Emarsys Pricing: Is it Worth it & What to Expect? [2025]

If you are wondering about Emarsys’s pricing and what you can expect in 2025, this guide is for you.

Even though Emarsys does not publish pricing on its website, we compiled common cost drivers, ranges, and buyer-reported insights.

This article reviews Emarsys’s pricing model, editions, add-ons, and real-world cost structure.

Tl;dr

- Emarsys does not publicly disclose exact prices because plans are custom to your contact tiers, channels, and messaging volumes.

- Pricing combines a base platform subscription with usage for email and SMS, plus optional add-ons like Mobile Engage, Web Channel, Digital Ads, and Loyalty.

- Most buyers report mid-five-figure annual spend to start for email-led packages, with Advanced commonly landing in the high five to low six figures at mid-market scale.

- There is no free plan or self-serve trial, and onboarding and implementation services are typically billed separately.

- Costs scale with marketable contacts and message volumes, and overages for email and SMS are often pricier than pre-committed bundles.

- SMS is metered per message with country-specific carrier fees and sender registration that can materially increase total cost.

- SAP Emarsys Loyalty is sold separately and is usually priced by program scope and member volume.

- Deliverability and infrastructure extras like dedicated email IPs, sender domains, and additional environments can add recurring and one-time fees.

- Renewal surprises often stem from contact tier ups and accumulated SMS usage, so negotiate caps and run a 30 to 60-day pre-renewal true-up.

- Max AI is priced based on contact scale, cross-channel volumes, enabled AI modules, and support SLAs.

At the end of this guide, we’ll introduce a new AI-powered solution that can be an alternative to Emarsys or a complementary solution.

Complete summary of Emarsys’s pricing in 2025

| Plan | Best For | Key Strength | Drawbacks | Pricing |

|---|---|---|---|---|

| Emarsys Essential | Email‑led teams starting marketing automation; mid‑market brands | Drag‑and‑drop email journeys, segmentation, templating; core analytics; standard APIs for contacts, catalog, events | Email‑first scope; true omnichannel (SMS, web, mobile) requires paid add‑ons; no free plan or self‑serve trial | Quote‑based; typically mid–five figures/yr for entry tiers; priced by active contacts and email volume; onboarding billed separately; overages for sends |

| Emarsys Advanced | Retail/D2C teams needing cross‑channel orchestration beyond email | Omnichannel journeys (email, SMS, web, mobile when licensed); predictive segments; catalog/behavioral data; ad audience sync | Nontrivial data plumbing and identity resolution; mobile SDK/web tagging required; time‑to‑value depends on clean feeds | Quote‑based; high five to low six figures/yr at mid‑market volumes; priced by contact tiers + per‑channel sends; SMS billed per country with carrier fees |

| Emarsys Max AI | Enterprises seeking scaled AI personalization and offer optimization | AI predictions (propensity, churn, affinity), next‑best action, open‑time content, incentive optimization, deeper analytics and experimentation | AI lift depends on data scale/quality; sensitive to taxonomy drift and latency; requires governance, monitoring, and model upkeep | Custom; contact tiers + cross‑channel volumes + enabled AI modules; multi‑year discounts; regional SMS costs passed through; elevated SLAs available |

| SAP Emarsys Loyalty (add‑on) | Brands running structured loyalty programs (points/offers/tiers) | Integrated loyalty program management tied to Emarsys journeys and personalization | Sold separately; adds recurring cost and implementation complexity; priced by member volume | Add‑on license; priced by program scope and members; services for setup/migration often quoted |

| Big Sur AI (Top Alternative) | Ecommerce brands wanting real‑time conversational selling, fast deployment, predictable costs | AI Sales Agent that understands your catalog/policies with cited answers; 1:1 conversational recommendations; intent/behavior analytics; APIs to surface recs across channels | Not a traditional campaign orchestration suite; best as a conversion‑driving layer that can complement or replace parts of MA stacks | Transparent, self‑serve plans priced by AI conversations/sessions (not contact list size); core channels included; month‑to‑month available; no mandatory pro services; clear overages. See pricing |

Emarsys's plans

Emarsys (SAP Emarsys Customer Engagement) is an enterprise marketing platform that helps brands automate and personalize omnichannel campaigns across email, mobile, web, and ads.

There are 2 different products of Emarsys:

- SAP Emarsys Customer Engagement.

- SAP Emarsys Loyalty.

Emarsys’s pricing works with custom annual subscriptions that consist of the following:

- Base platform subscription: A core annual fee that reflects the edition/package you license and which channels and capabilities are enabled.

- Contact or audience tiers: Pricing typically scales with the size of your marketable contact database or monthly active profiles, moving you into higher tiers as you grow.

- Messaging volume: Usage-based charges for sends and deliveries, such as email volume packages and country-specific SMS credits; push notifications may be bundled or metered.

- Channel and feature add-ons: Enabling modules like Mobile Engage, Web Channel, Digital Ads connectivity, and onsite personalization can add recurring fees.

- Loyalty add-on: SAP Emarsys Loyalty is sold separately and is priced by program scope and member volume.

- Geography and deliverability extras: Dedicated email IPs, additional IPs, sender domains, and SMS sender IDs or short codes can add cost; SMS rates vary by destination country.

- Implementation and professional services: One-time onboarding, data migration, and solution design are commonly quoted by SAP or a services partner.

- Support and environments: Premium support plans, additional sandboxes, or extra account instances for multi-brand or multi-region setups may be billable.

- Data and API usage: Higher data retention, increased event throughput, or elevated API rate limits may require expanded tiers.

- User access: While user seats are not usually the primary pricing lever, some contracts may include limits or fees for advanced access controls or SSO.

A few pricing insights buyers care about:

- Contact tier jumps can be the biggest step-change in cost. Audit how “marketable” or “active” contacts are defined so you do not pay for dormant profiles, test records, or un-mailable contacts.

- Overages on email or SMS are often pricier than pre-committed volume. Secure roll-over or pre-buy bundles ahead of seasonal peaks to keep effective rates down.

- International SMS spend can dwarf software fees due to carrier tariffs and registration requirements. Budget separately for sender IDs, short codes, and country-specific compliance.

- High-volume email senders may need multiple dedicated IPs and a warm-up plan. These deliverability extras can add recurring and one-time costs that are easy to overlook.

- Multi-brand or multi-storefront organizations sometimes require extra environments or tenants to isolate data and templates. Confirm whether this is included or quoted as additional instances.

- Data retention defaults can be conservative. If you rely on long lookback windows for attribution or lifecycle modeling, ask about the cost of extended retention and bulk exports.

- Renewal uplifts and indexation can apply even without usage growth. Negotiate caps on annual increases and tie price breaks to verifiable usage thresholds.

Here’s a little sneak-a-peek into Emarsys's products:

Does Emarsys have a free version?

Emarsys does not offer a free plan or a self-serve free trial.

Access is sales-led, with demos and a paid subscription after implementation. If you want to explore the product at no cost, the closest options are a requested demo, on-demand product tours and webinars, and public documentation on the SAP Help Portal. None of these provide a hands-on environment to integrate your data or run live campaigns.

Drawback - No hands-on environment to validate data fit and channel performance

Without a free tier or trial workspace, you cannot practically test key risks before buying, such as how your data model maps to Emarsys objects, email deliverability and sender reputation setup, SMS compliance and throughput, or real-world automation complexity.

For teams evaluating Emarsys, this means committing time and budget ahead of proving day-to-day fit. If you proceed, ask for a tailored demo using your sample data, detailed implementation scope, references from similar stacks, and clear pilot or exit criteria in the contract.

Emarsys's essential plan

Emarsys does not publish list prices for this plan, and contracts are quote-based with annual commitments.

Pricing is typically structured around active contact tiers, monthly message volume (primarily email sends), required channels, environments, and services.

Buyer disclosures and marketplaces like Vendr commonly report mid–five-figure annual spend for entry tiers, with onboarding and implementation fees billed separately.

What you get in essential typically centers on email-led engagement and core automation.

You can expect:

- Email marketing with drag‑and‑drop journeys in Automation Center.

- Audience segmentation, personalization tokens, and templating for campaigns.

- Core analytics and revenue attribution for email performance.

- Standard APIs and data feeds for contacts, catalog, and events needed for email use cases.

- A contracted allotment of contacts and email sends defined in your SOW, with overage or tier upgrades if you exceed them.

- Access to additional paid channels and modules as add‑ons, such as SMS, mobile push, web channel, and loyalty.

Drawback: email-first scope means you will quickly need paid add-ons to get true omnichannel lift

Essential is designed for teams starting with email automation, so web, mobile, and ads orchestration are limited or sold separately.

If your roadmap includes product recommendations, mobile push, on-site personalization, or offer optimization, you will layer add-ons early, which changes your total cost of ownership and complicates procurement.

Plan for add-on packaging and message-volume pricing up front, or you will face change orders once you move beyond email-only journeys.

Emarsys's advanced plan

Advanced is sold on a quote basis and priced by active contact tiers, total monthly cross‑channel message volume, and enabled modules, with annual or multi‑year terms.

Public buyer reports and marketplaces indicate pricing typically in the high five figures to low six figures annually for mid-market volumes, plus professional services for data integration and rollout.

Advanced expands from email into broader orchestration and personalization.

You can expect:

- Omnichannel journeys across email, SMS, web channel, and mobile messaging when those channels are licensed.

- Behavioral and catalog data ingestion to support product and content personalization on-site and in messaging.

- Predictive segments and lifecycle programs for browse, abandon, post‑purchase, and winback.

- Relational data and segment filters to model business-specific attributes and offers.

- Advertising audience sync to paid media for acquisition and retargeting use cases.

- Contracted allowances for contacts and sends per channel, with country‑specific carrier fees for SMS billed separately.

- Solution support SLAs and sandbox or additional environments available by package.

Drawback: orchestration power requires nontrivial data plumbing and identity work to pay off

Advanced’s value depends on reliable product feeds, web tagging, mobile SDK implementation, and consistent customer identifiers across systems.

Teams underestimate the effort to reconcile identities, map events, and keep the catalog clean, which delays time to value and can suppress recommendation and trigger accuracy.

Budget for integration and ongoing data quality ownership, not just licenses, or the incremental channels will underdeliver.

Emarsys's Max AI plan

Max AI is an enterprise, custom‑quoted package that layers Emarsys’s full AI decisioning and predictive capabilities on top of omnichannel orchestration.

Active contact tiers, channel volumes price contracts, enabled AI modules, environments, and support level, with volume discounts typically tied to multi‑year agreements.

Max AI is built for scaled personalization and optimization.

You can expect:

- The full advanced feature set plus AI‑driven predictions for propensity, churn risk, affinity, and next‑best product or action.

- Open‑time content and offer decisioning to tailor messages at send or open.

- Incentive and offer optimization to minimize over‑discounting while preserving conversion.

- Deeper analytics and experimentation for revenue lift measurement across channels.

- Enterprise controls, governance, and elevated support SLAs appropriate for multi‑brand and multi‑region deployments.

- Contracted high‑volume allowances for contacts and cross‑channel sends, with negotiated overage pricing and regional SMS costs passed through.

Drawback: the AI upside depends on data scale and cleanliness, which raises the bar for setup and governance

Max AI’s models need rich, timely event streams and a well‑structured catalog to produce stable lift, and they are sensitive to taxonomy drift and sparse histories.

If your SKU metadata, identity resolution, or event timeliness are inconsistent, you will see volatile recommendations and conservative offer policies that blunt performance.

Expect to invest in data contracts, monitoring, and periodic model recalibration, or the premium you pay for AI features will not translate into durable ROI.

Does emarsys have paid add-ons?

Yes.

Common paid add-ons buyers call out include Loyalty, Mobile Engage for SMS and mobile, Web Channel, and Digital Advertising audiences.

SAP lists Loyalty as a separate module of SAP Emarsys Customer Engagement, indicating it is licensed in addition to core packages.

Audience extension to ad platforms and on-site overlays via Web Channel and Digital Ads are also positioned as modular capabilities, which many buyers treat as add-ons in commercial discussions, see product capability overviews.

Usage-based channels like SMS typically carry metered fees on top of the base subscription, which aligns with how other enterprise MA platforms meter telecom traffic, and you should confirm message rates and included volumes in your order form.

How does Emarsys bill, and what drives your total cost?

Emarsys sells as an annual subscription with pricing tailored to your contact database size, channels enabled, and expected messaging volumes, with contracts commonly running 12–36 months according to enterprise procurement guides like Vendr.

Core cost drivers buyers report are the number of marketable contacts in your database, the specific channels you license (email, SMS, web and mobile), and any add-on modules such as Loyalty or advanced personalization.

Metered usage, such as SMS typically bills per message in addition to the platform subscription. At the same time, email is usually covered within plan entitlements up to a fair-use threshold, which SAP documents at a high level in the Emarsys help portal.

Professional services for onboarding, data modeling, and integrations can be a meaningful one-time cost line and should be scoped explicitly.

💡 To avoid surprises, document your active-contact definition, monthly send assumptions, countries you’ll text, and any add-ons you require, and have those inclusions and volumes enumerated in the order form or a pricing exhibit.

Any reported surprises at renewal?

The most common renewal surprises buyers report with enterprise marketing platforms like Emarsys are automatic tier-ups when your marketable contact count grows beyond your contracted volume and SMS usage that exceeds initial assumptions.

Teams also call out add-on modules that were piloted mid-term and then show up as full-year charges at renewal if not declined in writing ahead of time.

Seasonal list growth and peak-season message volumes can push you into higher bands if your contract measures billable contacts as “active” over a recent period, so clarify the contact definition and measurement window up front.

Enterprise buying guides like Vendr recommend confirming notice periods and auto-renewal terms in the MSA to prevent rollovers at higher tiers without review.

A practical playbook is to run a contact-count and channel-usage true-up 30–60 days before renewal, right-size entitlements to your actual seasonality, and capture price-protection language for your current tier in the renewal order form.

Does Emarsys change or increase pricing often?

Plan packaging and feature inclusions can evolve over time in enterprise suites, so it is prudent to attach a dated capability list or service description to your order form and ask for a renewal price cap or hold on your current tier for a defined period.

Is Emarsys’s price well adapted for scale?

Emarsys targets mid-market and enterprise retailers and D2C brands, and its packaging around omnichannel automation, catalog-driven personalization, and retail data models is designed to consolidate multiple point tools as you scale.

Per-contact commercial models scale predictably with database growth, but brands with rapid list expansion should negotiate tiered pricing, growth bands, or seasonal headroom to avoid step-function jumps in subscription cost.

If SMS becomes a major channel, model message volumes by country and carrier to ensure usage does not overtake your base subscription at scale, and ask for volume discounts and committed-rate cards for your top geographies.

Large catalogs and multiple storefronts often require additional data feeds and environments, so confirm whether multi-brand or multi-region setups are included or require additional environments or add-on licenses.

What has been the real reported price of emarsys?

Emarsys does not publish list pricing, and review sites list it as quote-based, which means actual spend varies widely by contact count and channel mix.

Procurement marketplaces such as Vendr summarize Emarsys as an enterprise-grade, custom-priced platform with annual contracts, with buyers typically budgeting in the five-to-six-figure range per year depending on database size, channels, and services.

In public buyer discussions and forums, marketers commonly cite quotes that start in the tens of thousands annually for smaller mid-market databases and scale into the low six figures for larger lists with SMS and add-ons, which aligns with how enterprise MA suites meter contacts and usage, and you should validate any third-party figures against your own scoped volumes before anchoring negotiations.

Looking for an alternative to Emarsys?

Are you looking for an Emarsys alternative with transparent, predictable, no-contact-based pricing for your brand?

Or, perhaps you're looking for an AI chatbot that helps you convert more visitors by answering complex product questions and guiding them to the right purchase in real time.

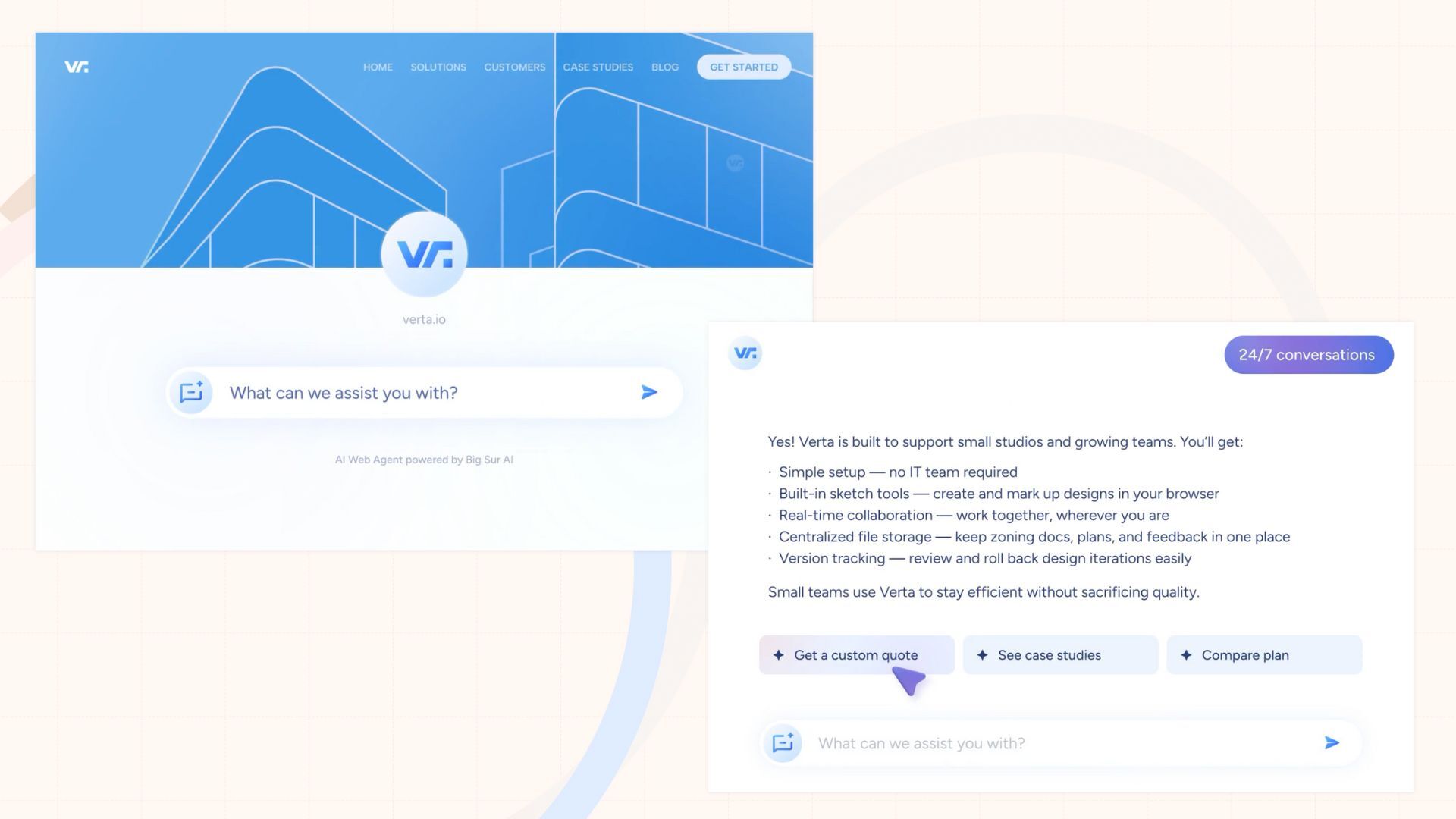

Big Sur AI is a conversational commerce platform that learns your catalog, policies, and inventory to power real-time sales conversations, product recommendations, and intent analytics without long implementations.

Let's go over Big Sur AI's key features 👇

AI sales agent

Big Sur AI's Sales Agent recreates the experience of talking to a knowledgeable salesperson who understands your products and your customers’ needs.

Unlike Emarsys, which centers on campaign orchestration and rules-based personalization, Big Sur AI converses in real time to help shoppers find, compare, and choose the right products.

Available 24/7, the Sales Agent understands your catalog, variants, sizing, materials, compatibility, and policies, answering nuanced questions with citations from your site.

It proactively asks clarifying questions, handles objections, and guides the next best step to increase conversion and average order value.

Every conversation is personalized using zero-party data gathered in chat, along with behavioral context from the session.

Optimized for conversions, the agent tailors prompts and recommendations to what is most likely to lead to a purchase for each visitor.

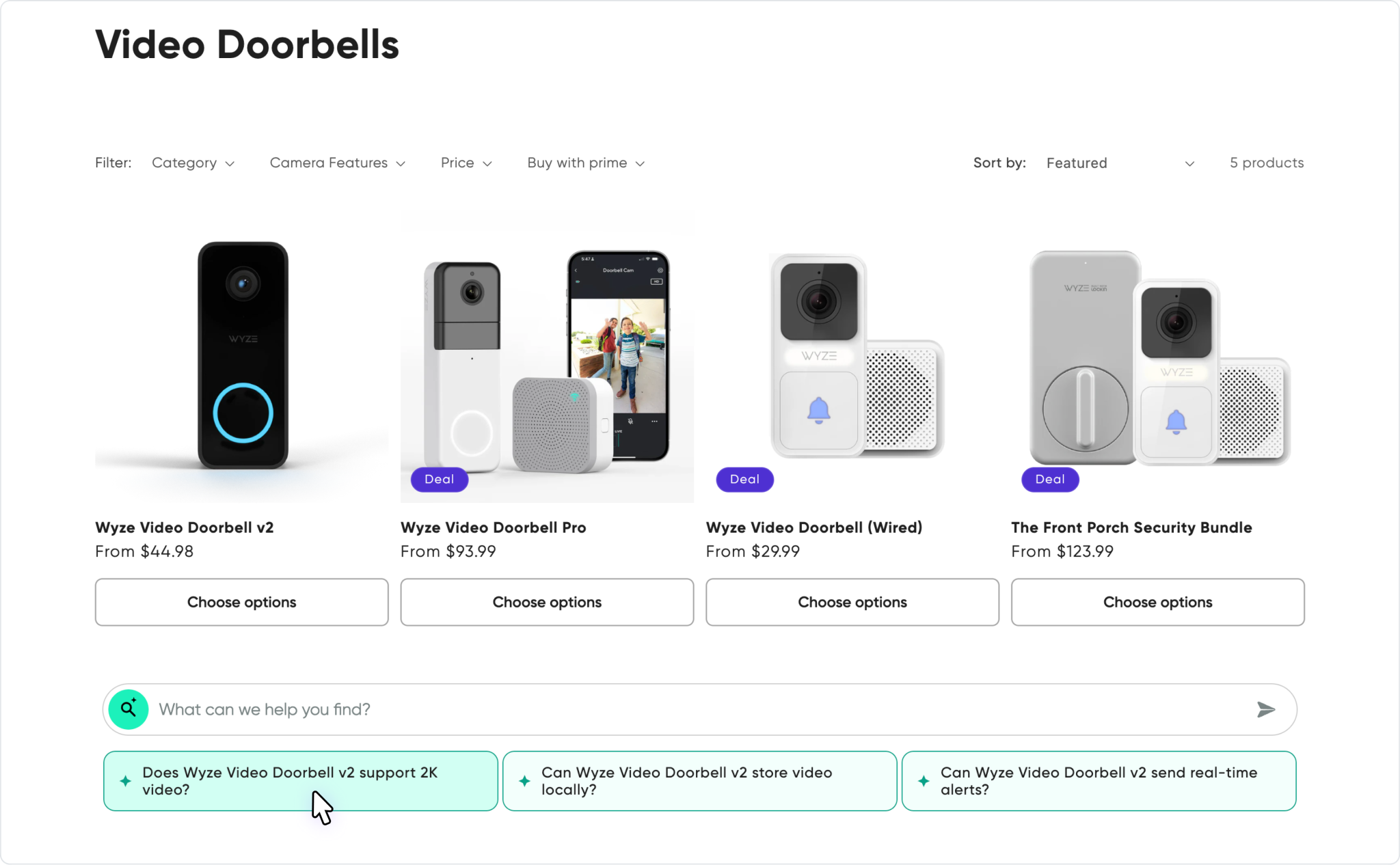

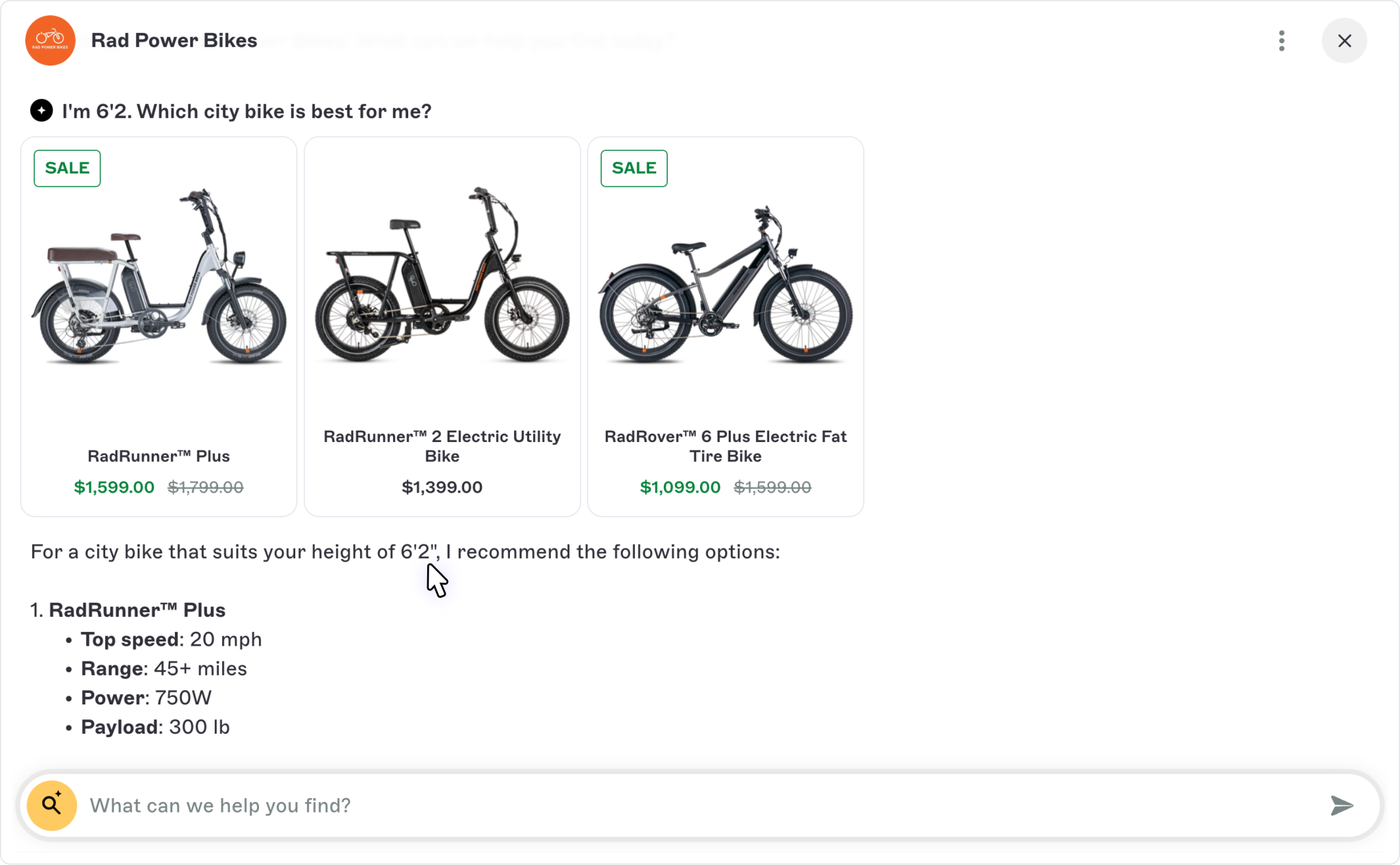

AI product recommendations

Big Sur AI delivers 1:1 recommendations that adapt in real time to each shopper’s preferences expressed in conversation and their on-site behavior.

Unlike Emarsys’s traditional widgets driven by predefined rules or past purchases, Big Sur AI uses conversational signals and current session context to suggest the most relevant products, bundles, and add-ons.

Recommendations update instantly as the shopper asks questions, compares items, or signals constraints like budget, size, or use case.

They are grounded in live catalog data, availability, and pricing, so suggestions are accurate and actionable.

You can surface recommendations inside chat, on PDPs and collection pages, or via API to email and SMS, and A/B test placements for lift.

Behavioral analytics

Big Sur AI turns every interaction into structured insights about intent, objections, and buying friction.

Unlike Emarsys’s campaign-level reports, which focus on sends, opens, and clicks, Big Sur AI shows the why behind behavior with top questions, unmet needs, and product feedback straight from customer conversations.

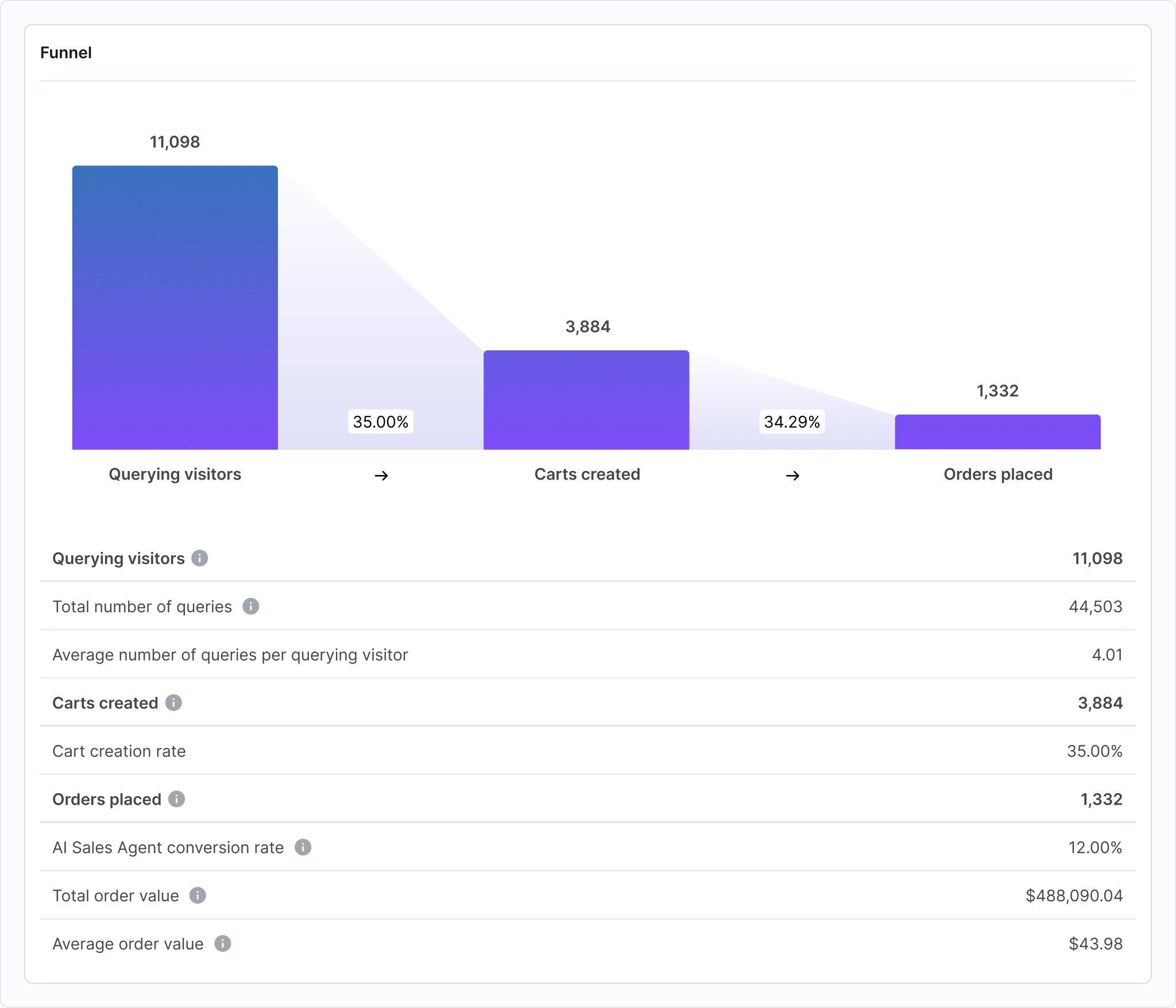

Track funnels from first message to purchase, measure conversion impact by intent cluster, and attribute revenue to AI-assisted sessions.

Export insights to your BI stack or trigger workflows in your CRM and ad platforms to create smarter segments and retargeting.

Use these analytics to improve product pages, refine messaging, and prioritize merchandising based on what customers actually ask for.

How Big Sur AI's pricing is different from Emarsys

- Transparent, self-serve plans you can see upfront, instead of opaque, quote-only tiers.

- Priced by AI conversations or sessions rather than contact list size or email sends, so growth in subscribers doesn’t spike your bill.

- All core channels for the AI agent included, avoiding per-channel add-on fees.

- No mandatory professional services or lengthy implementations, so you don’t pay onboarding premiums just to get started.

- Month-to-month flexibility available, avoiding multi-year commitments that lock you in before you see ROI.

- Clear overage rules and simple scaling, so budgeting is predictable even during peak seasons.

Get started with Big Sur AI today

Here’s how you can deploy a fully-trained, customizable AI chatbot on your website in under 10 minutes with Big Sur AI 👇

- Sign up on Big Sur AI's Hub (link to https://hub.bigsur.ai/signup).

- Enter your website URL. Big Sur AI will automatically analyze your site content.

- Customize your AI agent. Set up specific AI actions and decide where the AI agent will appear on your site.

- Launch and monitor. Your AI agent will be live in minutes, and you can track performance with real-time analytics.