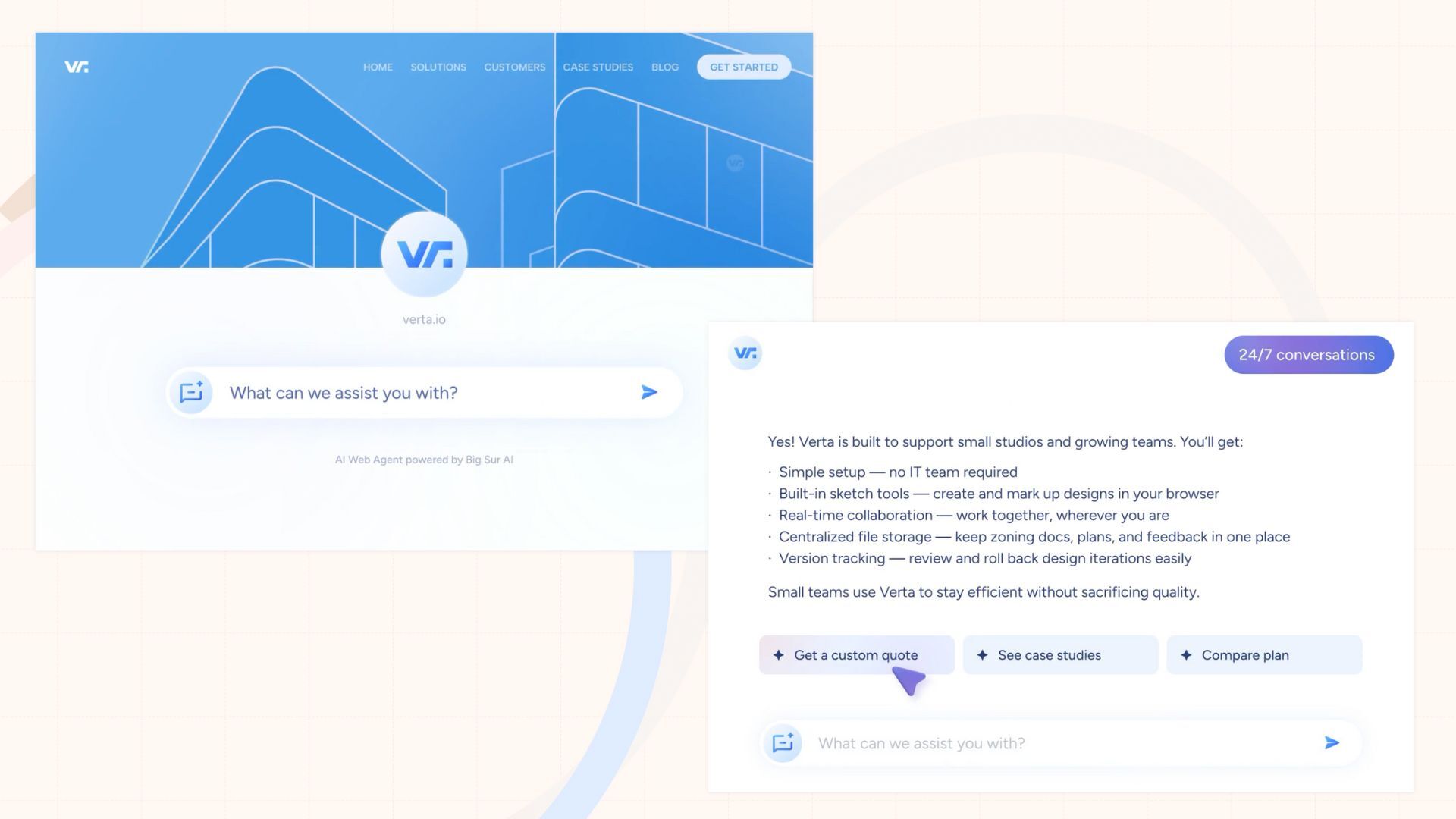

What does Big Sur AI do?

An AI-powered Sales Agent that replicates the in-store assistant experience via website chat.

It engages in real-time, human-like conversations with shoppers to deliver tailored product recommendations and conversion-optimized prompts that guide users to purchase.

It is trained on your product catalog, site content, and customer behavior, and surfaces merchant insights on user questions, product affinity, and conversion triggers.

Why is Big Sur AI a top product discovery tool?

Simple → It provides a complete suite of products that drive conversion-optimized product discover, and the product has been purposefully built for e-commerce brands.

Big Sur AI’s top features

- AI Sales Agent: Natural-language assistant trained on your store’s content and shopper behavior for tailored product advice.

- Modular recommendations: Personalized modules (“Picked just for you,” “Frequently bought together,” “Top sellers”) dynamically appear based on page context and user behavior.

- Conversion-Optimized Prompts (AI Corner): Smart, contextually timed suggestions that anticipate shopper questions and keep them engaged.

- Merchant Insights Dashboard: Deep analytics on user questions, interaction paths, conversion correlation, and cart affinity, helping you iterate product presentation and marketing.

Pros and cons of Big Sur AI

Pros: Why do people pick Big Sur AI over other product discovery tools?

✅ Conversational, human-like shopping assistant Engages users in natural language, replicating the in-store associate experience and driving higher engagement.

✅ Conversion-optimized AI promptsContext-aware suggestions (“AI Corner”) surface at the right time to reduce hesitation and increase add-to-cart rates.

✅ Quick, low-friction integrationDeploys on Shopify in minutes and other CMS platforms with minimal developer effort, lowering time-to-value.

Cons: What do people dislike about Big Sur AI?

❌ Fewer public reviews than incumbents As a newer entrant compared to Bloomreach or Coveo, it has less third-party review volume to benchmark reliability.

❌ Still maturing feature depth While strong on conversational recs and prompts, advanced enterprise-grade controls (complex rules, deep API extensibility) are less extensive than legacy players.

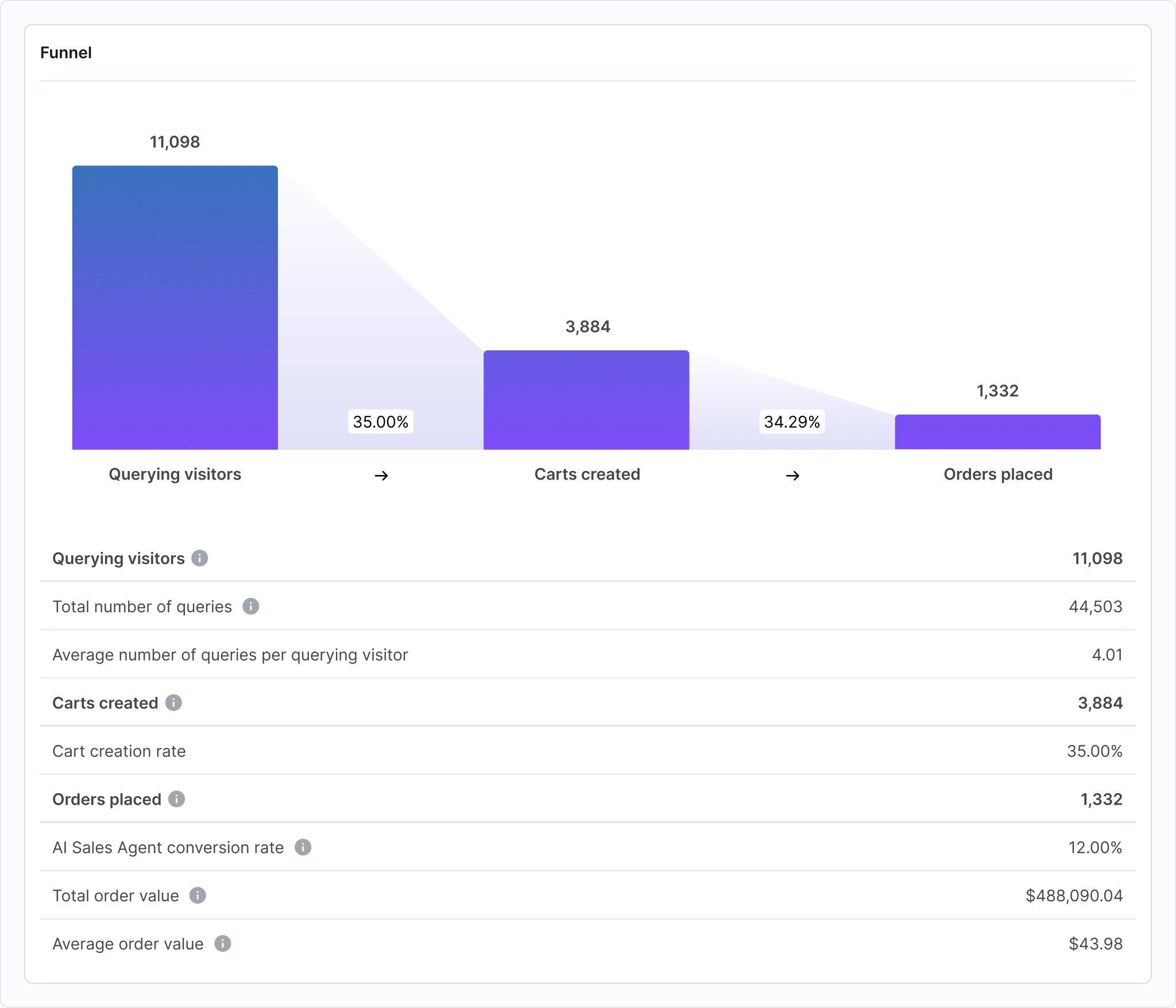

Is there data to back Big Sur AI as the best Product Discovery Tool?

Algolia Recommend

Public reviews: 4.7 ⭐ (G2, Capterra average)

Our rating: 8/10 ⭐

Similar to: Dynamic Yield, Coveo

Typical users: E-commerce and retail product teams

Known for: Fast, accurate AI-powered recommendations

Why choose it? Seamless integration, flexible APIs, and scalable performance for personalized product discovery at any volume

What is Algolia Recommend?

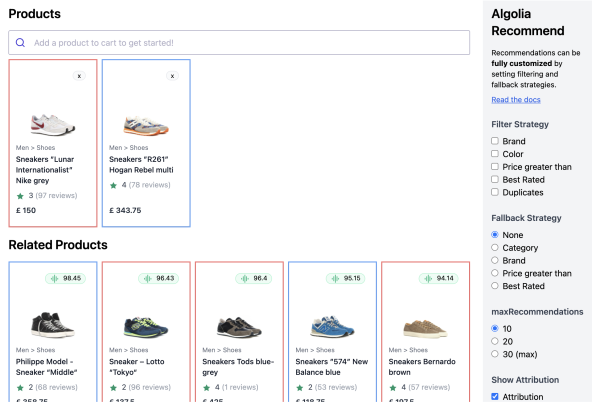

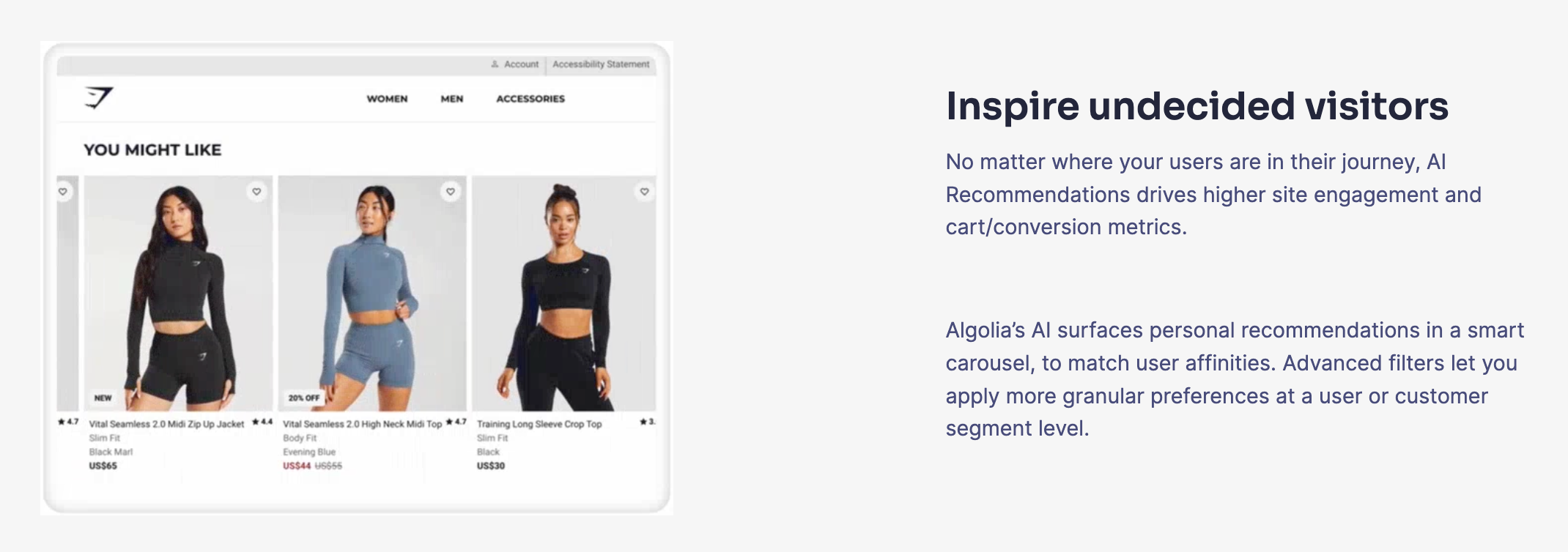

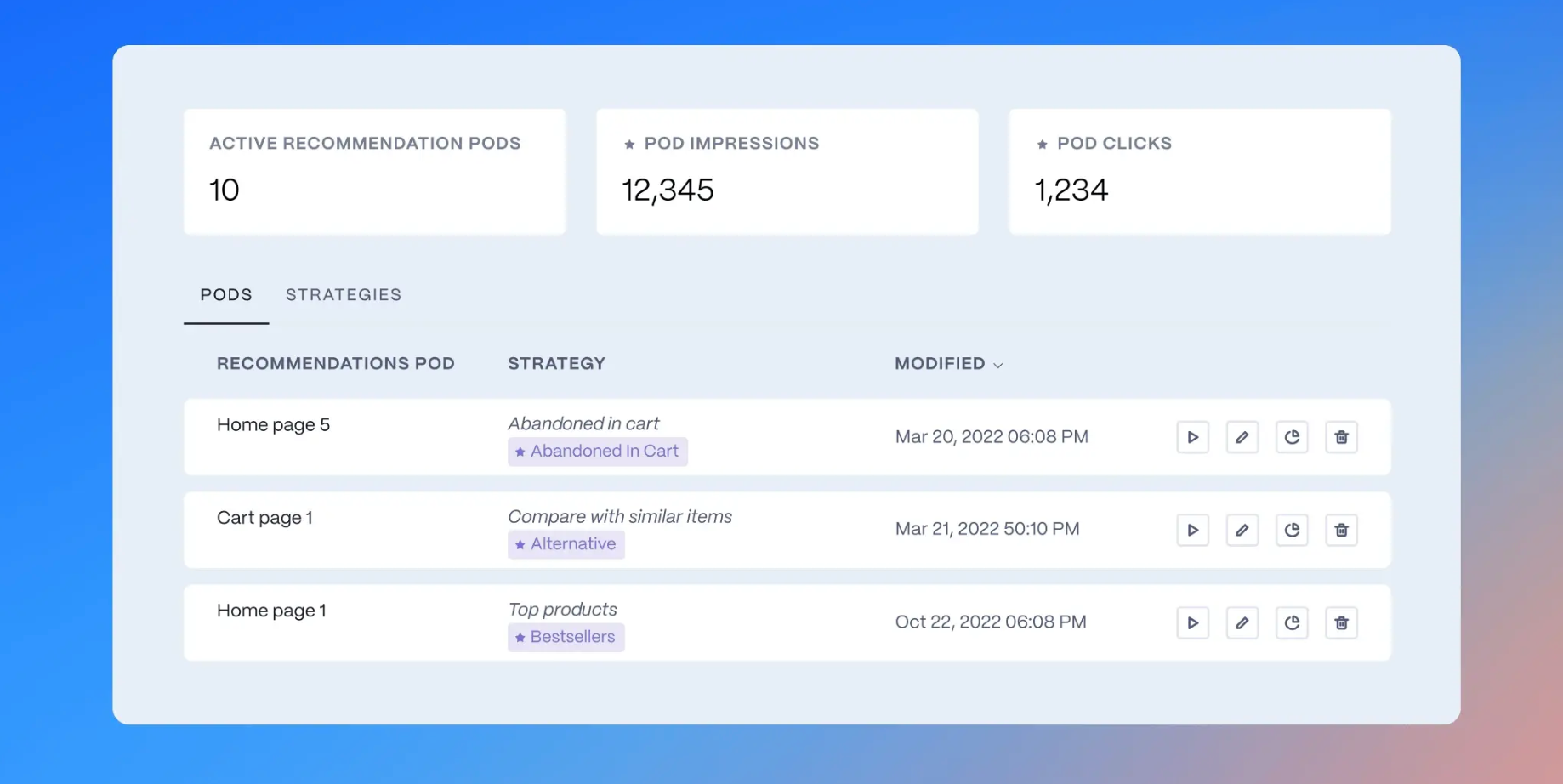

AI recommendations for ecommerce using clickstream, catalog, and search signals to power related, FBT, and trending carousels.

Integrate via APIs or dashboard, apply merchandising rules and filters, A/B test, and scale to peak traffic.

Why is Algolia Recommend a top product discovery tool?

Uses clickstream, catalog, and search data to power fast related, bundles, and trending carousels. Integrate via API or dashboard, set rules, A/B test, and handle peak traffic at scale.

Algolia Recommend's top features

- Prebuilt recommendation models: Generate carousels for related products, frequently bought together, and trending items using co-view, co-purchase, and popularity signals.

- Clickstream and catalog signals: Ingest view, click, add-to-cart, and purchase events via the Insights/Events API and combine them with product catalog attributes in your index to compute item-to-item relationships.

- Recommend API and UI components: Retrieve recommendations through the Recommend API/SDKs and render carousels with JavaScript and React components, with configurable item counts, layouts, and fallbacks.

- Merchandising rules and filters: Apply facet and tag filters and business rules to include or exclude items, constrain by category, brand, price, or availability, and align results with page or campaign context.

- Experimentation and analytics: Run A/B tests on recommendation configurations and track metrics such as click-through rate, add-to-cart events, and conversions in Algolia’s dashboard.

Pros and cons of Algolia Recommend

Pros: Why do people pick Algolia Recommend over other product discovery tools?

✅ Index-native with Algolia Search

Leverages your Algolia indices and Events API for real-time, facet-aware item-to-item recommendations.

✅ Granular merchandising control

Facet/tag filters and rules align recs to category, brand, price, availability, and campaign context.

✅ FBT/related/trending out of the box

Prebuilt co-view/co-buy/popularity models ship fast via SDKs/components with robust fallback behavior.

Cons: What do people dislike about Algolia Recommend?

❌ Limited 1:1 depth

Primarily item-to-item/popularity models; lacks rich session-based or user-level personalization.

❌ Cold-start on sparse data

FBT/related need event volume; long-tail or new SKUs often fall back to generic trending.

❌ High event instrumentation burden

Accurate recs demand rigorous Events API setup, ID stitching, and ongoing schema hygiene.

Is there data to back Algolia Recommend as the best Product Discovery Tool?

4.7/5

customer rating on G2 & Capterra (Algolia overall). Source: G2, Capterra 2024–2025

<50 ms

typical API response time on Algolia’s network (Recommend runs on same infra). Source: Algolia docs/status

99.99%

availability SLA for enterprise deployments, supporting peak-traffic recs. Source: Algolia SLA

17,000+

companies use Algolia in production—ecommerce at global scale. Source: Algolia company stats

Pricing: How much does Algolia Recommend really cost?

Algolia prices Recommend as a quote-based, usage-driven add-on to paid Algolia Search plans, with no public list price on its site.

Read more: Algolia Pricing: Is it Worth The Money? [2025]

Price limitations & potential surprises

- Large minimum commitments

- Sneaky cost increase as usage scales

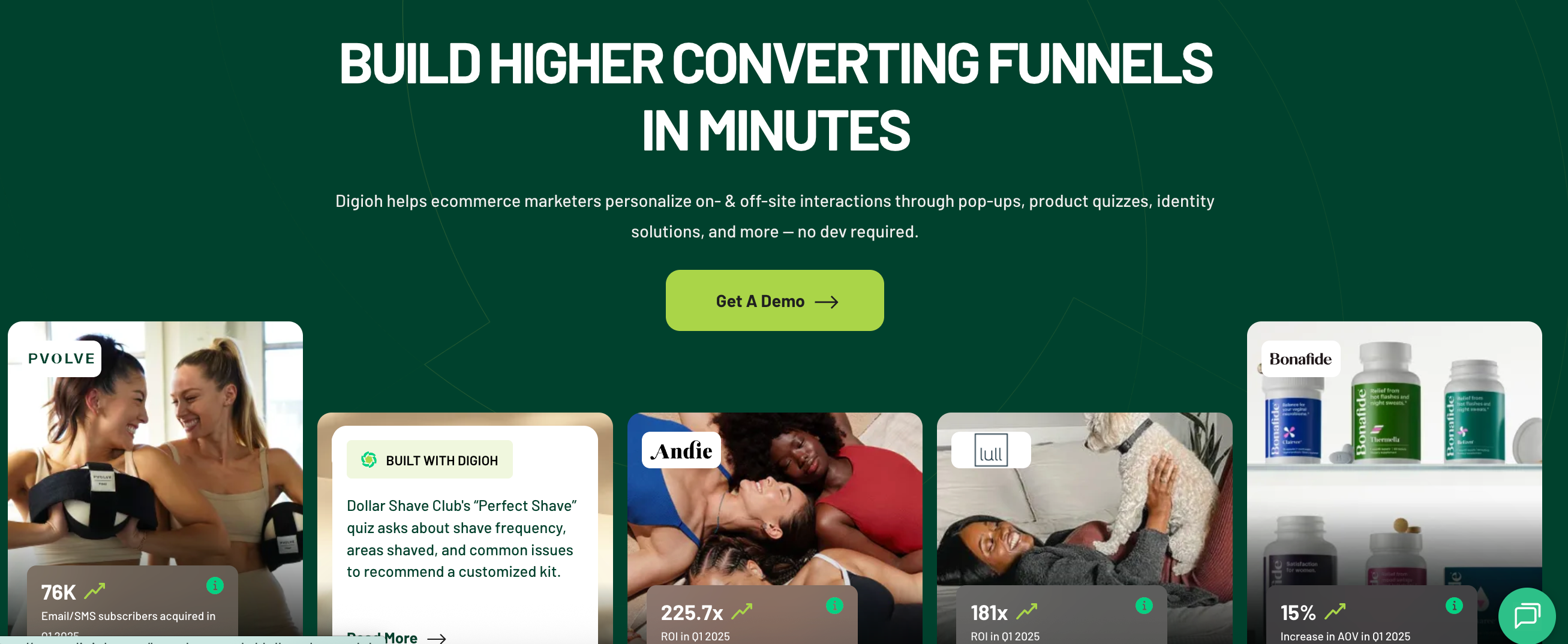

Digioh

Public reviews: 4.7 ⭐ (G2, Capterra)

Our rating: 8/10 ⭐

Similar to: OptiMonk, ConvertFlow

Typical users: E-commerce teams, marketers, digital product managers

Known for: Highly customizable quizzes and dynamic lead capture forms

Why choose it? Deep personalization options and robust integrations for optimizing conversion and product discovery experiences

What is Digioh?

Digioh lets ecommerce teams build shoppable quizzes, dynamic forms, and targeted popups to guide product discovery and grow lists. It personalizes by segment, runs A/B tests, and syncs data to ESPs/CRMs/CDPs to fuel email/SMS and onsite personalization.

Why is Digioh a top product discovery tool?

Digioh pairs shoppable quizzes with targeted forms to recommend products, run A/B tests, segment by behavior, and push answers to your email and customer systems for smarter onsite and SMS flows.

Digioh's top features

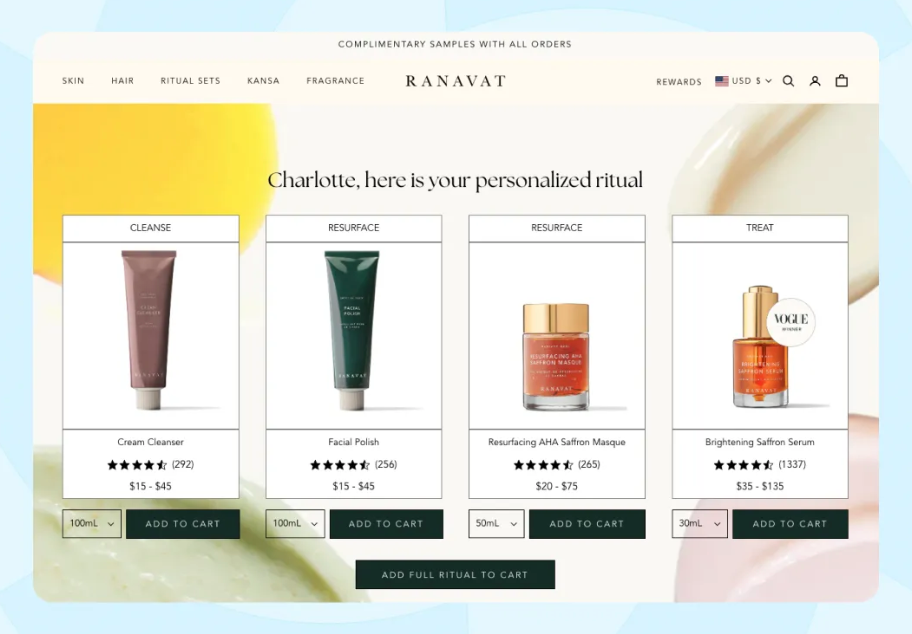

- Shoppable quizzes & product recommendations: Build multi-step quizzes with branching logic; map answers to product attributes, collections, or tags; generate ranked product results or bundles; optionally push selected items to the cart or a prefilled checkout.

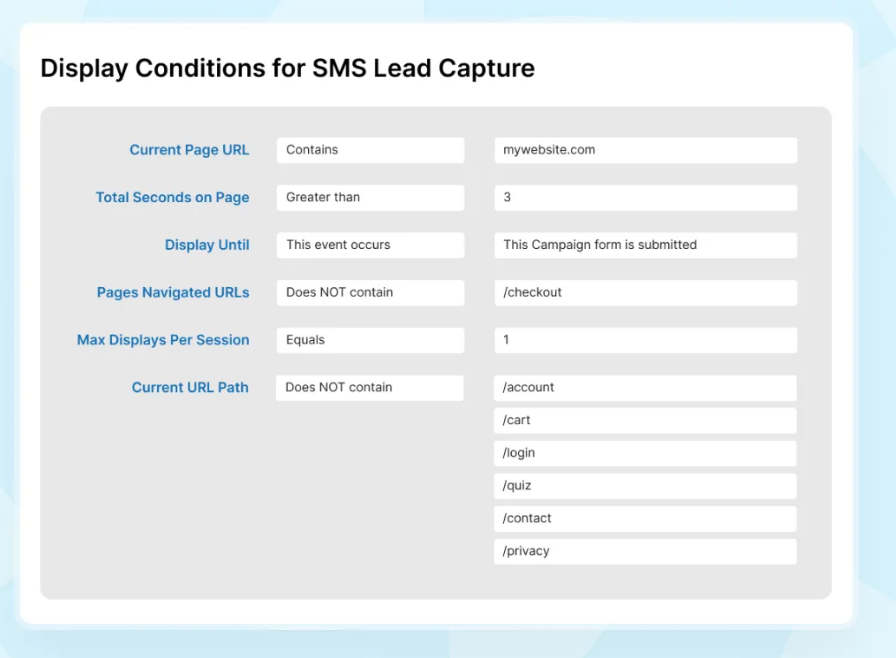

- Dynamic forms, popups, and onsite widgets: Create lightboxes, slide-ins, inline forms, banners, and full-screen overlays; trigger by exit intent, scroll depth, time-on-page, click, or URL rules; support multi-step capture with conditional fields.

- Behavioral targeting & audience rules: Target experiences by device, geolocation, referral source/UTM, page or category, cart contents, session behavior, and known customer attributes; control frequency caps and display sequences.

- A/B testing & experiments: Split traffic across variants of quizzes, forms, copy, or layouts; compare performance with built-in analytics to refine flows.

- Integrations & data pass-through: Sync leads, quiz answers, and events to ESPs/CRMs/CDPs (e.g., Klaviyo, HubSpot, Salesforce, Shopify) via native connectors, APIs, or webhooks; map fields to send real-time attributes and segments.

Pros and cons of Digioh

Pros: Why do people pick Digioh over other product discovery tools?

✅ Catalog-aware shoppable quizzes

Map answers to attributes/tags to auto-build bundles and push picks to cart or checkout.

✅ Real-time CDP/ESP sync

Stream quiz answers and segments to Klaviyo/Shopify to trigger tailored email/SMS and onsite flows.

✅ Granular behavioral targeting

Target by UTM, page, cart, device, and session behavior with frequency caps and display sequences.

Cons: What do people dislike about Digioh?

❌ No native ML recommendations

Product matches rely on rules; AI ranking needs external tools or custom work.

❌ Complex setup for large catalogs

Branching logic and attribute mapping get heavy; often needs a technical hand to maintain.

❌ Shallow revenue attribution

Experiment reports lack cohort/LTV; most teams stitch impact in GA/Klaviyo.

Is there data to back Digioh as the best Product Discovery Tool?

4.7/5

avg public rating (G2 + Capterra)

N/A

published NPS or avg support response time (not disclosed)

Case‑study

evidence type: vendor/client case studies; no 3rd‑party CVR benchmarks

Real‑time

sync to Klaviyo, HubSpot, Salesforce, Shopify via native connectors/webhooks

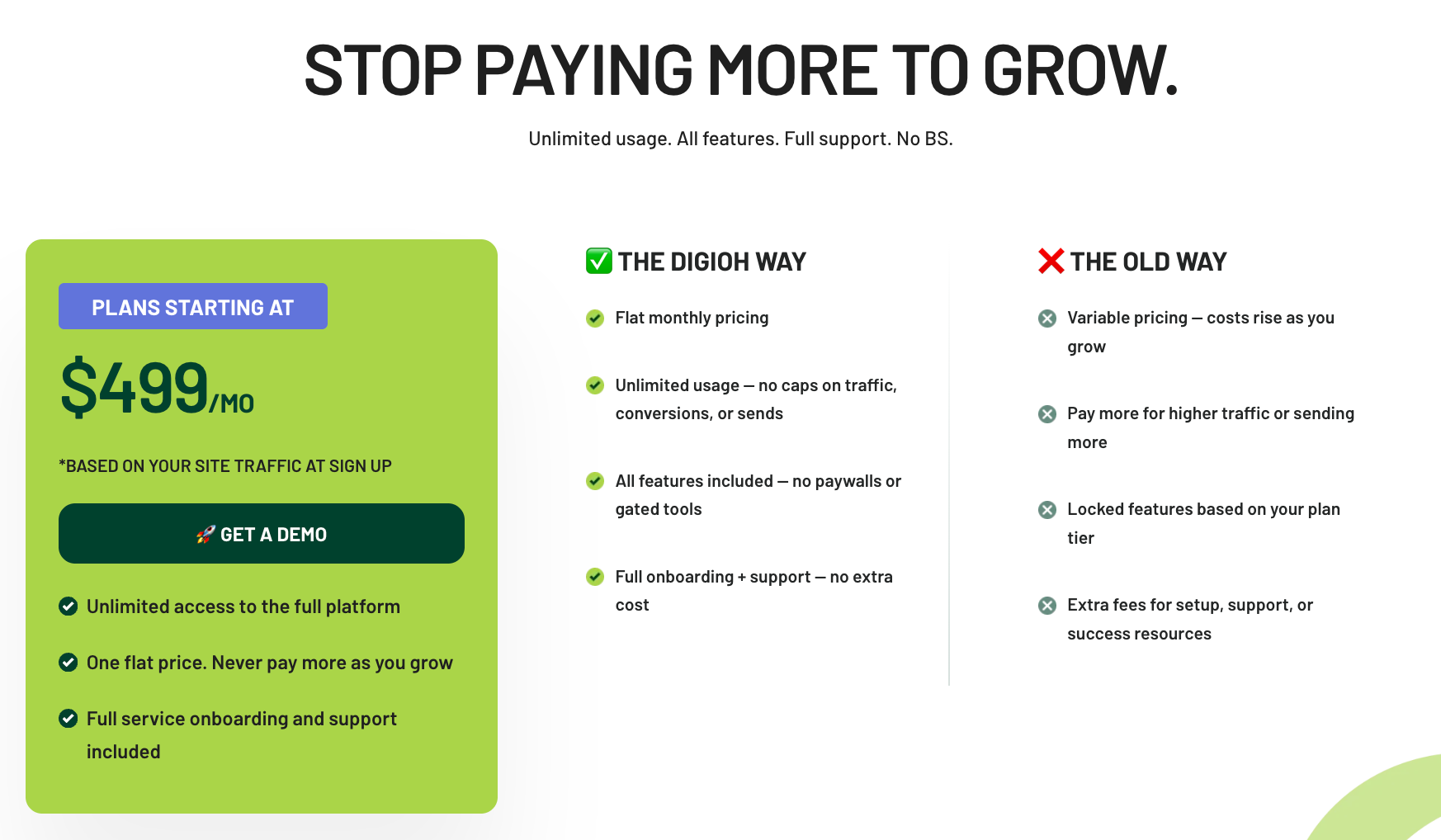

Pricing: How much does Digioh really cost?

Pricing: How much does Digioh really cost?

Digioh uses a flat, traffic-based monthly model.

You pay a single fixed rate of $499/month that covers unlimited usage, full feature access, and onboarding and support, regardless of scale.

Choose between these plans:

- Baseline Starter – $499/month (starting point): Covers unlimited quizzes, pop-ups, forms, all platform features, and includes full-service onboarding and ongoing support.

- Higher tiers – $800+/month: Some sources report starting plans at ~$800/month for more advanced needs, though these details are less consistent and likely reflect customized usage packages.

- Enterprise-level custom pricing: If you require additional domains, HIPAA compliance, white-labeling, or high-volume needs, expect add-ons that significantly raise costs.

Price limitations & potential surprises

Add-on domains can increase cost quickly

While the base rate covers “unlimited usage,” adding extra domains costs from ~$39/month each. If your brand spans multiple domains, this multiplies your baseline expense.

High-volume or customized implementations may require custom quotes well above the baseline

For enterprise-level usage with high traffic volumes, integrations, or identity resolution, you’ll likely negotiate a custom plan that could start near $800/month and scale upward quickly.

Read more: Digioh Review (2025): Key Features, Pricing & Insights

Amazon Rufus

Public reviews: 4.3 ⭐ (Trustpilot, general consensus)

Our rating: 7.5/10 ⭐

Similar to: Klarna AI, Shopify Sidekick

Typical users: E-commerce shoppers and online retailers

Known for: AI-powered personalized product recommendations

Why choose it? Seamlessly integrates with Amazon, leveraging vast data for highly relevant product suggestions

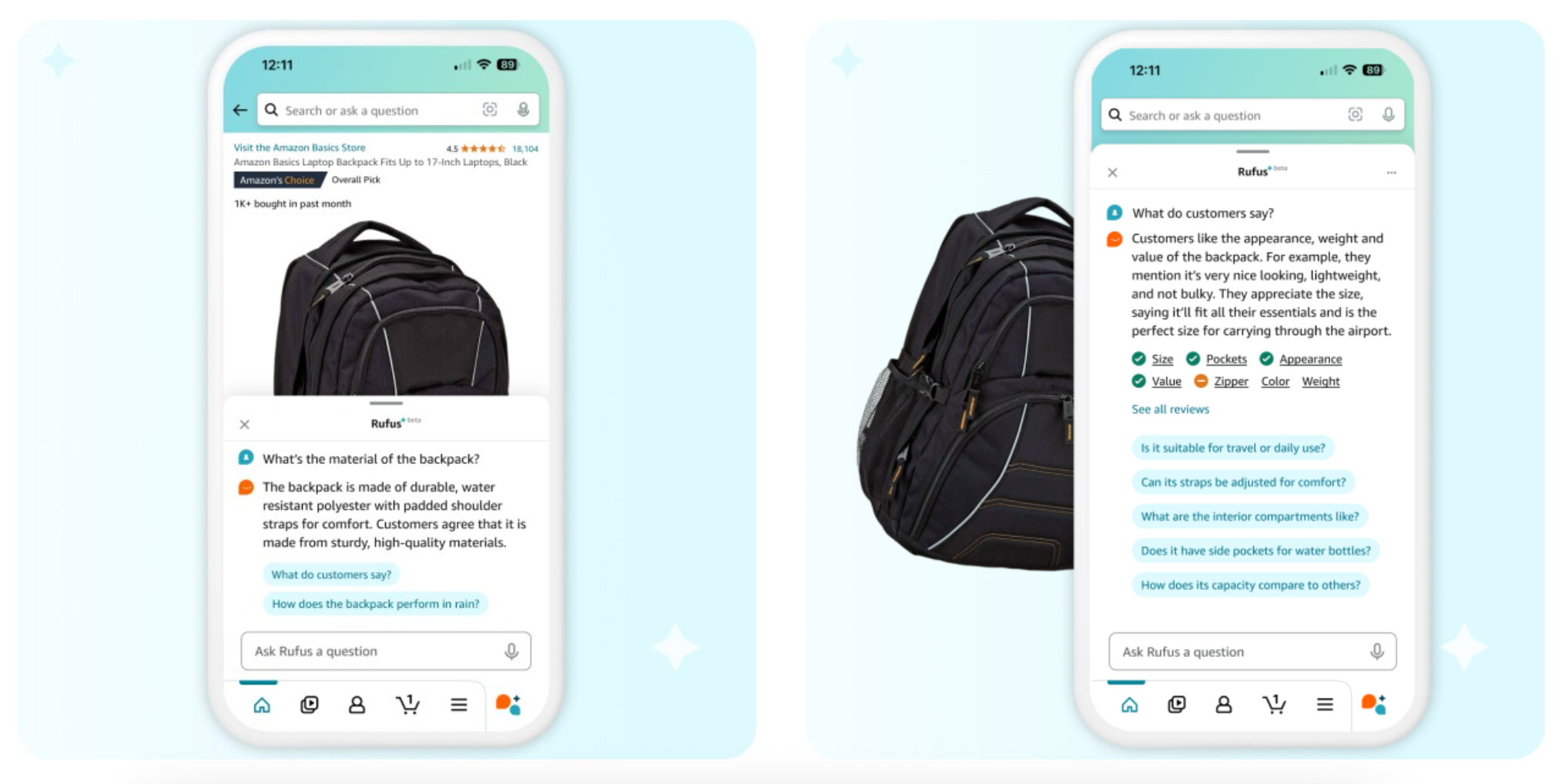

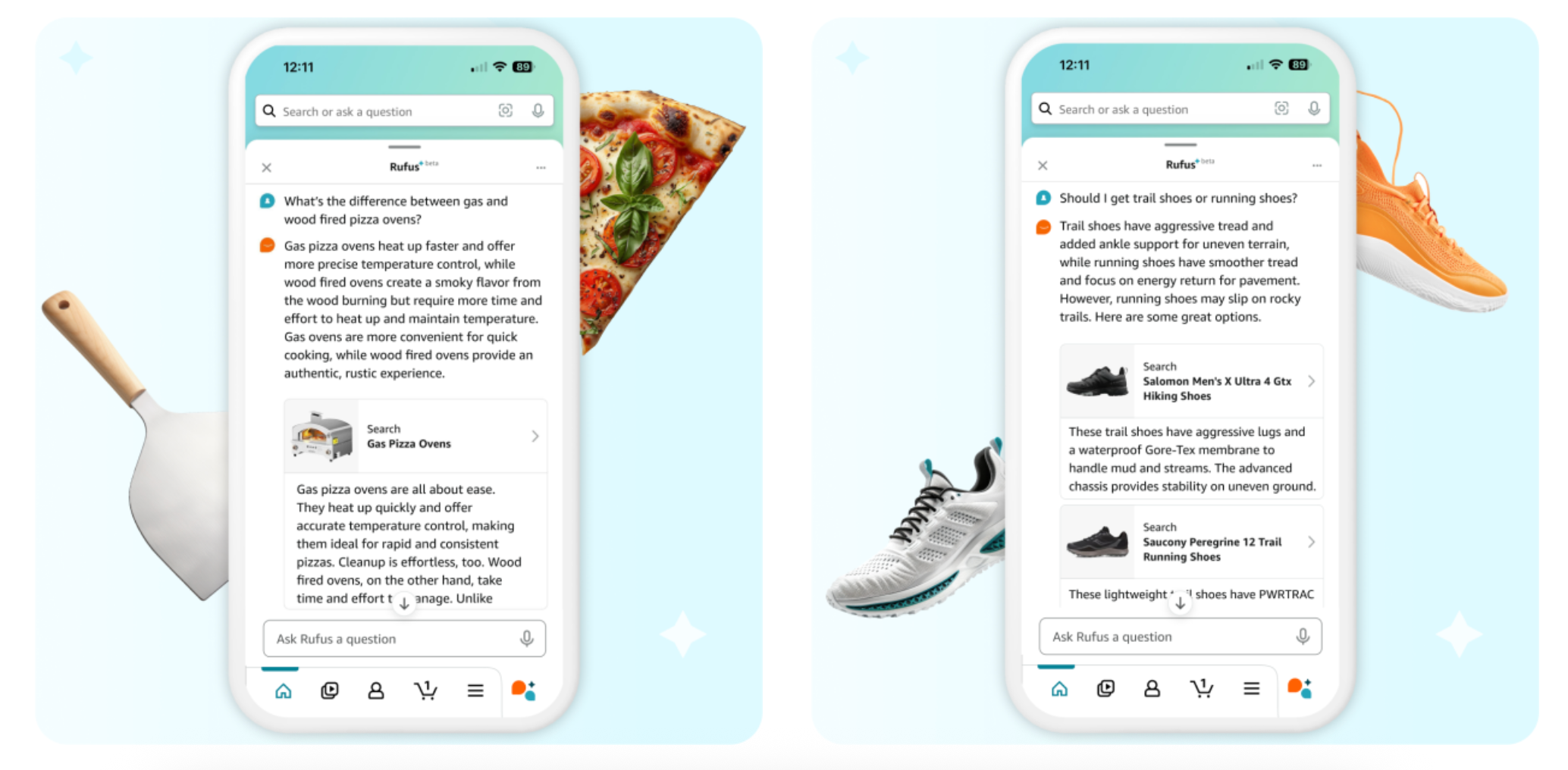

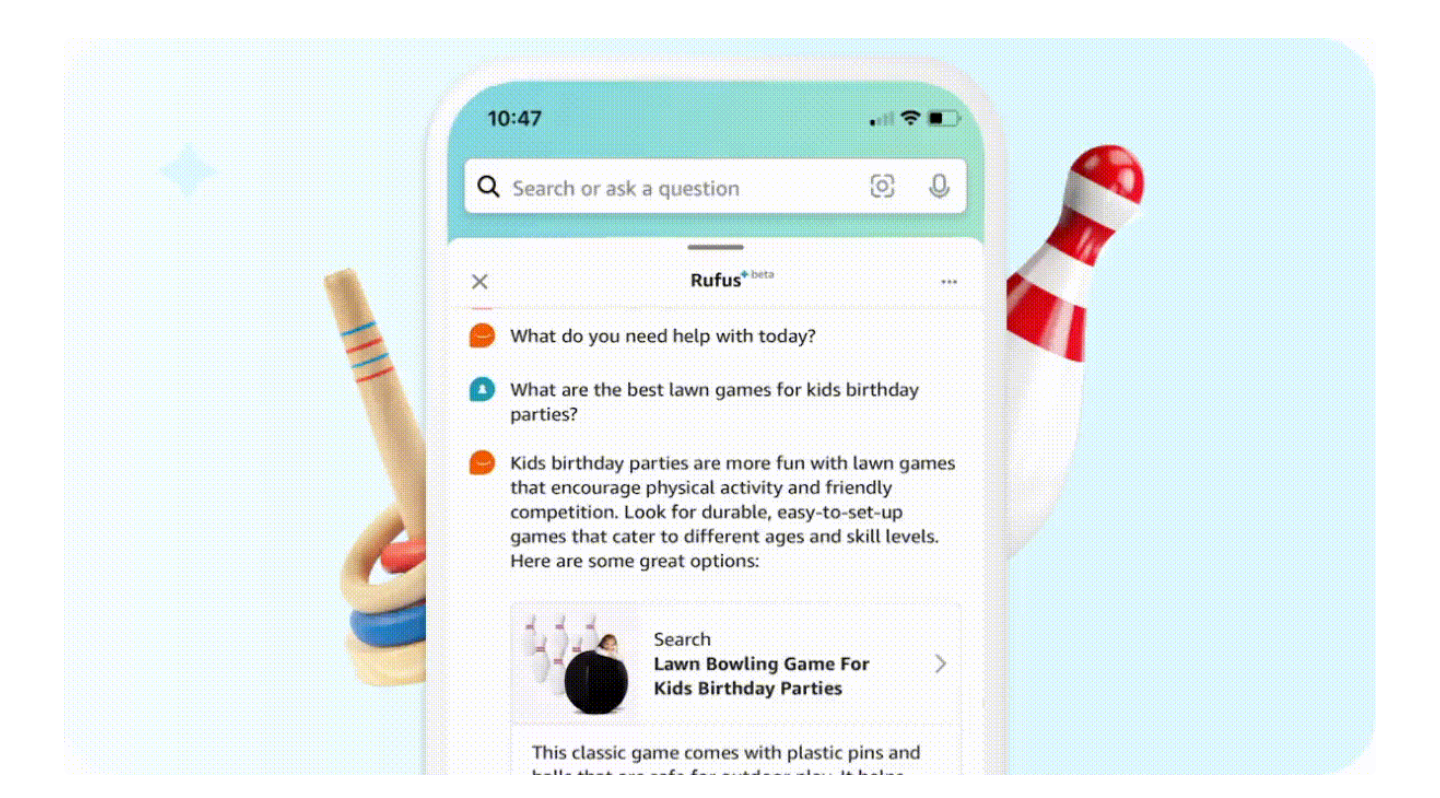

What is Amazon Rufus?

Amazon Rufus is an AI shopping copilot inside Amazon that turns vague intents into shoppable results. It parses queries, compares options, builds shortlists, and explains trade-offs using catalog data, reviews, and behavior signals so buyers land on the right product faster.

Why is Amazon Rufus a top product discovery tool?

It converts vague queries into ranked picks using Amazon catalog and reviews, compares options, explains tradeoffs, and builds shortlists so shoppers and sellers get to the right product fast.

Amazon Rufus's top features

- Bold Natural-language query understanding: Interprets conversational prompts (e.g., “compact stroller for travel,” “gifts for runners”) and returns shoppable results mapped to relevant categories and product lists within Amazon.

- Bold Buying guides and considerations: Generates category-specific “what to consider” checklists and key criteria, grounding guidance in Amazon’s catalog structure and product attributes.

- Bold Product comparison and trade-off explanation: Produces side-by-side comparisons of shortlisted items, calling out differences in specs, materials, performance attributes, and notable patterns found in listings and reviews.

- Bold Review and product Q&A summarization: Condenses customer reviews and on-page Q&A into concise summaries of recurring pros, cons, and frequently mentioned features for each item.

- Bold Iterative refinement and in-chat filters: Accepts follow-up constraints (price, brand, size, compatibility, certifications) and spec questions, then re-ranks and narrows the result set in-session.

Pros and cons of Amazon Rufus

Pros: Why do people pick Amazon Rufus over other product discovery tools?

✅ Amazon-native data advantage

Leverages first-party catalog, review, and behavior signals to out-rank third‑party PD tools.

✅ Query-to-shortlist automation

Converts vague intents into ranked shortlists with explicit trade‑offs, cutting steps to purchase.

✅ Live, iterative re-ranking

In‑chat filters and spec Q&A re‑rank results instantly using availability and attribute constraints.

Cons: What do people dislike about Amazon Rufus?

❌ Sponsored bias in rankings

Sponsored slots and Amazon brands can outrank more relevant picks.

❌ Amazon‑only scope

No cross‑site comparisons, limiting discovery of DTC or niche‑market options.

❌ Opaque ranking rationale

Limited visibility into why items rank, making trade‑offs hard to audit.

Is there data to back Amazon Rufus as the best Product Discovery Tool?

60%+

US shoppers who start product searches on Amazon—placing Rufus at the point of intent. Source: Jungle Scout, 2024 Consumer Trends Report.

≈38%

Amazon’s share of US e-commerce sales, giving Rufus unmatched first-party catalog, review, and behavior signals. Source: Insider Intelligence (eMarketer), 2024.

2B+

monthly visits to Amazon.com in 2024, providing massive interaction data for ranking and recommendations. Source: Similarweb, 2024.

0

publicly audited Rufus-specific conversion, latency, or NPS disclosures through 2024; Amazon’s statements are qualitative. Sources: Amazon Day One (Rufus launch, 2024); 2024 earnings calls.

Pricing: How much does Amazon Rufus really cost?

Amazon does not publish a Rufus pricing page; it’s included free within the Amazon shopping experience and is not sold as standalone software.

Price limitations & potential surprises

For brands, visibility is influenced by Amazon Ads budgets and competition, so maintaining top placements may require rising CPC spend even though Rufus itself has no fee.

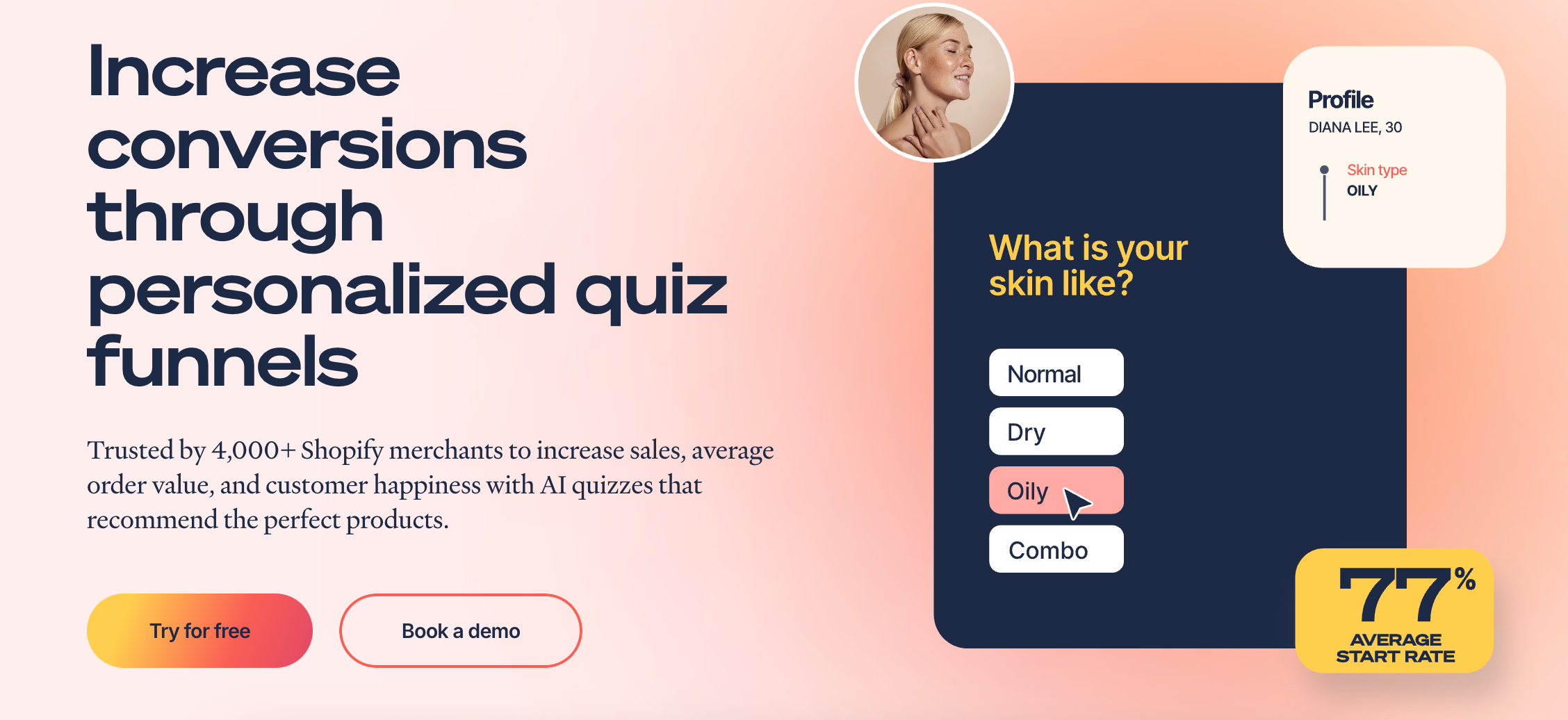

Octane AI

Public reviews: 4.7 ⭐ (G2, Shopify App Store)

Our rating: 8.5/10 ⭐

Similar to: QuizKit, Typeform

Typical users: E-commerce brands and online retailers

Known for: AI-powered conversational product quizzes

Why choose it? Drives personalized product recommendations and boosts conversion rates

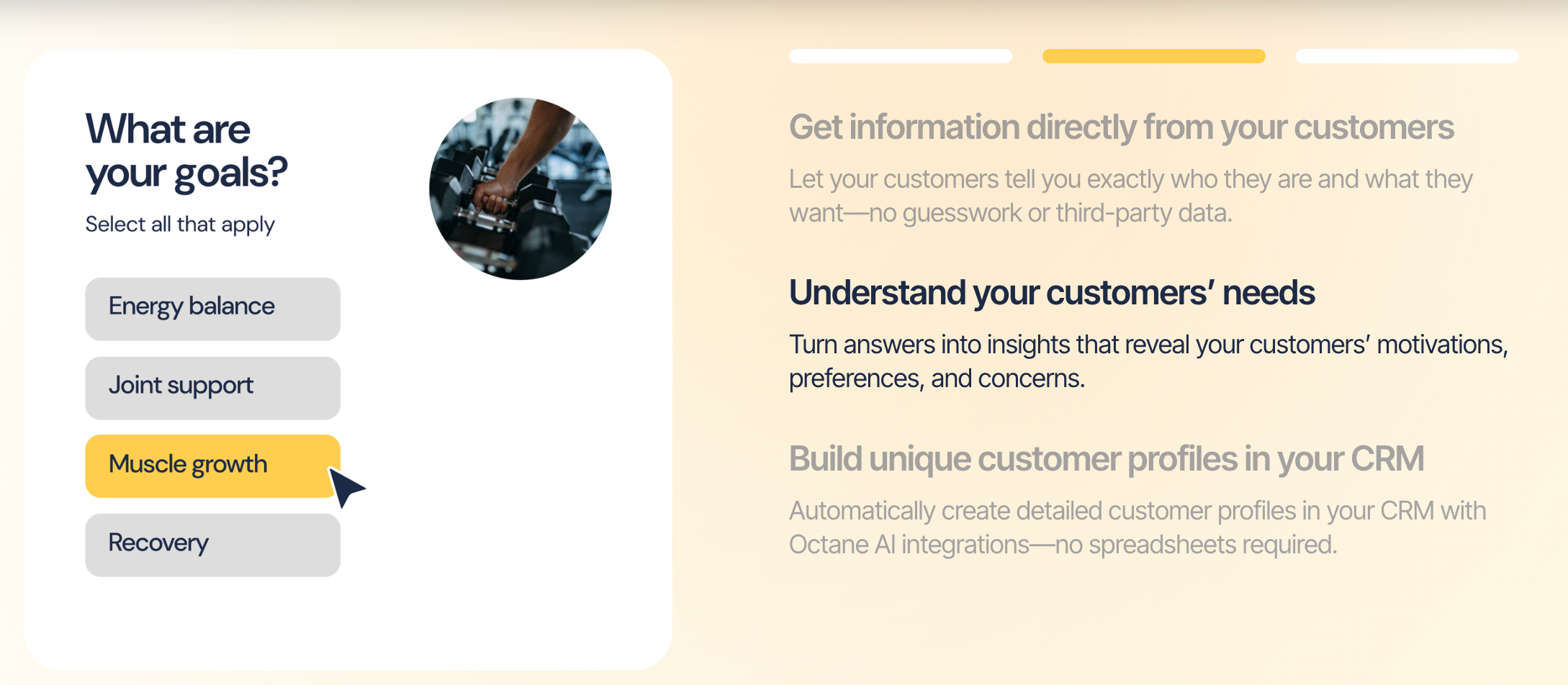

What is Octane AI?

Octane AI is a Shopify-first conversational quiz that captures zero-party data and delivers on-site product recommendations.

It syncs to Klaviyo and SMS to segment shoppers, trigger flows, lift conversion and AOV, and power PDP and bundle recs.

Why is Octane AI a top product discovery tool?

Uses shopper quizzes to capture zero-party data, syncs with Klaviyo and SMS to segment and trigger flows, and serves PDP and bundle recs that lift conversion and AOV on Shopify.

Octane AI's top features

- Conversational quiz builder: Create guided product-finder quizzes with a drag‑and‑drop editor, conditional logic/branching, image choices, and customizable design that matches your Shopify theme.

- Product recommendation engine: Map quiz answers to specific products, variants, or collections using rules, then display dynamic results pages and on-page widgets that surface PDP and bundle recommendations.

- Zero-party data capture and profiles: Collect declared preferences, needs, and attributes from quiz responses and store them as structured fields on customer profiles for reuse across your stack.

- Klaviyo and SMS integrations: Sync quiz responses, recommended products, and custom properties to Klaviyo and compatible SMS tools to create segments and trigger automated flows.

- On-site embedding and theme blocks: Embed quizzes across the storefront (home, landing, collection pages, pop‑ups) and place results and recommendation widgets using Shopify theme app blocks, with add‑to‑cart from results.

Pros and cons of Octane AI

Pros: Why do people pick Octane AI over other product discovery tools?

✅ Shopify-native merchandising

Theme app blocks turn quiz outcomes into PDP/bundle widgets with add‑to‑cart, reducing clicks to purchase.

✅ Deterministic recommendations

Rules map branches to SKUs/variants for precise PDP and bundle recs—no black‑box surprises.

Cons: What do people dislike about Octane AI?

❌ Shopify-only footprint

No native support for non‑Shopify stacks or headless setups limits broader deployment.

❌ High rules‑maintenance overhead

Mapping quiz branches to SKUs at scale is manual, brittle, and needs frequent upkeep.

❌ Limited behavioral personalization

Recommendations rely on quiz rules; lacks ML ranking from browsing or purchase signals.

Is there data to back Octane AI as the best Product Discovery Tool?

2–3x

higher conversion rate for quiz takers vs. site average reported in Octane AI customer case studies. Sources: https://octaneai.com/case-studies

+10–30%

AOV lift from rules‑based PDP/bundle recs driven by quiz answers in multiple merchant stories. Sources: https://octaneai.com/case-studies, https://apps.shopify.com/octane-ai-quiz

35–55%

email/SMS opt‑in rates on quizzes when synced to Klaviyo/SMS—materially above typical pop‑ups. Sources: https://octaneai.com/case-studies, https://www.klaviyo.com/partners/octane-ai

4.7/5

public rating on G2 and Shopify App Store, indicating high user satisfaction vs. alternatives. Sources: https://www.g2.com/products/octane-ai, https://apps.shopify.com/octane-ai-quiz

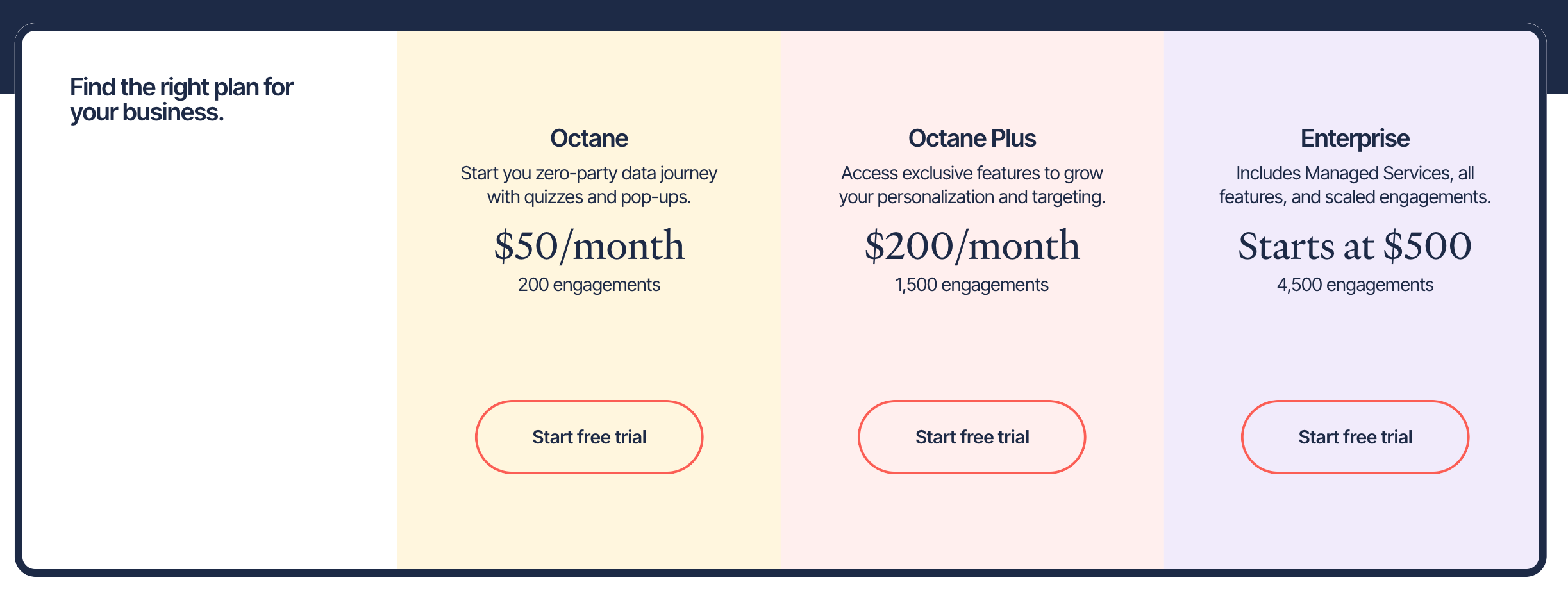

Pricing: How much does Octane AI really cost?

Read more: Octane AI Pricing: Is It Worth It? [2025 Review]

Octane AI has a tiered, usage-based pricing model where you’re charged based on the number of monthly quiz engagements (not total site traffic).

Higher engagement volumes unlock lower cost per interaction and richer features.

Choose between these 3 plans (monthly engagements included):

- Octane – $50/month: Up to 200 engagements/month; includes unlimited quizzes and pop-ups, data syncing (Klaviyo, Zapier, Attentive, etc.), and basic logic and design features.

- Octane Plus – $200/month (or $350 for 3,000 engagements): Up to 1,500 engagements/month; adds advanced logic branching, shareable results pages, A/B testing, custom CSS, dynamic Klaviyo blocks, and Smart Copy.

- Enterprise – Starts at $500/month (for 4,500 engagements); includes all Plus features, managed services, and a dedicated account manager. Tiered pricing continues with volume-based discounts—e.g., $750 for 7,000, $1,000 for 15,000, up to $5,000 for 200,000 engagements.

Price Limitations & Surprises

Every interaction counts. Even non-completions

Octane AI counts all "engagements," meaning even a user clicking one quiz question and leaving counts against your quota.

If your bounce rates are high, you might exceed your plan’s limits faster than expected.

Higher tiers reduce cost per engagement (but only if you scale)

Upgrading from Octane ($0.25 per engagement) to Enterprise (~$0.11 or less) lowers unit cost, but only if you regularly hit those higher engagement levels.

For intermittent high volume, cost efficiency may actually decline.

Coveo

Public reviews: 4.7 ⭐ (G2, Capterra)

Our rating: 8.5/10 ⭐

Similar to: Algolia, Elasticsearch

Typical users: E-commerce sites, enterprise search teams, content managers

Known for: AI-powered search and personalized product discovery

Why choose it: Delivers highly relevant search results, robust personalization, and seamless integration with major e-commerce platforms

What is Coveo?

Coveo is an AI search and product discovery platform for ecommerce.

It blends semantic and vector search with real-time re-ranking and recommendations, plus merch rules, A/B testing, and native connectors for Shopify and Salesforce Commerce Cloud.

Why is Coveo a top product discovery tool?

Semantic and vector search, real-time re-ranking, and recommendations raise relevance. Merchandising rules, A/B tests, and Shopify and Salesforce Commerce Cloud connectors speed launch.

Coveo's top features

- Bold Semantic and vector search: Combines keyword, semantic, and vector retrieval to index and surface products and content; supports typo tolerance, synonyms, attribute filtering, facets, and query suggestions/autocorrect.

- Bold Real-time re-ranking (Coveo ML): Adjusts search results and category listings on the fly using behavioral signals, context, and freshness/inventory inputs; updates ordering as new click and browse data streams in.

- Bold Product recommendations: Provides prebuilt and configurable models (e.g., trending, similar items, frequently bought together, recently viewed) for placements across PDP, PLP, cart, and homepage; accepts context and audience parameters.

- Bold Merchandising and rules: Enables boost/bury/pin actions, query pipelines, synonym management, facet and sort configuration, result badging, and time-based campaign scheduling.

- Bold Native commerce connectors: Offers connectors for Shopify and Salesforce Commerce Cloud to ingest catalogs, attributes, prices, and availability; supports field mapping and scheduled/event-based data sync for indexing.

Pros and cons of Coveo

Pros: why do people pick Coveo over other product discovery tools?

✅ Hybrid AI relevance

Combines lexical+semantic+vector search with ML re-rank to lift relevance on messy, long-tail queries.

✅ Live behavioral re-ranking

Coveo ML reorders PLPs and search results in-session using clicks, context, and inventory/freshness.

✅ Native Shopify and SFCC connectors

Out-of-box catalog, price, and availability syncs cut integration time and keep indices current.

Cons: What do people dislike about Coveo?

❌ Opaque enterprise pricing

Add-on modules (recs, A/B, QA) and usage tiers can spike TCO as traffic scales.

❌ Limited ML explainability

Re-rank decisions are hard to audit; debugging boosts/pins across pipelines is tedious.

❌ Merch analytics depth

Native reports lack attribution clarity; many teams export events to BI for real analysis.

Is there data to back Coveo as the best Product Discovery Tool?

4.7/5

G2 Ecommerce Search & Product Discovery rating (2025)

2–5%

median RPV uplift from personalization (Qubit Benchmark, 2021; now part of Coveo)

3–10%

conversion-rate lift reported in Coveo/Qubit retail case studies after AI search + recs

99.99%

published uptime SLA (Coveo Trust Center)

Pricing: How much does Coveo really cost?

Coveo does not publish list prices; packages are quote based and typically priced by product edition and usage such as queries, events, and index size.

No public plan tiers to choose from; pricing is customized per account.

- Coveo for Commerce - quote only, packaged for ecommerce AI search and product discovery with options for recommendations, merchandising, and native commerce connectors

- Coveo for Service - quote only, packaged for support and knowledge search with options for case deflection, agent assist, and analytics

- Coveo for Website - quote only, packaged for site search and content discovery with options for personalization and analytics

- Recommendations add‑on - quote only, prebuilt and configurable recommendation models for PDP, PLP, cart, and homepage placements

- A/B testing add‑on - quote only, experimentation tools for pipelines and merchandising strategies

- AI answering/Q&A add‑on - quote only, generative answers layered on your content and product data

Price limitations & potential surprises

Expect annual contracts with usage thresholds for requests, events, and index size; overages or jumps to higher tiers can raise costs as traffic grows.

Add‑ons like recommendations, A/B testing, and AI answering are priced separately, and implementation or connector work may be extra.

Constructor

Public reviews: 4.7 ⭐ (G2, Capterra average)

Our rating: 8.5/10 ⭐

Similar to: Algolia, Bloomreach

Typical users: Mid-to-large e-commerce retailers, product managers, merchandisers

Known for: AI-driven search and personalized product discovery

Why choose it? Delivers tailored shopping experiences at scale with strong relevance and conversion-focused features.

What is Constructor?

Constructor is an AI product discovery suite for ecommerce retailers: search, autocomplete, and recs with session-level personalization, quiz-driven zero‑party data, revenue‑driven ranking, and merch controls like boosts, pins, rules, and A/B tests.

Why is Constructor a top product discovery tool?

Per-session personalization, quiz data, revenue-led ranking, and merchandising controls: boosts, pins, rules, A/B tests raise relevance and sales.

Constructor's top features

- AI search and autocomplete: Indexes product catalogs, interprets queries (including typos and synonyms), returns ranked results with facets/filters, and surfaces query and product suggestions as users type.

- Product recommendations: Generates modules such as “Similar items,” “Frequently bought together,” “Trending,” and “Recently viewed,” and serves them across placements like PDPs, category pages, carts, homepages, and email.

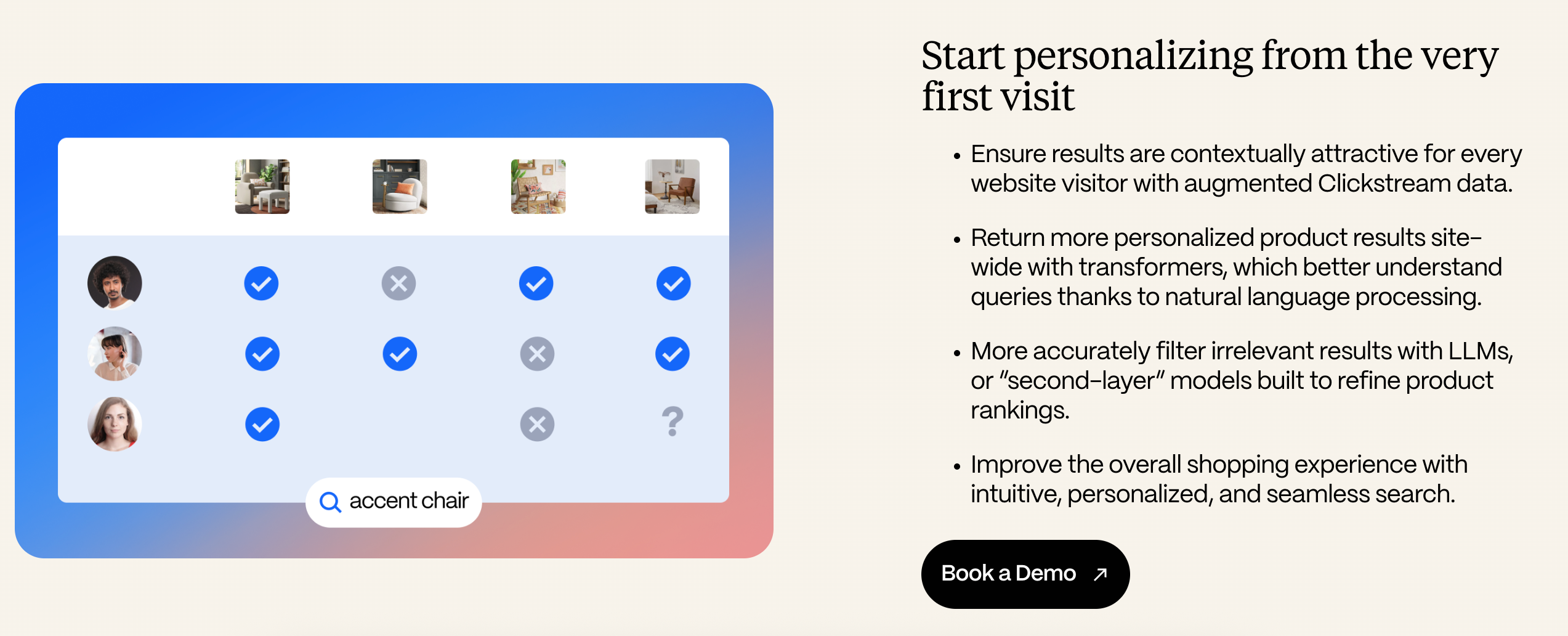

- Session-level personalization: Adjusts search, browse, and recommendation outputs in real time based on in-session behavior (clicks, views, add-to-cart) and context signals, re-ranking items and modules dynamically.

- Merchandising controls and A/B testing: Provides a console to pin/boost/demote products, define query/category rules, manage synonyms and redirects, set facet ordering and campaigns, and run A/B tests or holdouts to compare configurations.

- Quizzes and zero‑party data capture: Lets teams build on-site shopping quizzes, collect declared preferences, map answers to product attributes, and feed that data into search ranking and recommendations.

Pros and cons of Constructor

Pros: Why do people pick Constructor over other product discovery tools?

✅ Real-time session personalization

Live reranking from in-session clicks/views across search and recommendations drives measurable lift.

✅ Revenue-driven ranking and optimization

Optimizes for revenue and units—not just CTR—aligning ranking to margin and conversion goals.

✅ Quizzes that feed zero‑party data into ranking

On-site quizzes map preferences to attributes, improving cold-start relevance and discovery speed.

Cons: What do people dislike about Constructor?

❌ Premium pricing and minimums

Enterprise contracts and usage-based fees can spike with SKU count and peak queries.

❌ Heavy implementation and data prep

Strong results require rigorous event tagging and attribute normalization across catalogs.

❌ Opaque relevance and limited bulk controls

Hard to audit model decisions; bulk rule export/editing lags peers like Algolia and Bloomreach.

Is there data to back Constructor as the best Product Discovery Tool?

4.7/5

Average user rating from G2 + Capterra reviewers (as of 2024). Source: G2, Capterra listings for Constructor.

8–15%

Revenue-per-visitor lift reported in vendor A/B tests after migrating search + recs to Constructor. Source: Constructor public case studies hub.

99.99%

12‑mo API uptime with sub‑200 ms p95 search latency typical at edge. Source: Constructor status page/performance docs.

90%+

“Likely to Recommend” from verified buyers in G2’s E‑commerce Search/Product Discovery categories. Source: G2 category reports.

Pricing: How much does Constructor really cost?

Constructor does not publish pricing on its site; it’s custom, sales‑quoted enterprise pricing that scales with catalog size and traffic according to reviewer reports.

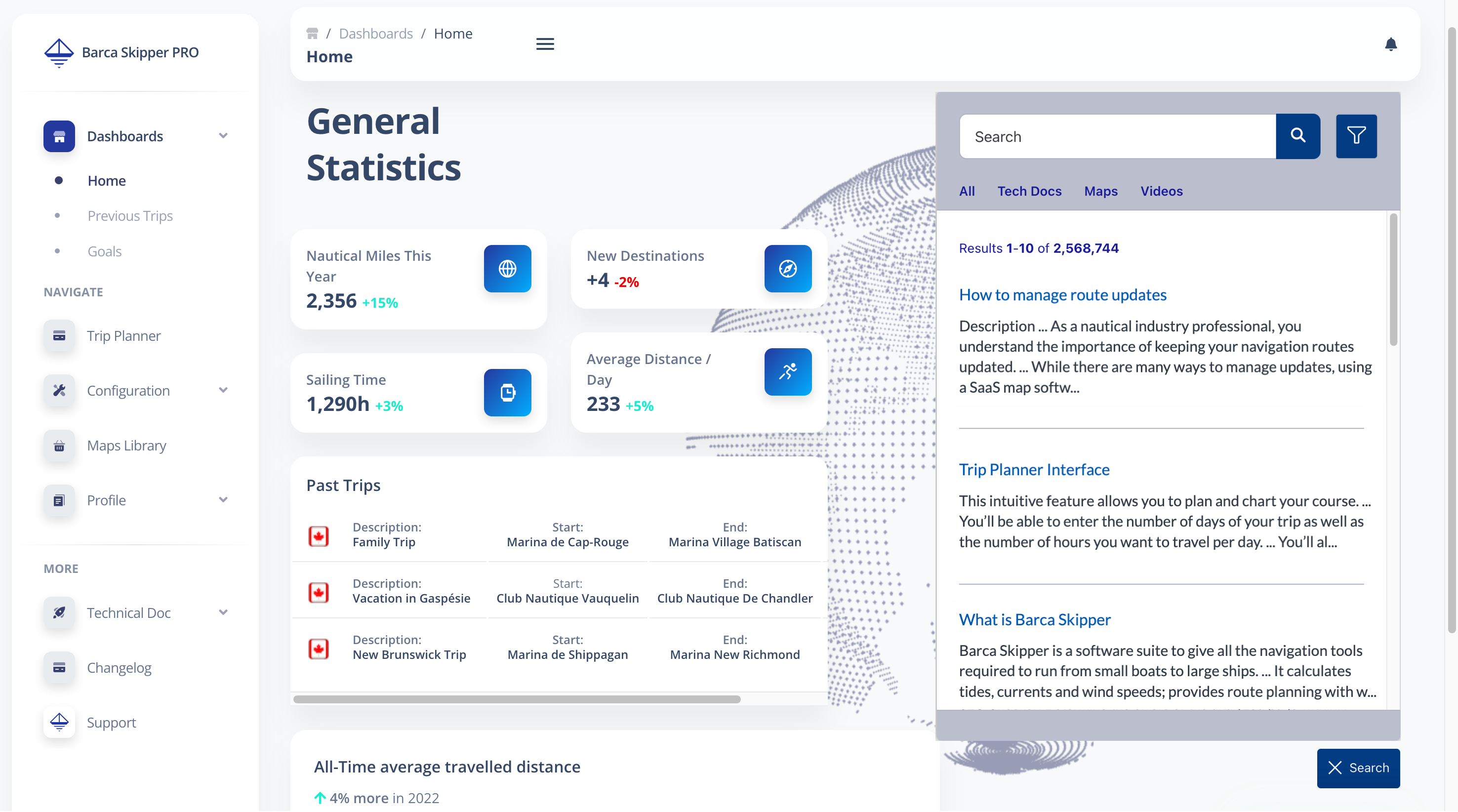

Which product discovery tool is best for you?

If you care about:

- Seamless site-wide recommendations at scale → Algolia Recommend is your pick.

- Creative, quiz-driven personalization and lead capture → Choose Digioh or Octane AI.

- The broadest, intent-driven product search within Amazon → Amazon Rufus stands out.

- Fine-tuned relevance for complex catalogs and enterprise search → Go with Coveo.

Ready to see how Big Sur AI can power smarter product discovery and conversions for your brand? Give Big Sur AI a try now.