2025 Conversational Commerce Statistics: Market size, ROI, and growth trends

Global spend will approach 290 billion dollars by 2025. Retail chatbot spend hit 142 billion dollars in 2024. Voice shopping is nearing 82 billion dollars by 2025. Brands use chat to lift conversions up to 35 percent and increase repeat purchases through WhatsApp and personalized recommendations.

Shoppers now browse, ask questions, and buy inside chat, messaging apps, and voice assistants. For brands, conversational channels are becoming a primary sales path.

The data below shows where the market is heading and what teams can do this quarter to capture the upside.

Stats at a glance

$290B

global conversational commerce by 2025

$142B

retail spend via chatbots in 2024

$81.8B

voice shopping by 2025

35%

conversion lift from AI chat assistants

66%

buyers who have purchased via WhatsApp

Overview table: key 2024–2025 conversational commerce plays

| Plan | Best For | Key Strength | Drawbacks | Pricing |

|---|---|---|---|---|

| Messaging storefronts | DTC brands on WhatsApp and Messenger | High conversion with guided chat and payments in thread | Requires tight catalog sync and fast reply SLAs | Usage based or per seat |

| AI chatbot assisted selling | Mid market and enterprise retail | Personalized recs, FAQs, order help in one flow | Needs strong product data and guardrails | Tiered with MAU or session limits |

| Voice commerce | Hands free shopping and reorder use cases | Fast intents for repeat buys and status checks | Limited browsing experience for complex discovery | Platform and usage fees |

| Agent copilot for sales chat | High touch sales and support teams | Suggested replies, cross sell, and instant summaries | Training time and change management | Per user plus usage |

| Unified conversational stack | Global brands with multiple regions | Omnichannel routing, analytics, payments, compliance | Higher complexity and integrations | Custom enterprise |

Market size and growth

TL;DR → Conversational commerce is becoming a primary shopping channel. Messaging and voice are no longer side doors. If you manage revenue, plan for a material share of transactions to originate or close in chat threads and voice flows. Start by enabling product discovery, payments, and order support in the same conversation to reduce drop-off.

- Global spend via conversational commerce is projected at about 290 billion dollars in 2025, up from 41 billion dollars in 2021

- Retail spend via chatbots reached about 142 billion dollars in 2024, up from 2.8 billion dollars in 2019

- Voice commerce grew from 4.6 billion dollars in 2021 to nearly 20 billion dollars in 2023, with forecasts of 39.8 billion dollars in 2024 and 81.8 billion dollars in 2025

- United States market value is about 3.06 billion dollars in 2024, about 37 percent of global, with about 17 percent compound growth expected

💡 Takeaway: Build a channel mix model that assigns clear revenue targets to WhatsApp, Messenger, site chat, and voice. Connect your product catalog and payments to these channels. Track assisted revenue and attribution from chat sessions, not only last click. Add reorder and subscription flows to voice for repeat purchase convenience.

Data sources: Actum Digital, Retail Dive, commercetools, Capital One Shopping, Market.us

Business adoption and investment

TL;DR → Brands are shifting budgets toward chat based interfaces. If you lead digital or product, prioritize official APIs and commerce features in WhatsApp and Messenger. Invest in AI rec engines inside chat to turn conversations into carts.

- 85 percent of brands use Facebook Messenger for marketing or support

- Over 50 million companies use WhatsApp to communicate with customers

- About 80 percent of retailers will use chatbots to engage customers by 2025

- By 2025, 50 percent of enterprises will spend more on chatbots than mobile app development

- About 25 percent of companies use AI chatbots for personalized product recommendations

- 97 percent of retailers plan to increase AI spending in the next year, and 84 percent say AI chatbots will become more important in customer communications

💡 Takeaway: Stand up official WhatsApp Business and Messenger integrations with catalog, inventory, and order status APIs. Add product recommendation prompts based on browsing and cart events. Reserve a budget line for chat specific growth experiments like broadcast lists, click to chat ads, and conversational landing pages.

Data sources: adamconnell.me, DoubleTick, Firework, Sprinklr, Dashly, HelloRep

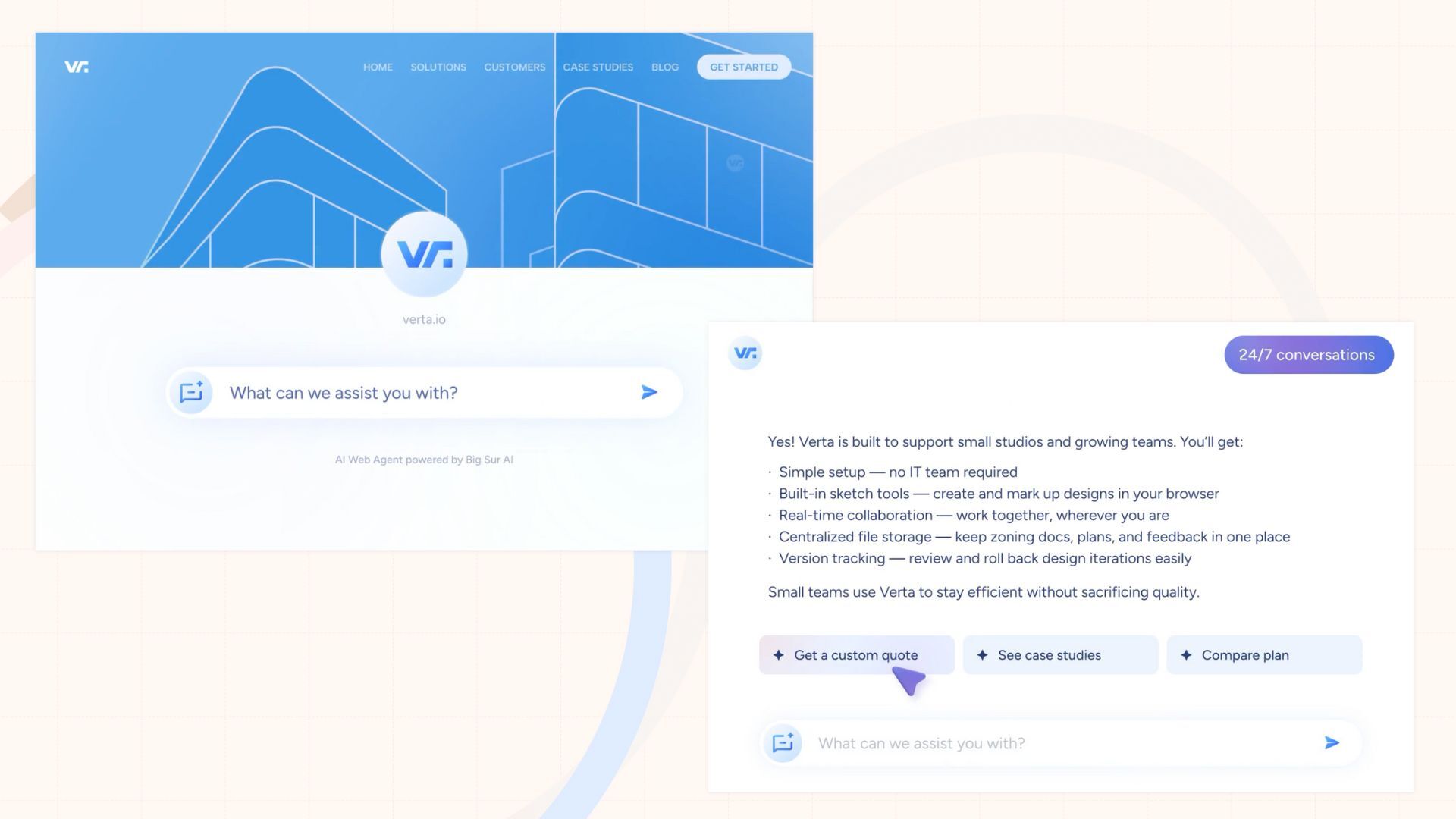

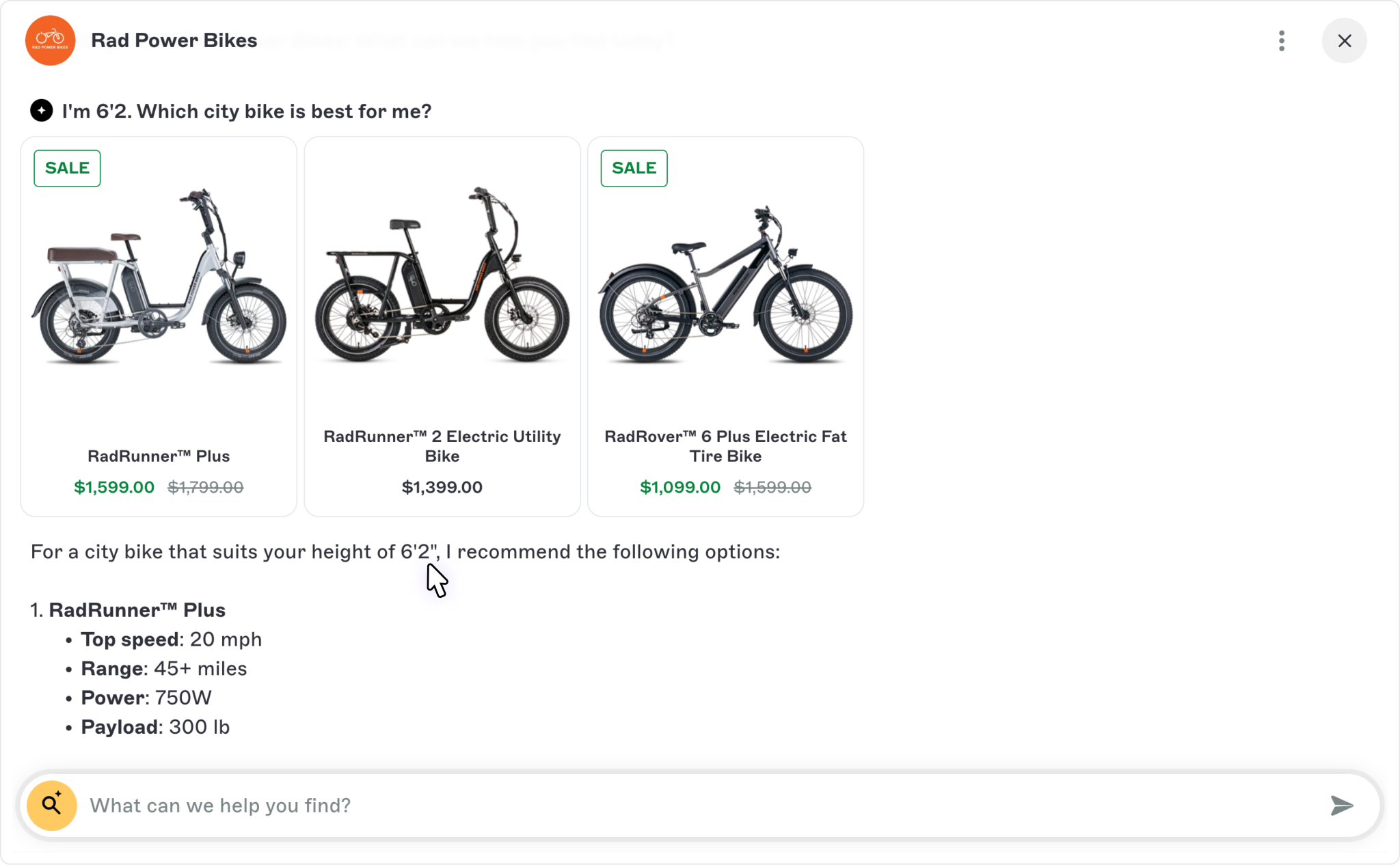

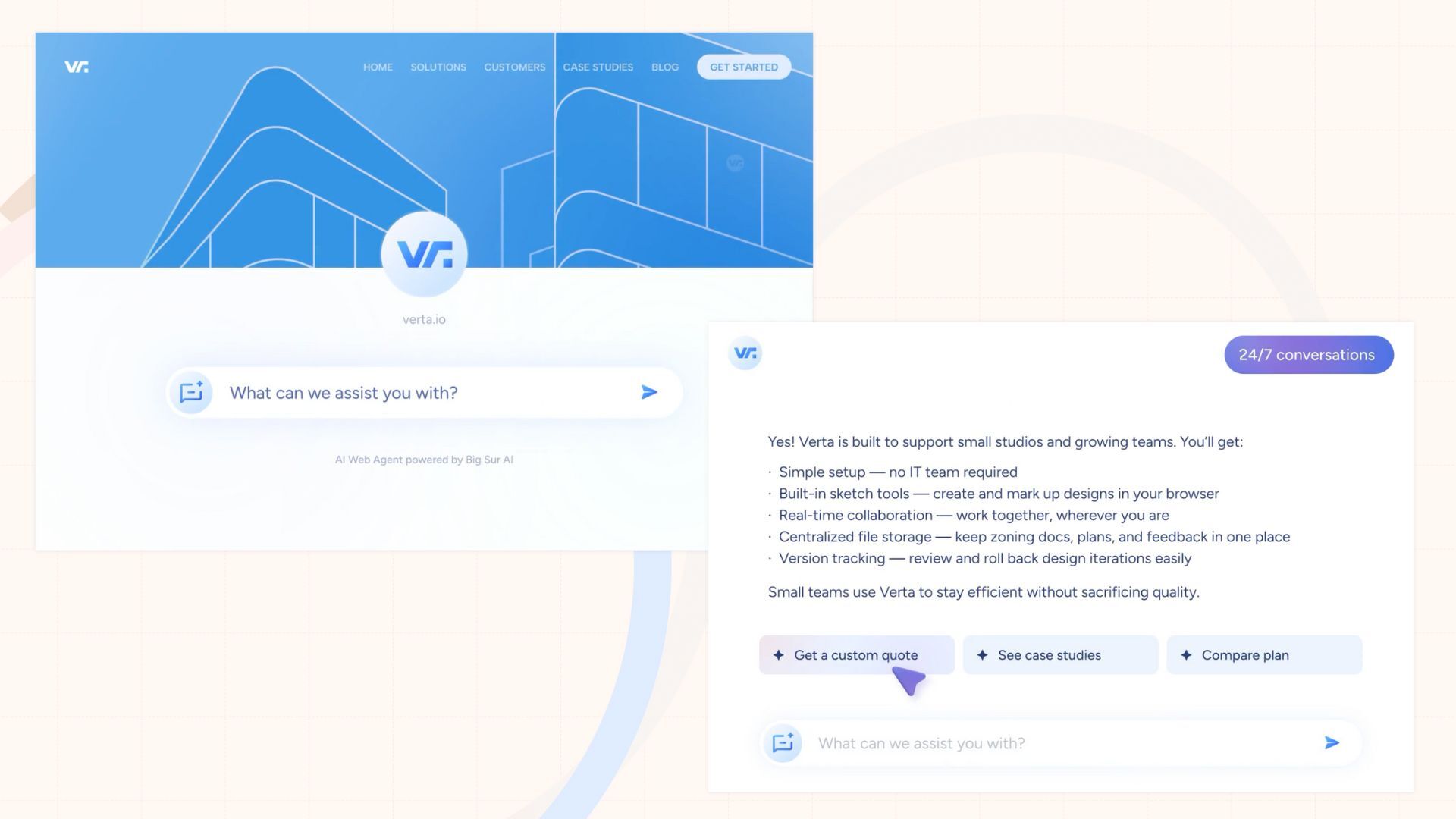

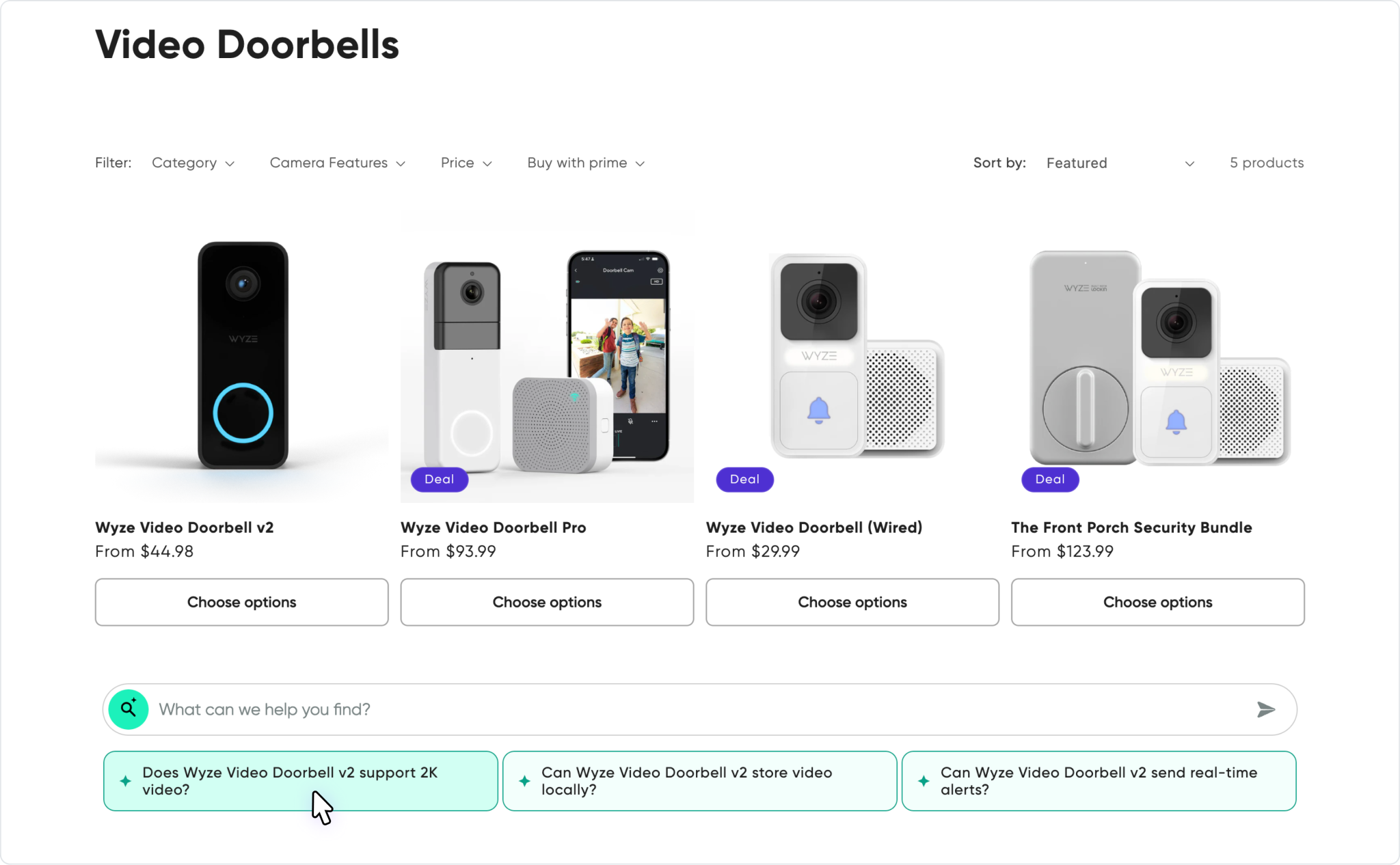

Need an AI chatbot that converts website visitors?

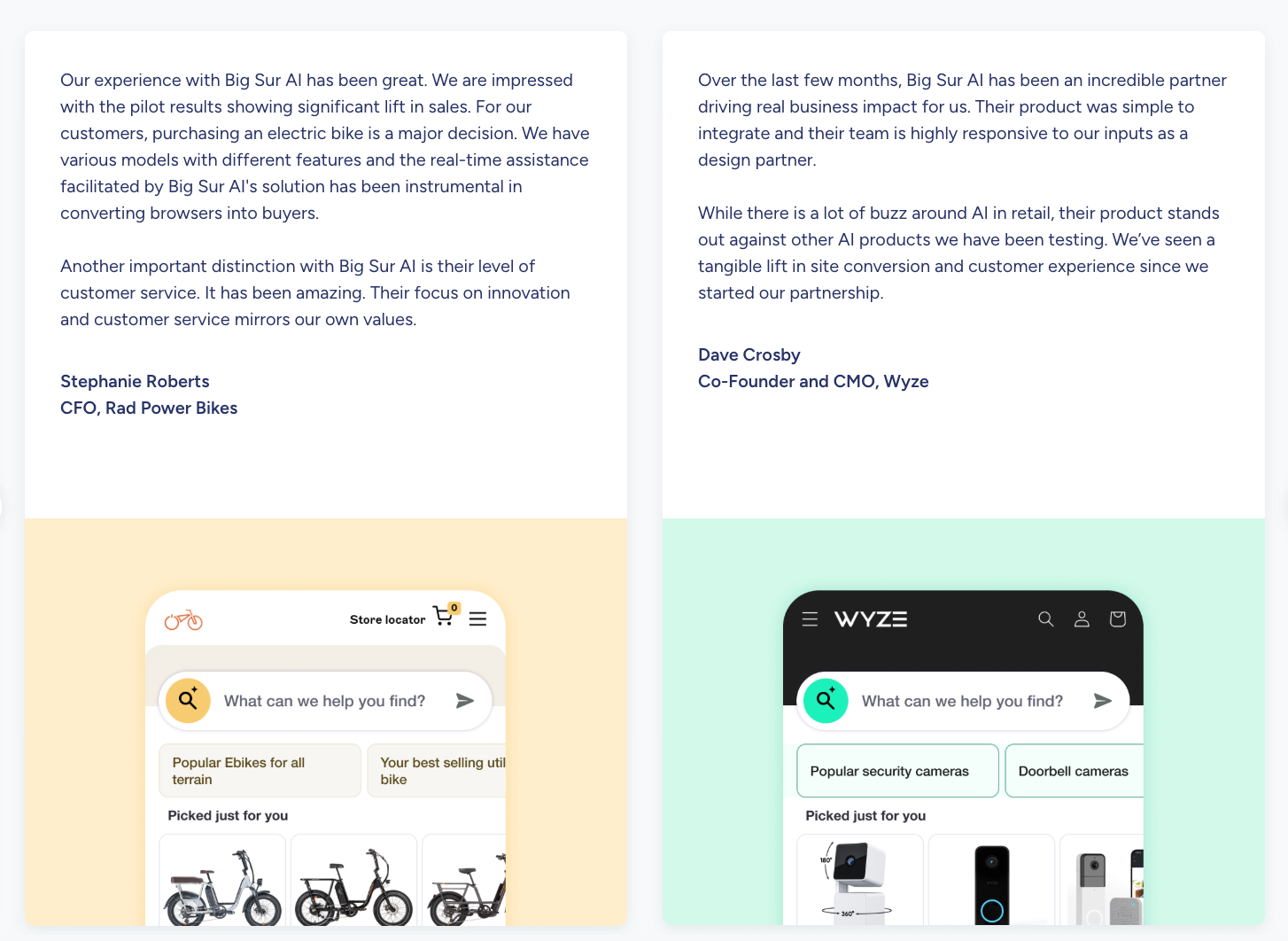

Big Sur AI (that’s us 👋) is an AI-first chatbot assistant, personalization engine, and content marketer for websites.

Designed as AI-native from the ground up, our agents deliver deep personalization by syncing your website’s unique content and proprietary data in real time.

They interact naturally with visitors anywhere on your site, providing relevant, helpful answers that guide users toward their goals → whether that’s making a decision, finding information, or completing an action.

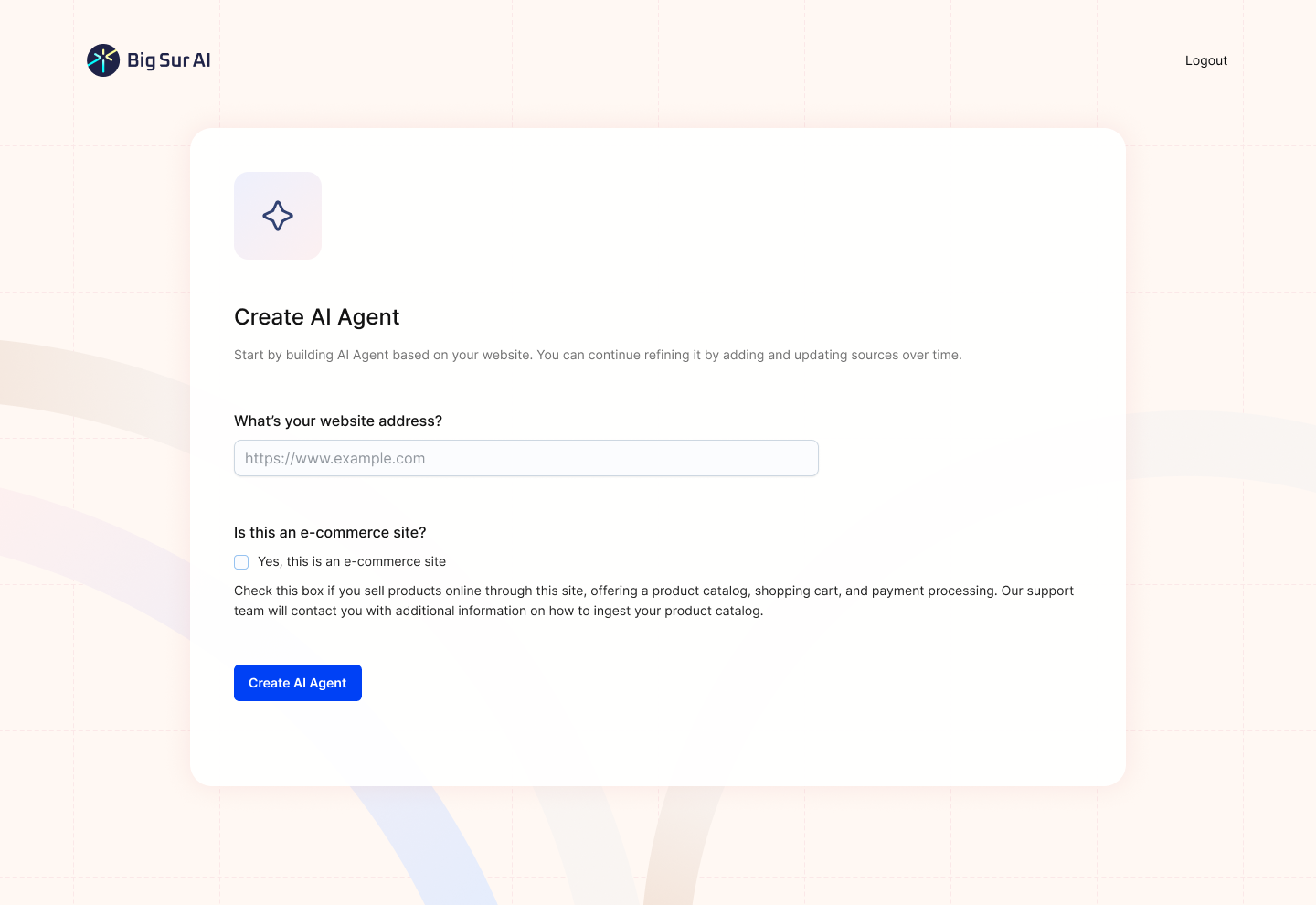

All you need to do is type in your URL, and your AI agent can be live in under 5 minutes ⤵️

Here’s what you have to do:

- Sign up on Big Sur AI's Hub (link here).

- Enter your website URL. Big Sur AI will automatically analyze your site content.

- Customize your AI agent. Set up specific AI actions and decide where the AI agent will appear on your site.

- Launch and monitor. Your AI agent will be live in minutes, and you can track performance with real-time analytics.

Try Big Sur AI on your site in minutes by clicking the image below 👇

Conversion and sales impact

TL;DR → Conversational flows shorten time to value and reduce decision friction. If you own growth, deploy guided selling and live cart assistance in chat. Measure conversion, average order value, and response time at the conversation level.

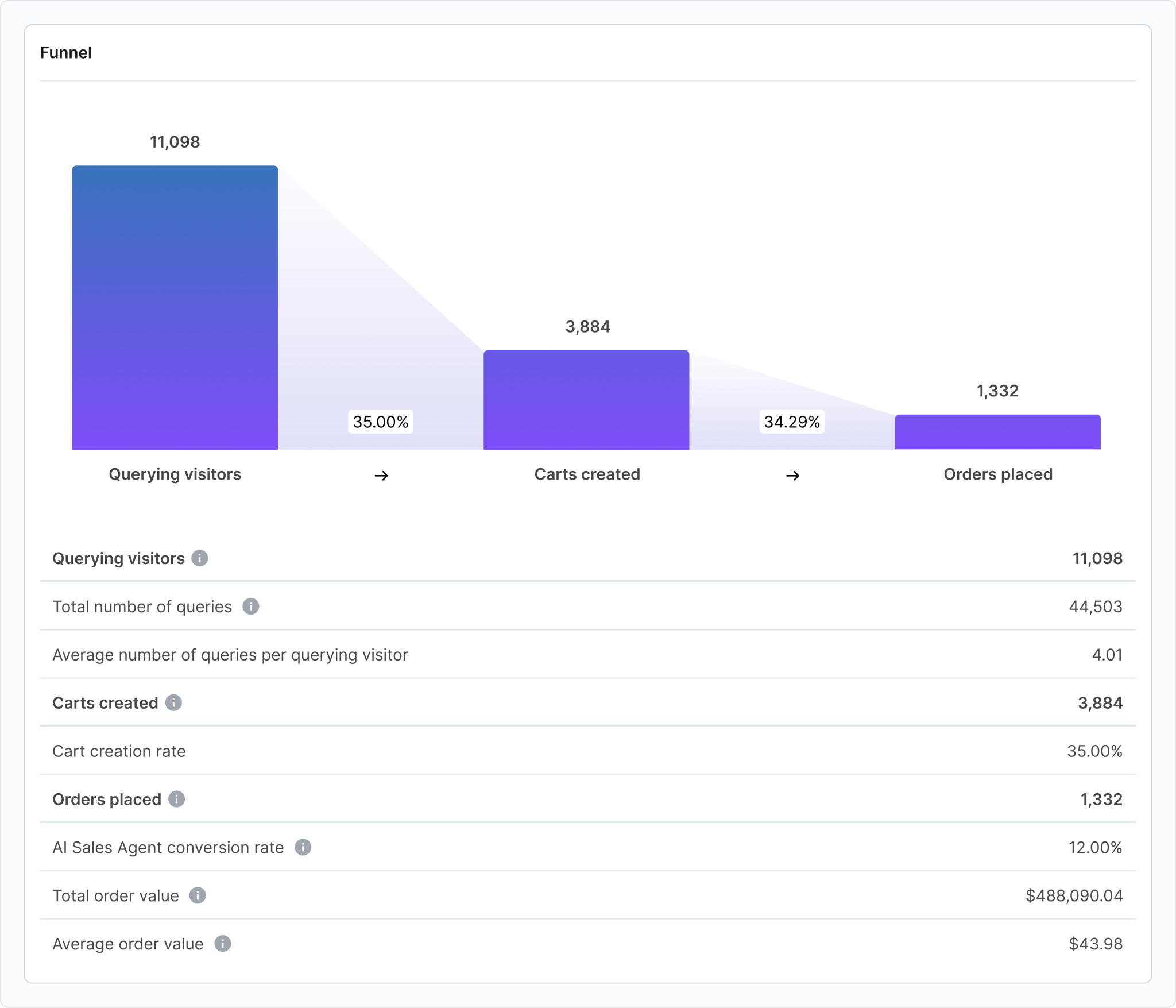

- Companies using AI chat assistants report up to a 35 percent increase in conversion rate

- In large-scale session analysis, 12.3 percent of shoppers who chatted purchased, versus 3.1 percent who did not

- E-commerce brands saw sales lift between 7 percent and 25 percent after launching effective chatbots

- Returning shoppers who use AI chat spend about 25 percent more per order than returning shoppers who do not

- WhatsApp only sellers report about 68 percent of customers are repeat buyers

- Chatbot interactions are about 30 percent cheaper on average than human-led interactions, and AI chatbots can save billions of hours in service time

💡 Takeaway: Launch conversational product finders that map intents to SKUs. Offer checkout inside the thread. Proactively nudge stalled carts with context aware prompts. Expose bundles and upsells as quick reply chips.

Track first response time under 30 seconds for sales chats. Tie agent or bot success to revenue influenced, not only tickets solved.

Data sources: Perficient, HelloRep, Sprinklr, DoubleTick, Chatbots Magazine via Sprinklr

Consumer preferences and behavior

TL;DR → Consumers want to browse and buy where they already chat. They value instant answers and personalization, but they bounce when replies are slow or generic. If you manage CX, tune bots for speed and relevance, and make handoffs to humans obvious.

- About 75 to 80 percent of consumers prefer messaging or chat channels over calling for quick inquiries

- 85 percent of consumers expect to interact with brands via messaging apps as part of the shopping journey

- 58 percent of online shoppers are at least moderately interested in AI powered conversational tools for purchases

- On WhatsApp, 66 percent of consumers have bought after chatting with a brand, and 69 percent are more likely to patronize brands that communicate on WhatsApp

- Speed matters. 73 percent are turned off by slow replies, and over half have abandoned a purchase due to lagging responses. 64 percent say they would spend more with businesses that respond actively

- In personalization, 78 percent are more likely to buy when experiences are tailored, and 72 percent engage more with personalized WhatsApp messages

💡 Takeaway: Staff WhatsApp and site chat with strict response time goals. Use retrieval based prompts that reference product specs, shipping, and store policies to answer with precision. Personalize recommendations by session context and past orders. Add smart entry points like QR to WhatsApp in store, click to chat in ads, and deep links from email for continuity.

Data sources: Moldstud, Firework, Sprinklr, DoubleTick, Actum Digital

Final thoughts

Conversational commerce is not a side channel. It is a conversion engine that lives where customers already spend their time. The numbers point to rapid growth and real revenue impact. Teams that wire product data, payments, and service into chat and voice will see faster paths to purchase and higher lifetime value.

Implementation roadmap

- Audit and intent mapping List the top 20 pre purchase and post purchase intents. Map each to data sources and eligible responses.

- Catalog and payments in channel Sync product catalog to WhatsApp and Messenger. Enable payments or fast redirects that preserve cart context.

- Guided selling flows Launch a conversational product finder and quick answer flows for shipping, returns, and availability.

- Speed and SLA Set reply time targets. Under 30 seconds for sales chats. Under 2 minutes for complex handoffs. Monitor with conversation level analytics.

- Personalization and growth loops Use event based recommendations, back in stock alerts, reorder and subscription prompts. Add click to chat ads and QR to chat in store to grow the channel.

FAQ: conversational commerce 2024–2025

Q1: What is conversational commerce Selling and serving customers through chat, messaging apps, and voice assistants. It includes guided product discovery, in thread payments, and instant support inside channels like WhatsApp, Messenger, site chat, and smart speakers.

Q2: Which channels matter most in 2025 WhatsApp for many regions, Facebook Messenger for reach, site chat for owned traffic, and voice for repeat purchases and status checks. Choose based on your audience and payment availability in each market.

Q3: How do I measure success Track conversation sourced revenue, conversion rate of engaged sessions, average order value, repeat purchase rate, and response time. Attribute influenced revenue to both bots and agents. Compare cohorts that chat versus those that do not.

Q4: What product data do I need Real time price and inventory, variant details, sizing or fit guides, shipping rules, and return policies. Keep this accessible through APIs so bots can answer with precision.

Q5: How do I keep experiences high quality Set clear escalation paths to humans. Train with real transcripts. Review failure intents weekly. Localize content. Personalize replies with recent browsing and order context. Maintain reply speed goals and audit them monthly.